We would like to inform you that the Inland Revenue Board of Malaysia (IRBM) has disseminated a revised version of the Company Return Form (Form C) for the Year of Assessment 2022.

To download a PDF copy of the return – https://t.me/YourAuditor/3259

Chartered Tax Institute of Malaysia’s Previous Feedback

Regarding Form e-C 2022, the Chartered Tax Institute of Malaysia (CTIM) has offered their input and comments to the Inland Revenue Board of Malaysia (IRBM).

The responses from IRBM were shared by us on August 25, 2022 (https://www.ccs-co.com/post/irbm-s-response-to-ctim-on-e-c-2022)

Chartered Tax Institute of Malaysia’s Additional Feedback

Following the responses provided by IRBM, CTIM has forwarded Additional Feedback and Comments on Form e-C 2022 to IRBM. Some of the areas:-

- Statutory Income, Total Income and Chargeable Income [Part A]

- Summary of Statutory Income from Sources of Business(es) and Partnership(s) in Malaysia [Attachment A1]

- Summary of Statutory Income from Sources of Business(es) and Partnership(s) Outside Malaysia Received in Malaysia Effective From 1 July 2022 [Attachment A2]

- Other Statutory Income from Other Sources in Malaysia [Attachment A6]

- Other Statutory Income from Sources Outside Malaysia Received in Malaysia Effective from 1 July 2022 [Attachment A7]

- Summary of Investment Allowance for Service Sector Under Schedule 7B [Attachment C4]

The responses were provided by IRBM on September 9, 2022.

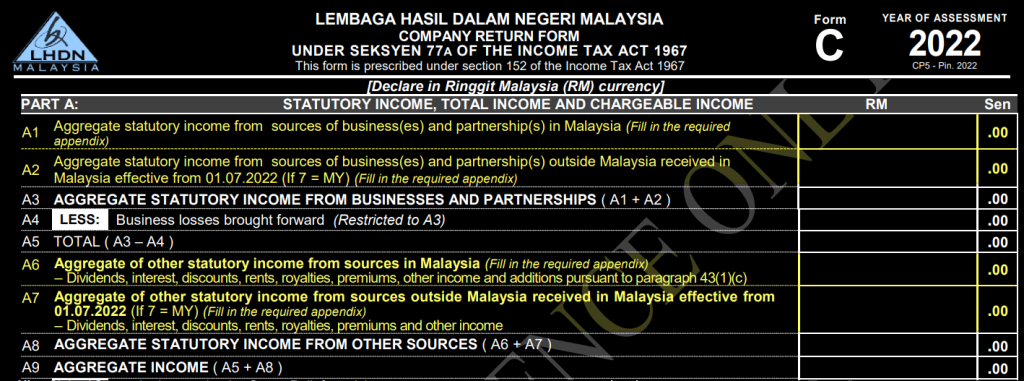

Issue No 1: Statutory Income, Total Income and Chargeable Income [Part A]

Form e-C 2022:

There is a reference to the columns A1, A2, A6, and A7.

Matter 1

In Form e-C 2022, Aggregate Statutory Income from sources of businesses/partnerships in Malaysia and Aggregate Statutory Income from sources of businesses/partnerships outside Malaysia received in Malaysia effective from 01.07.2022 are to be disclosed separately:

- A1; and

- A2

But, Statutory income from businesses and partnerships is taxed as a source of income under Section 4(a) of the ITA. This is true no matter country of origin from (what country the income comes).

Matter 2

In Form e-C 2022, Aggregate Statutory Income from sources in Malaysia and Aggregate Statutory Income from sources outside Malaysia received in Malaysia effective from 01.07.2022 are to be disclosed separately:

- A6; and

- A7

But, These statutory incomes are taxed as separate sources of income, regardless of country of origin.

Practical Issue

- This distinction between Malaysian and foreign origin increases the cost of compliance since additional effort will be necessary, for example, to apportion the amounts for each source of income.

- As a result, the cost of compliance will increase.

Feedback / Proposal of CTIM

- To remain as per YA2021 as a single item labelled Aggregate statutory income from other sources

Response of IRBM on September 9, 2022

The separation between income from Malaysia and income from outside Malaysia received in Malaysia must be done in the tax calculation for the purpose of:

- Ensures the correct imposition of tax rates and avoids source income outside Malaysia received in Malaysia from being taken into account in determining tax according to the prosperous tax rate (33%).

- Determining the eligibility of tax credit claims under sections 132 and 133, as this depends on whether or not that country has a DTA with Malaysia.

Issue No 2: Summary of Statutory Income from Sources of Business(es) and Partnership(s) in Malaysia [Attachment A1]

Attachment A1 of Form e-C 2022:

Attachment A1 in Form e-C 2022 requires a summary of Statutory Income from Sources of Business(es) and Partnership(s) in Malaysia only.

Practical Issue

- This distinction between Malaysian and foreign origin increases the cost of compliance since additional effort will be necessary, for example, to apportion the amounts for each source of income.

- As a result, the cost of compliance will increase.

