Do you worry if the Company acquired via merger & acquisition deal is overvalued?

Why bought at overprice while you can prevent it via Financial Due Diligence?

Financial due diligence is a comprehensive investigation and analysis of a company’s financial health, performance, and position conducted by potential investors, acquirers, lenders, or other stakeholders before making significant business decisions.

The primary objective of financial due diligence is to assess the accuracy, reliability, and completeness of financial information provided by the target company and to identify any potential risks, liabilities, or red flags that could impact the investment or transaction.

Financial due diligence is typically conducted in various business scenarios, including:

Initial evaluation of the prospective company.

Comprehensive assessment and overview of the target company’s financials, which will vary based on associated costs and risks.

Determine of red flags and communicate.

Scope and focus on high risk areas.

CCS can act as Financial Due Diligence auditors for due diligence exercised.

CCS can assist to review matters of financial nature that importants to investors in making sound decision in an investment and merger and aquisition process.

In achieving this, CCS will dive in the financial aspect of the target which includes but not limited to their financial reports, contracts and agreements, debt and financing arrangements, assets and liabilities analysis and etc. to advice on the transaction and to support the acquirer on identifying issues in the financial statements of the target.

As such, choosing the right team, scope and professional firm for your due diligence exercise is important.

Statutory Audits, Financial Due Diligence, Internal Audit and etc.

Tax Computation & Advisory, Tax Audit & Investigation and etc.

Financial Advisory & Planning, Business Performance Analysis and etc.

Transfer Pricing Documentation, Benchmarking Service and etc.

HR Guidance & Advice, Policies & Documentation and etc.

Account Preparation & Advisory, SST Submission, Payroll and etc.

