Updated Food and Beverage Guidelines (16 April 2024)

The Service Tax reintroduced on 1 September 2018, is a consumption tax administered under the Service Tax Act 2018 and its subsidiary legislation. Service tax is imposed on prescribed services known as “taxable services”. A person who provides taxable services exceeding a specified threshold of taxable service value must register under the Service Tax Act […]

Attention Wholesalers and Retailers of Construction Materials!

Are you selling Precast Concrete Masonry Units (cement bricks)? If yes, then this is a must-read for you! As per the latest e-Invoice Specific Guideline (Version 2.1) issued by the Inland Revenue Board of Malaysia (IRBM), wholesalers and retailers dealing in construction materials, including cement bricks, are required to issue e-Invoices for every single transaction. […]

What are the e-Invoice Treatments for Directors’ Fees?

The e-Invoicing Guidelines in Malaysia are a comprehensive framework designed to modernise and streamline the invoicing process across various transactions, enhancing efficiency and tax compliance. The guidelines cover myriad transactions and touch upon the specific income types exempted from the e-invoicing system. For directors who have entered into a contract for services with a company, […]

If the supplier rejects the buyer’s request within 72 hours, does this mean the e-invoice will become a valid e-invoice after 72 hours?

Referring to Section 2.4.5 of the e-Invoice Guideline Version 2.3: “If the Supplier did not accept the request for rejection initiated by the Buyer (or did not proceed to cancel the said e-Invoice), no cancellation would be allowed after the 72 hours have elapsed. Any amendment thereon would require issuing a new e-invoice (e.g., credit […]

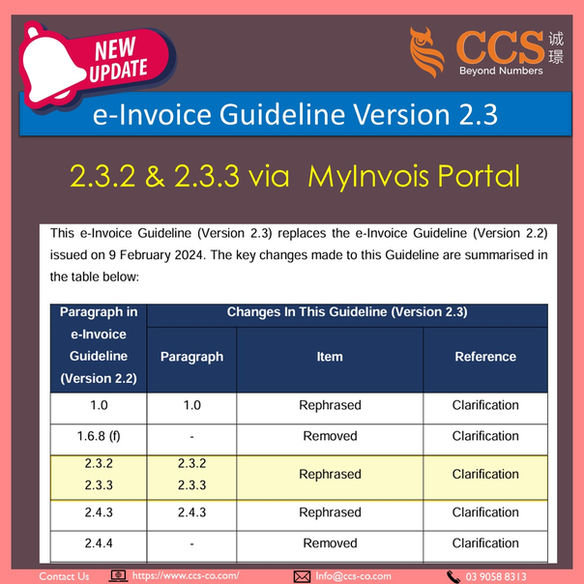

e-Invoice Guideline Version 2.3 – Enhancing Clarity in Batch Submission: Transition from “Batch Generation” to “Batch Upload”

2.3.2 Step 1 – Creation and Submission The change from “Batch Generation” to “Batch Upload” and from “defined layout file” to “pre-defined Microsoft Excel spreadsheet” in section 2.3.2 is likely to provide more clarity and specificity on the batch submission process via the MyInvois Portal. 📌 Batch Generation: ✅ This term is a bit vague and […]

LHDN’s Announcement: Notifikasi Sistem e-PCB Plus : Notice for Verification of TIN and MyTAX ID

Untuk makluman, Sistem e-PCB Plus akan menggantikan sistem PCB sediada (e-PCB / e-CP39 / e- Data PCB) dalam satu platform. Sistem baharu ini boleh diakses melalui Portal Mytax dengan menggunakan Nombor Pendaftaran Cukai (TIN) daripada ID MyTAX pengguna. Tarikh sebenar penggunaan sistem baharu ini akan dimaklumkan kemudian kepada majikan. Majikan perlu memastikan individu yang diberi […]

Expansion of the Scope of Service Tax (ST) Exemption for Maintenance Services

The government has agreed to extend the exemption from paying ST to maintenance services related to the following matters: This means that any maintenance and repair services on residential premises, such as roof repairs or any equipment and facilities that are part of residential premises, such as lifts, air conditioners, and water heating systems, are […]

Expansion of E-Invoicing Scope by IRBM: Introduction of Additional Self-Billed Document

The Inland Revenue Board of Malaysia (IRBM) has expanded the scope of e-invoicing to include additional document types beyond the initial Invoice, Credit Note, Debit Note, and Refund Note. This extension aims to provide comprehensive coverage and facilitate seamless e-invoicing operations across various business scenarios. In addition to the existing document types, businesses can now […]

E-Invoice Classification Codes: A Key Requirement for Tax Monitoring

The “Classification Code” is a mandatory field in e-Invoices that categorizes the nature of the transaction or the types of products/services involved. IRBM requires this code to facilitate the analysis and monitoring of various transactions for tax purposes. The classification codes cover a wide range of items and scenarios, from common expenses like medical treatments […]

Buying gifts for someone is no longer so Simple in e-invoicing era

Where goods purchased may need to be shipped directly to the Shipping Recipient instead of the Buyer In the new e-Invoice Specific Guideline (Version 2.1), paragraph 3.5.6 clarifies the details provided by individual Shipping Recipients to issue the Annexure to the e-Invoice. The key points are: 1. For Malaysian individuals, the Shipping Recipient needs to […]