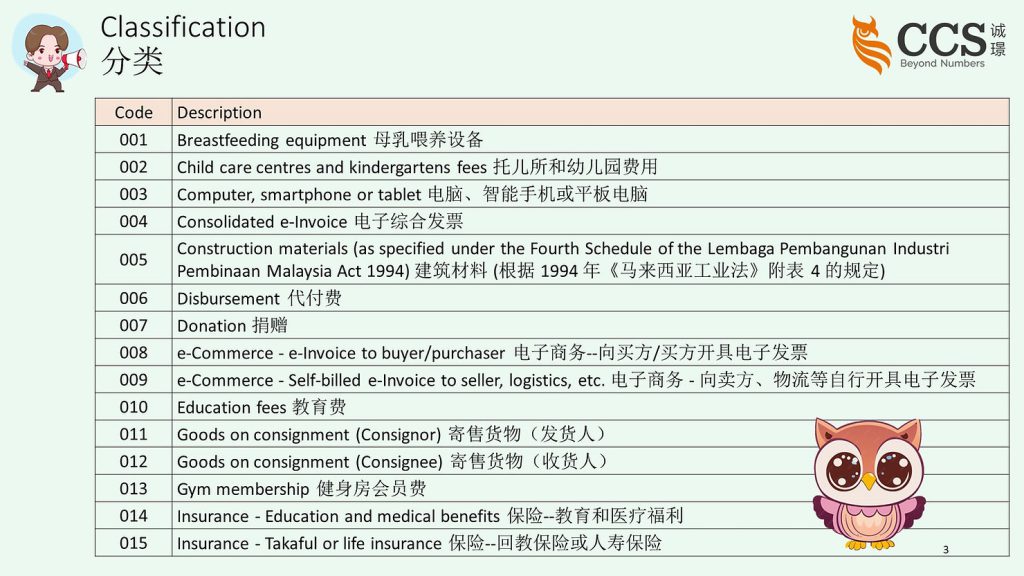

The “Classification Code” is a mandatory field in e-Invoices that categorizes the nature of the transaction or the types of products/services involved.

IRBM requires this code to facilitate the analysis and monitoring of various transactions for tax purposes.

The classification codes cover a wide range of items and scenarios, from common expenses like medical treatments and educational fees to specific transactions like consignment sales, self-billed invoices for imports/exports, and even categories like breastfeeding equipment or sports-related purchases.

By requiring businesses to assign the appropriate classification code, IRBM can gain valuable insights into spending patterns, identify potential areas of tax leakage or non-compliance, and make informed decisions regarding tax policies and administration.

For taxpayers, using the correct classification code ensures accurate reporting and compliance with e-invoicing requirements while enabling IRBM to streamline its processes and enhance tax collection and monitoring efficiency.

Therefore, taxpayers must familiarise themselves with the classification codes and select the most relevant option that accurately represents the nature of their transaction. This ensures compliance and contributes to the effectiveness of IRBM’s tax administration efforts.

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

“类别代码” (Classification Code) 是电子发票中的必填字段,用于对交易性质或所涉及的产品/服务类型进行分类。

IRBM 要求使用该代码,以便于分析和监控各种交易的税务目的。

类别代码涵盖广泛的项目和情况,从医疗和教育费用等常见支出,到寄售、进口/出口自开票等特定交易,甚至哺乳设备或体育相关采购等类别。

通过要求企业指定适当的分类代码,IRBM 可以深入了解消费模式,识别潜在的漏税或不合规领域,并就税收政策和管理做出明智决策。

对纳税人而言,使用正确的类别代码可确保准确报告和遵守电子发票要求,同时还能使 IRBM 简化流程,提高税收征管和监控的整体效率。

因此,纳税人必须熟悉分类代码,并选择最相关的选项,以准确反映其交易的性质。这不仅能确保纳税人遵守规定,还有助于提高 IRBM 税收管理工作的效率。