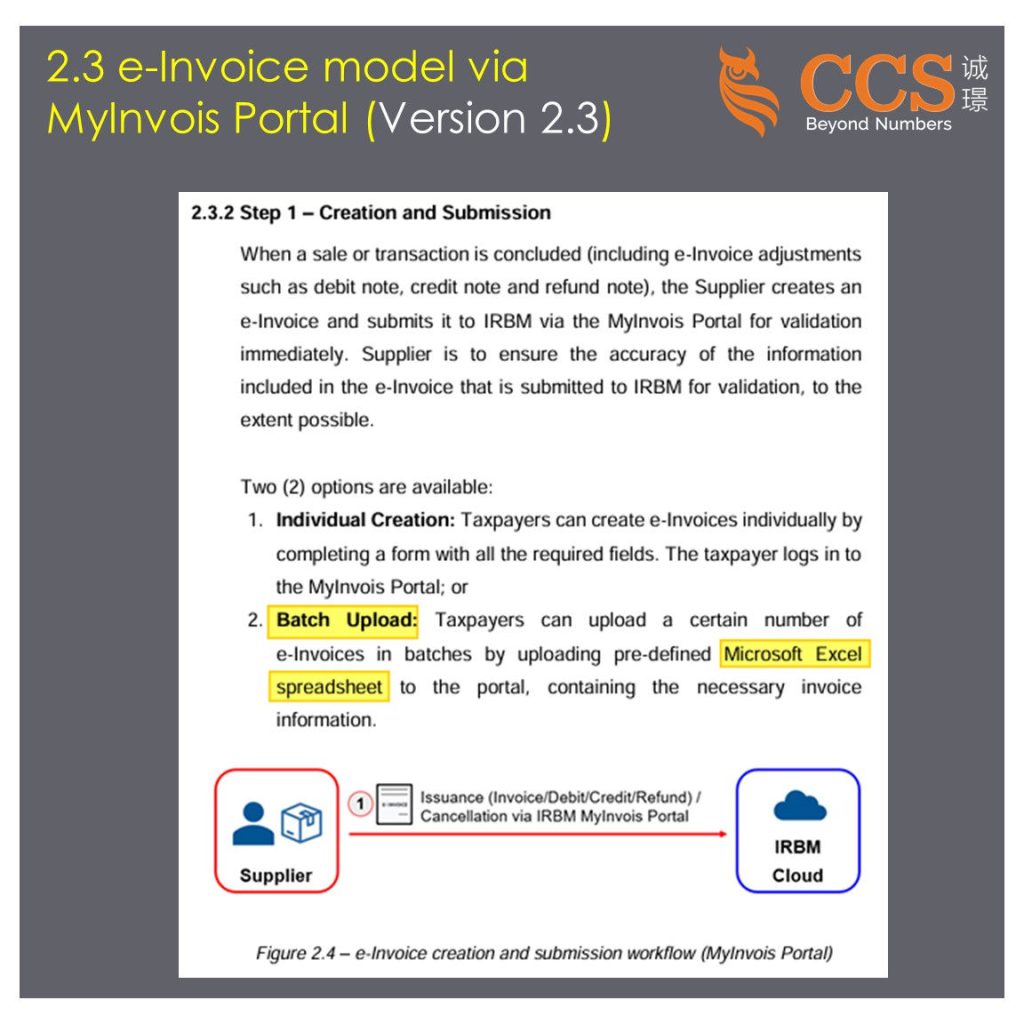

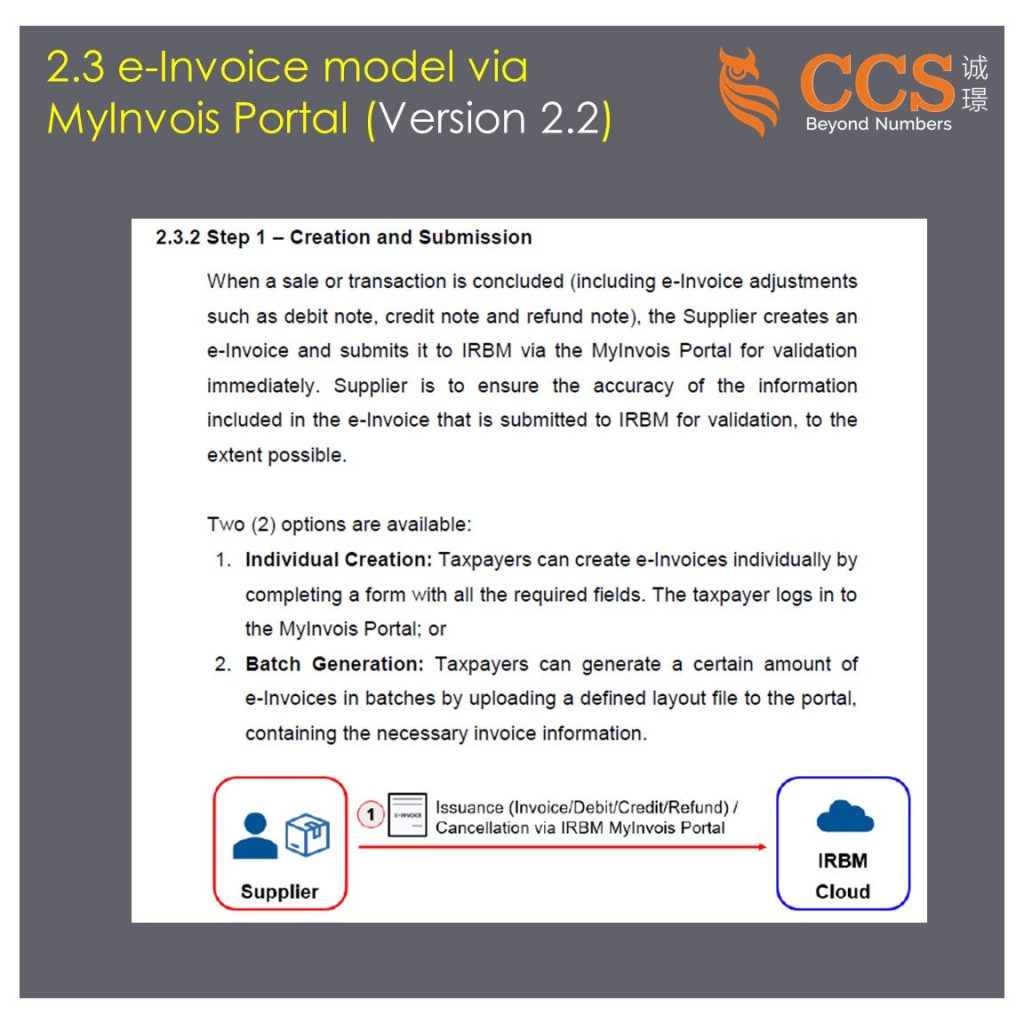

2.3.2 Step 1 – Creation and Submission

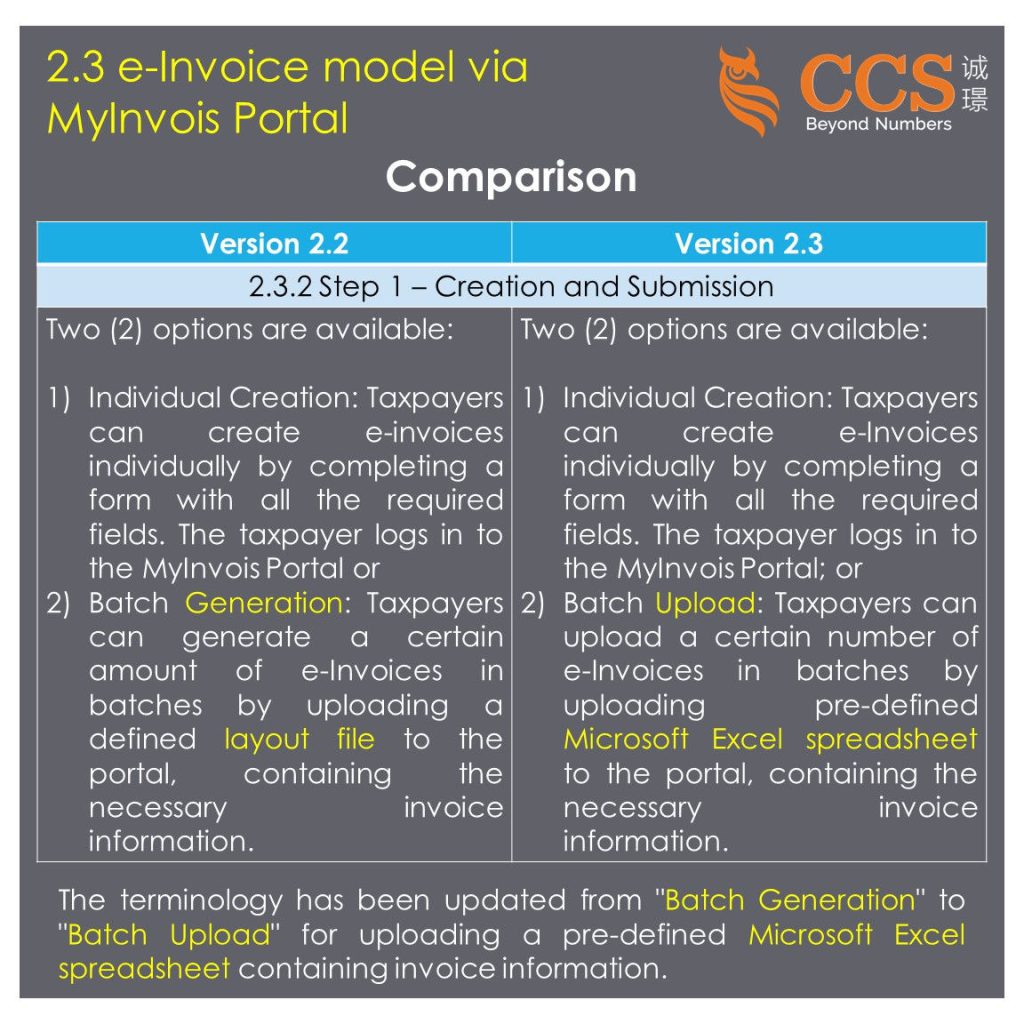

The change from “Batch Generation” to “Batch Upload” and from “defined layout file” to “pre-defined Microsoft Excel spreadsheet” in section 2.3.2 is likely to provide more clarity and specificity on the batch submission process via the MyInvois Portal.

📌 Batch Generation:

✅ This term is a bit vague and could be interpreted differently.

✅ It doesn’t specify the method or format for generating batches of e-invoices.

📌 Batch Upload:

✅ “Upload” is a more specific term that clearly indicates the action of transferring a file/data from the user’s system to the MyInvois Portal.

✅ It removes any ambiguity and makes it evident that batches of e-invoices are submitted to the portal through a file upload process.

📌 Defined Layout File:

✅ “Layout file” is a generic term that could refer to various file formats or structures.

✅ It lacks specificity on the exact file type and format expected for batch submissions.

📌 Pre-defined Microsoft Excel Spreadsheet:

✅ By explicitly mentioning “Microsoft Excel spreadsheet”, it provides clear guidance on the specific file format that is accepted for batch uploads.

✅ “Pre-defined” indicates that there is a predefined template or structure that users must follow when preparing the Excel file.

✅ This level of detail helps users understand exactly what is required for batch uploads, reducing confusion and ensuring compliance with the expected file format.

So, in essence, the changes were likely made to:

1) Use more precise terminology that accurately reflects the process (“Upload” instead of “Generate”).

2) Provide clear and specific information about the accepted file format (Microsoft Excel spreadsheet instead of a generic “layout file”).