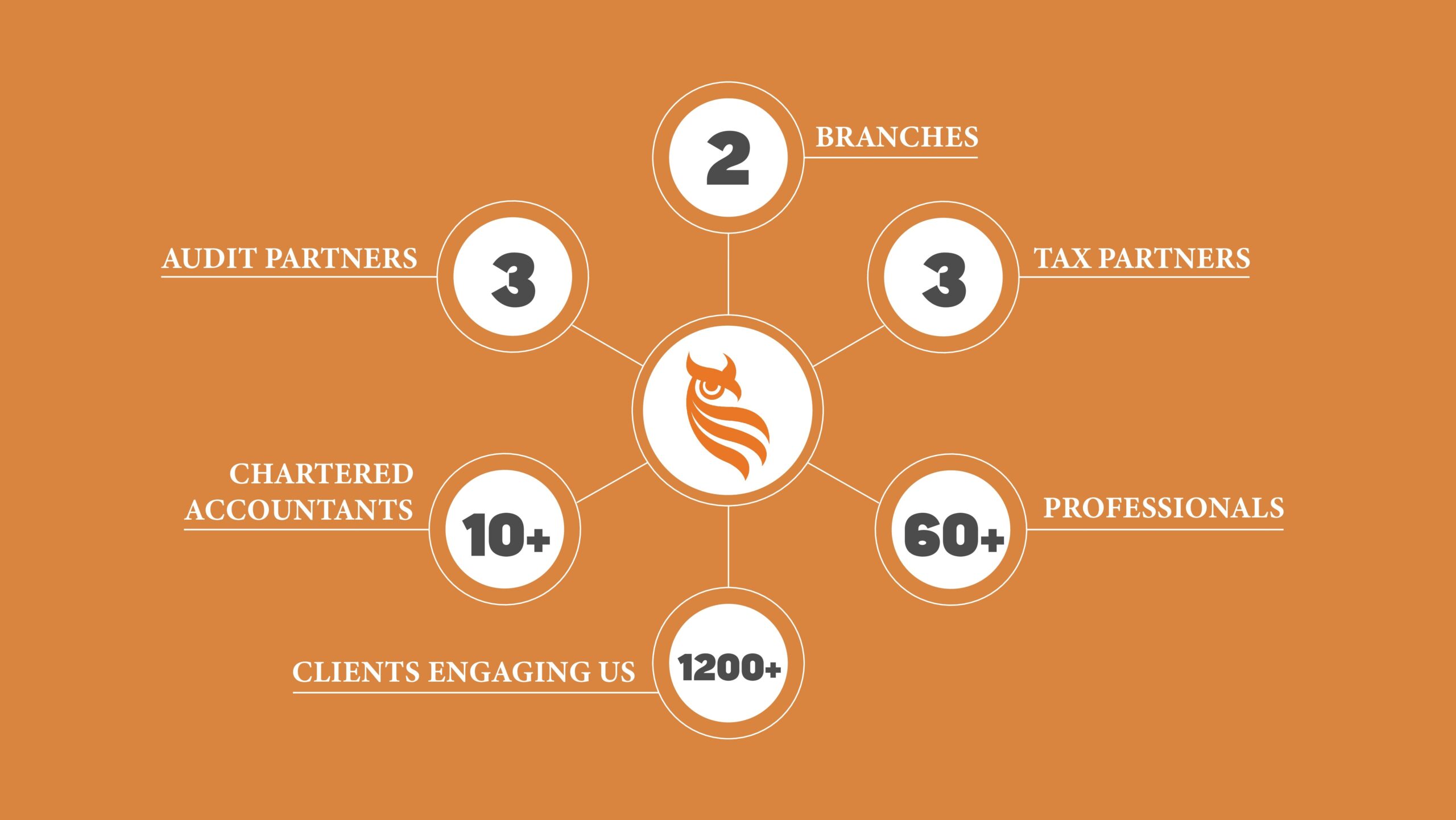

A trusted, award-winning accounting firm that delivers measurable, sustainable results for our clients and communities.

CCS & CO PLT 202206000043 (LLP0033899-LCA) & AF 1538 was registered on 29th December 2022.

With effect from that date, CCS & CO (AF 1538), a conventional partnership, was converted to a limited liability partnership.

©2019 – 2024 by CCS . All rights reserved.

C.A.(M), FCCA (UK), ASEAN CPA, B.Acc.(Hons)(UM)

Wong is a partner with CCS and plays an important role there.

She is currently directing the Assurance Departments of the Firms to deliver high-quality services to clients and ensure the Firm’s consistency in upholding the quality of assurance engagements. She is responsible for ensuring that the Firm’s approach has been consistently adhered to across the whole Firm, and she works closely with the assurance team to accomplish this.

Wong acquired a Bachelor of Accounting degree from the University of Malaya, where she studied for her whole academic career. In addition, she is a member of the Malaysian Institute of Accountants (abbreviated as “MIA”), a Fellow Member of the Association of Chartered Certified Accountants (abbreviated as “ACCA”), and she has registered to become an ASEAN Certified Public Accountant.

Wong first became a member of CCS in the year 2009. During her 14 years of expertise helping small and medium enterprises, she has worked in various industries, including construction, property development, and manufacturing.

In addition to the statutory financial audit, she has also participated in other engagements, such as the Agreed-Upon Procedure and the Corporate Tax Advisory. Throughout her years of service, she has been instrumental in reducing the number of disputes between taxpayers and officers and assisting small and medium enterprises in tax audit matters while attending to officers’ inquiries.

She has directed several GST implementation initiatives for corporations while providing internal training. During the implementation phase, she assisted a few businesses in resolving their GST registration issues by participating in a round table discussion hosted by the RMCD.

C.A.(M), ACA (ICAEW), CA (Singapore), ASEAN CPA, B.Acc.(Hons)(UM)

Edward is an Assurance Partner at CCS. He is also the leader of Quality Management and Technical of the Firm. His role is to uphold the audit quality and ensure the Firm is adhering to professional standards, legal and regulatory requirements when providing assurance services.

Edward graduated from University of Malaya with a degree of Bachelor of Accounting. He is a Chartered Accountant (“CA”) of Malaysian Institute of Accountants (“MIA”), and a member of Institute of Chartered Accountants in England and Wales (“ICAEW”), Institute of Singapore Chartered Accountants (“ISCA”) and ASEAN Chartered Professional Accountant (“ASEAN CPA”).

Edward has more than 10 years of combined experience in the field of audit, accounting advisory, financial control, financial analysis, and quality assurance. He worked in the Big 4 accounting firms across Malaysia and Singapore, with the last position as an Audit Manager. During his employment at the Big 4 accounting firms, he was involved in the audits of listed, non-listed and multinational companies of diversified industries. He was also a Practice Reviewer in MIA, who worked as a regulator to carry out surveillance activities on audit firms registered with MIA for quality assurance purposes.

Prior to joining CCS, Edward worked in a Minister of Finance (Incorporated) (“MOF Inc”) company. He was engaged as a Finance Manager, providing in-house technical expertise across a wide spectrum of financial areas including accounting advisory, tax advisory, corporate finance, valuation, financial due diligence, deal review, financial analysis, financial control, business process improvement, special financial assignments, special projects, and in-house training.

Edward is currently a certified trainer of Human Resource Development Corporation (“HRD Corp”) and a member of the Small and Medium Practices (“SMP”) Committee of MIA. His role in MIA is to build the capacity of SMPs, facilitate the adoption and implementation of new professional standards, promote the value of SMPs in supporting the Small and Medium Enterprises (“SME”) and represent SMPs’ interests to regulators.

With these diversified experiences, Edward strives to provide the high standard and wide spectrum of services to his clients.