The e-Invoicing Guidelines in Malaysia are a comprehensive framework designed to modernise and streamline the invoicing process across various transactions, enhancing efficiency and tax compliance.

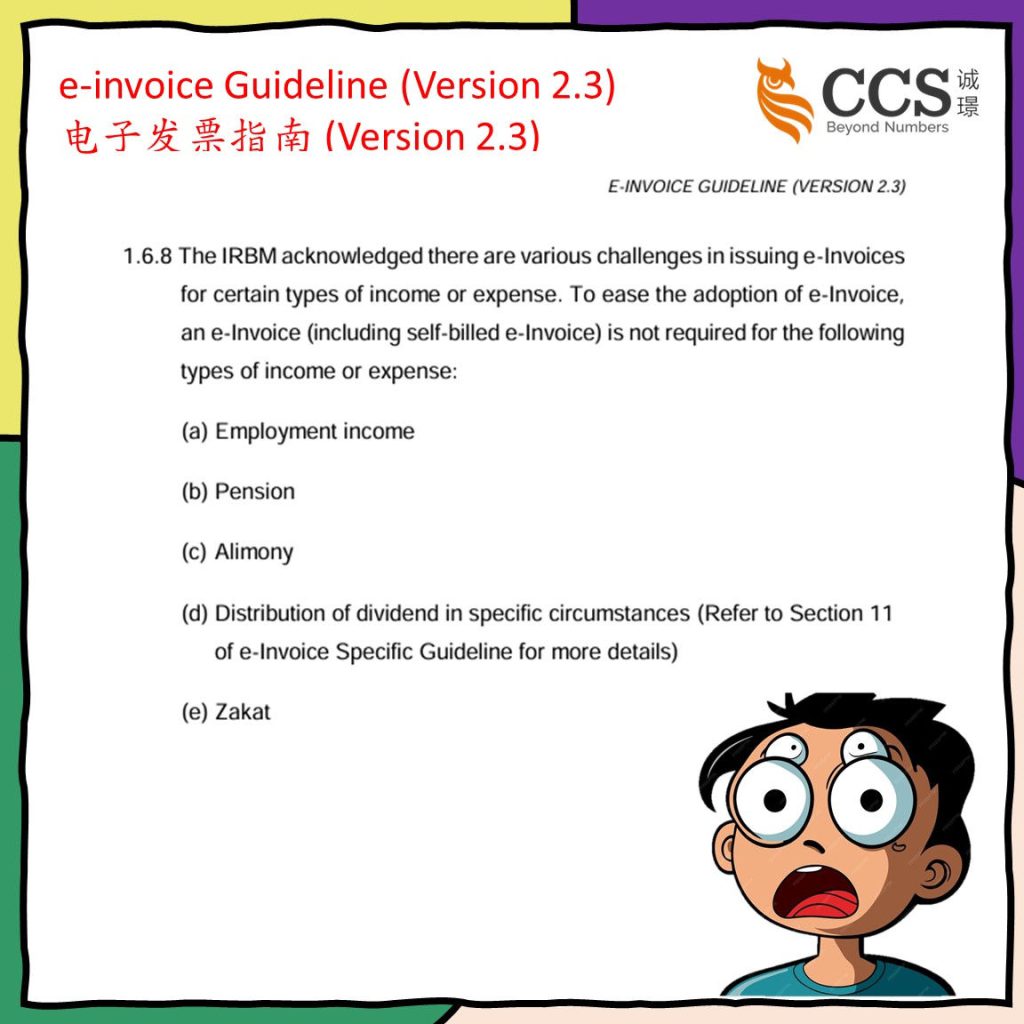

The guidelines cover myriad transactions and touch upon the specific income types exempted from the e-invoicing system.

For directors who have entered into a contract for services with a company, issuing an e-invoice for any income received is mandatory, reflecting the transaction’s commercial nature.

Conversely, directors’ fees from a service contract viewed as employment income are currently exempt from the e-invoicing requirement.

This distinction underscores the importance of understanding the nature of the contractual relationship and the corresponding e-invoicing obligations.

Taxpayers, especially those in directorial positions, are advised to stay informed about their e-invoicing responsibilities and any potential changes to exemptions, as guidelines are subject to periodic reviews and updates by the relevant authorities.

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

马来西亚电子发票指南是一个全面的框架,旨在更新和简化各种交易的发票开具流程,提高效率和税务合规性。

在其涵盖的众多交易中,该指南还涉及电子发票系统豁免的特定收入类型。

对于已与公司签订服务合同的董事,必须为收到的任何收入开具电子发票,以反映交易的商业性质。

相反,董事从雇佣合同中获得的酬金被视为就业收入,目前则不受电子发票要求的限制。

这种区别强调了了解合同关系性质和相应电子发票义务的重要性。

建议纳税人,特别是那些担任董事职务的纳税人,需要了解他们的电子发票责任以及豁免方面的任何潜在变化,因为有关当局会定期审查和更新准则。