3) Indicate that there is a predefined template/structure to follow for batch uploads (pre-defined Excel spreadsheet).

By making these changes, the guideline aims to give taxpayers and users more explicit and unambiguous instructions on correctly preparing and submitting batches of e-Invoices via the MyInvois Portal, minimising potential confusion or errors in the process.

将第 2.3.2 节中的 “批量生成 “改为 “批量上传”,并将 “设定的版式文件 “改为 “预 定义的 Microsoft Excel 电子表格”,可能会使通过 MyInvois 门户网站进行批量提交的 流程更加清晰和具体。

📌 批量生成:

✅ 这个术语有点模糊,可以有不同的解释。

✅ 它没有说明生成成批电子发票的方法或格式。

📌 批量上传:

✅ “上传”是一个更具体的术语,它明确指出了将文件/数据从用户系统传输到 MyInvois 门户网站的操作。

✅ 它消除了任何歧义,并清楚地表明电子发票批次是通过文件上传流程提交到门户网站的。

📌 设定的版式文件:

✅ ”设定文件” 是一个通用术语,可以指各种文件格式或结构。

✅ 它没有具体说明批量提交所需的确切文件类型和格式。

📌 预先设定的 Microsoft Excel 电子表格:

✅ 通过明确提及 “Microsoft Excel 电子表格”,为批量上传所接受的特定文件格式提供了明确的指导。

✅ “预先设定”表示用户在准备 Excel 文件时必须遵循预定义的模板或结构。

✅ 这种详细程度有助于用户准确了解批量上传的要求,减少混乱并确保符合预期的文件格式。

因此,从本质上讲,这些更改可能是为了

1) 使用更精确的术语,准确反映流程(用 “上传 “代替 “生成”)。

2) 提供有关可接受的文件格式的明确而具体的信息(Microsoft Excel 电子表格,而不是通用的 “设定的版式文件”)。

3) 说明批量上传有预定义模板/结构可循(预先设定 Excel 电子表格)。

通过这些改动,该指南旨在为纳税人和用户提供更清晰明确的指导,说明如何通过 MyInvois 门户网站正确准备和提交电子发票批次,最大限度地减少过程中可能出现的混乱或错误。

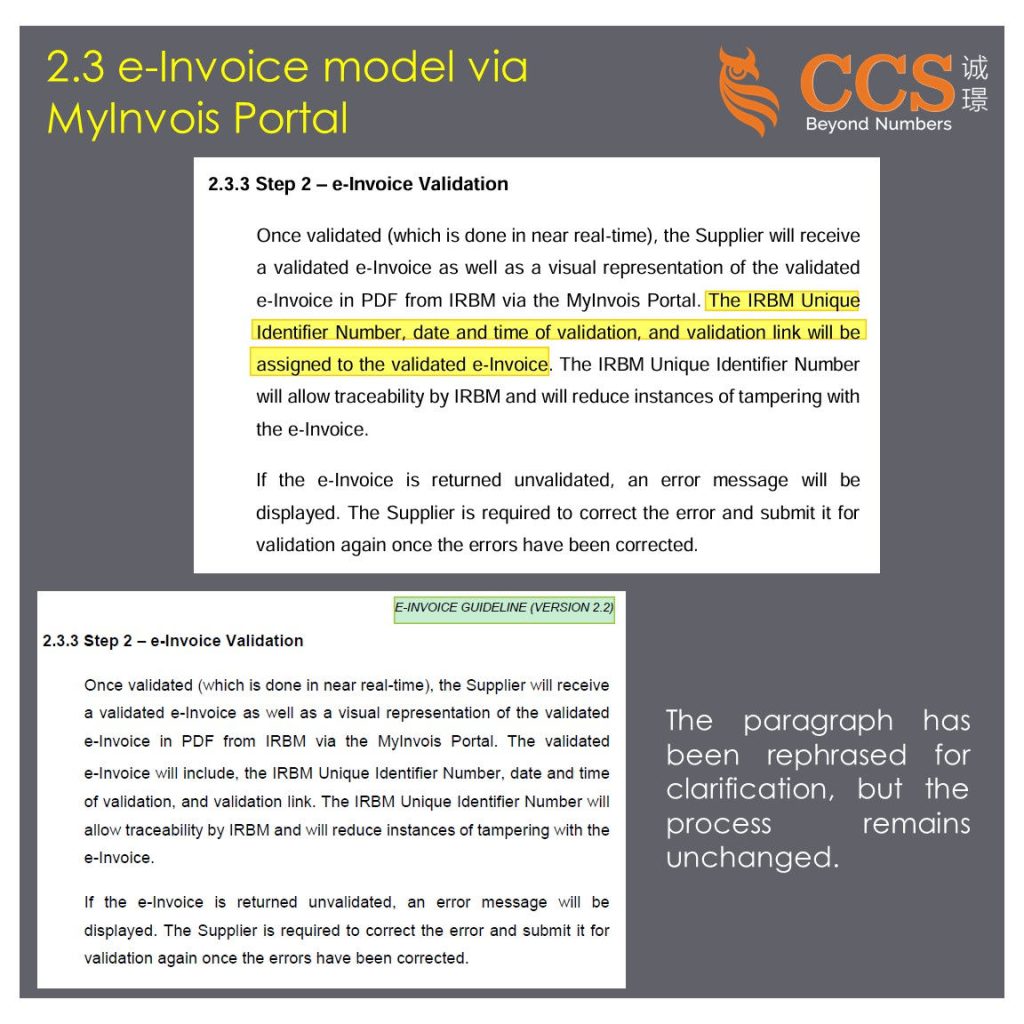

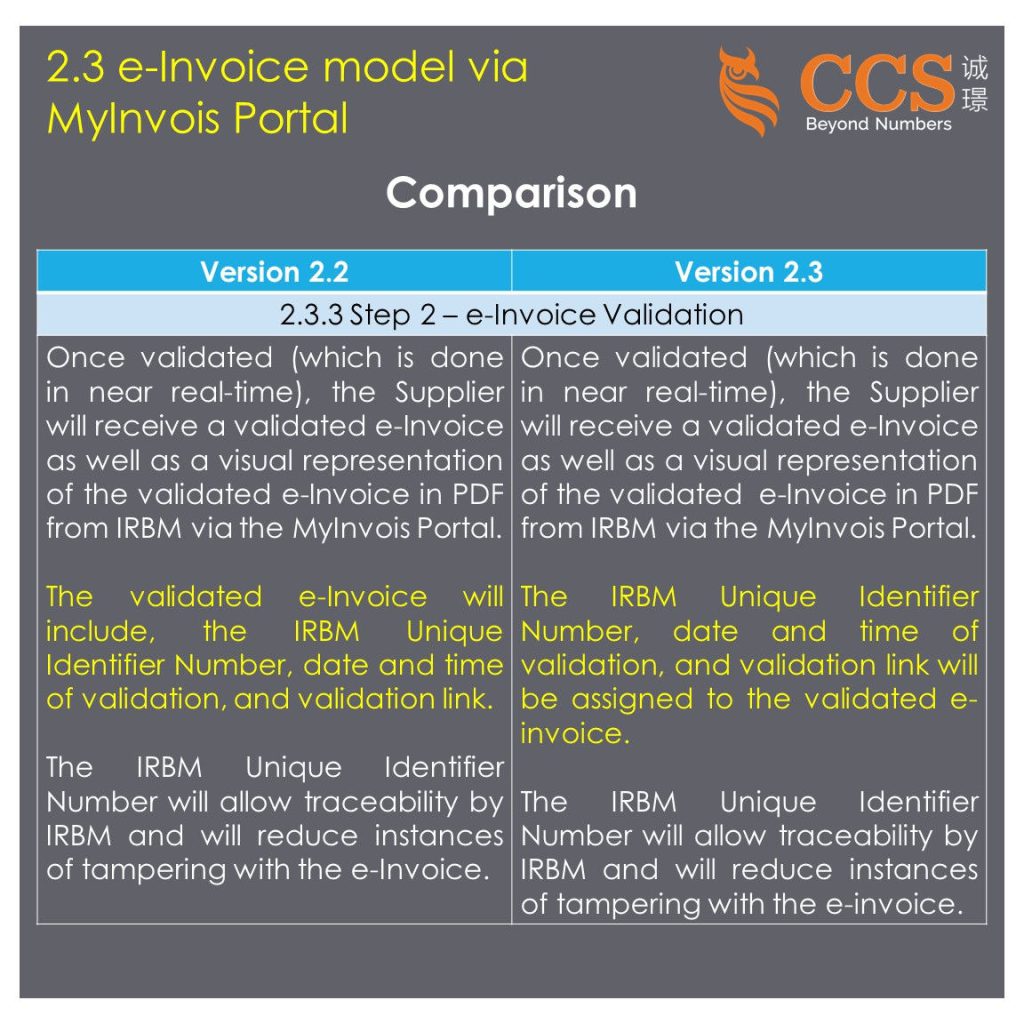

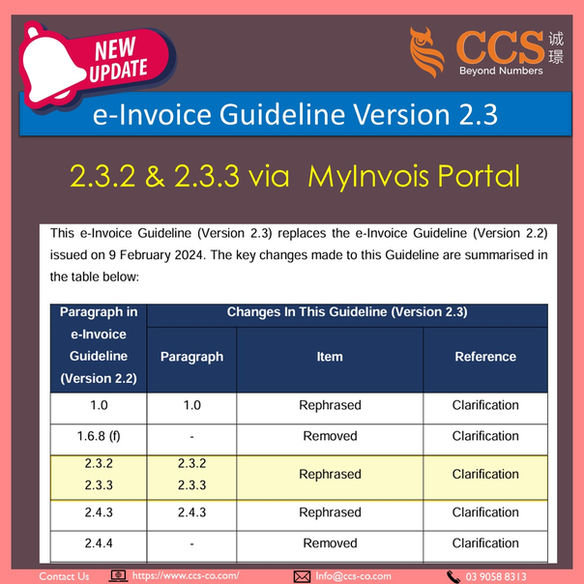

2.3.3 Step 2 – e-Invoice Validation

The change in section 2.3.3 between versions 2.2 and 2.3 is:

Version 2.2:

“The validated e-Invoice will include, the IRBM Unique Identifier Number, date and time of validation, and validation link.”

Version 2.3:

“The IRBM Unique Identifier Number, date and time of validation, and validation link will be assigned to the validated e-Invoice.”

So the change is from stating that the validated e-invoice “will include” those details to saying they “will be assigned to” the validated e-invoice.

This is a minor phrasing change, but it slightly alters the meaning. Version 2.3 clarifies that the IRBM Unique Identifier Number, date/time, and validation link are assigned or added to the e-invoice upon validation rather than already included in the original e-invoice submitted.

The rationale could be to make it clear that these validation-related details are dynamically assigned by IRBM during the validation process rather than being pre-existing elements in the e-Invoice created by the supplier.

在 2.3.3 节中,2.2 版和 2.3 版之间的变化如下:

版本 2.2:

“经过验证的电子发票将包括 IRBM 唯一标识符编号、验证日期和时间以及验证链接。

版本 2.3:

“IRBM 唯一标识符号码、验证日期和时间以及验证链接将分配给已验证的电子发票”。

因此,这一改动是将 “将包括 “验证过的电子发票的细节改为 “将分配给 “验证过的电子发票。

这只是措辞上的微小改动,但却略微改变了含义。2.3 版明确指出,IRBM 唯一标识符号码、日期/时间和验证链接将在验证时分配或添加到电子发票中,而不是已经包含在提交的原始电子发票中。

这样做的理由可能是为了明确这些与验证有关的细节是由 IRBM 在验证过程中动态分配的,而不是供应商创建的电子发票中预先存在的元素。

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