Feedback / Proposal of CTIM

- To remain as per YA2021, i.e., Attachment A1 for both sources in Malaysia and Outside Malaysia Received in Malaysia, effective from 1 July 2022.

Response of IRBM on September 9, 2022

Refer to IRBM’s response for Issue No 1.

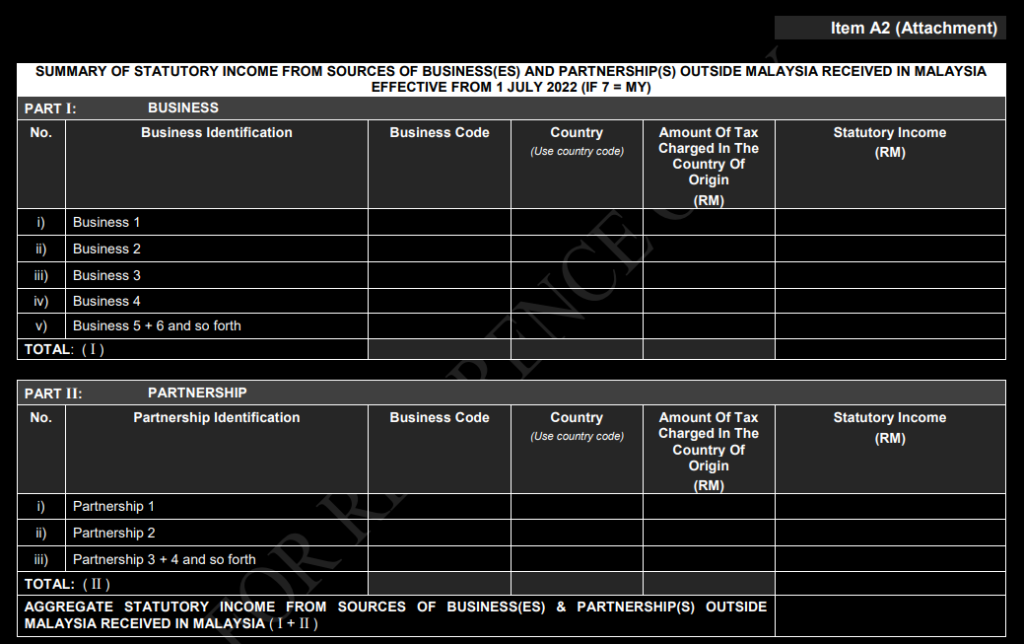

Issue No 3: Summary of Statutory Income from Sources of Business(es) and Partnership(s) Outside Malaysia Received in Malaysia Effective From 1 July 2022 [Attachment A2]

Attachment A2 in Form e-C 2022 requires a summary of Statutory Income from Sources of Business(es) and Partnership(s) outside Malaysia received in Malaysia effective from 1 July 2022.

Practical Issue

- This distinction between Malaysian and foreign origin increases the cost of compliance since additional effort will be necessary, for example, to apportion the amounts for each source of income.

- As a result, the cost of compliance will increase.

- In addition, the Attachment only allows a maximum of 5 rows in any individual component.

- Where there are several countries of origin for the same business or partnership source, taxpayers would not be able to give the relevant information.

Feedback / Proposal of CTIM

- To remove this Attachment, apply Attachment A1 for both sources in Malaysia and Outside Malaysia Received in Malaysia, effective from 1 July 2022.

Response of IRBM on September 9, 2022

Refer to IRBM’s response for Issue No 1.

Furthermore, if there is insufficient space, the 5th and subsequent foreign source of business income should be combined and reported in the 5th line of each category.

The Taxpayer can place one of the countries in the “Country” column. Keep complete records of each business source of income outside Malaysia for audit purposes.

Issue No 4: Other Statutory Income from Other Sources in Malaysia [Attachment A6]

Attachment A6 in Form e-C 2022 requires a summary of Other Statutory Income from Other Sources in Malaysia only.

Practical Issue

- This distinction between Malaysian and foreign origin increases the cost of compliance since additional effort will be necessary, for example, to apportion the amounts for each source of income.

- As a result, the cost of compliance will increase.

Feedback / Proposal of CTIM

- To remain as per YA2021, i.e., Attachment A6 for both sources in Malaysia and Outside Malaysia Received in Malaysia, effective from 1 July 2022.

Response of IRBM on September 9, 2022

Refer to IRBM’s response for Issue No 1.

Issue No 5: Other Statutory Income from Sources Outside Malaysia Received in Malaysia Effective from 1 July 2022 [Attachment A7]

Attachment A7 in Form e-C 2022 requires a summary of Other Statutory Income from Other Sources outside Malaysia received in Malaysia effective from 1 July 2022.

Practical Issue

- This distinction between Malaysian and foreign origin increases the cost of compliance since additional effort will be necessary, for example, to apportion the amounts for each source of income.

- As a result, the cost of compliance will increase.

Feedback / Proposal of CTIM

- To remain as per YA2021, i.e., Attachment A6 for both sources in Malaysia and Outside Malaysia Received in Malaysia, effective from 1 July 2022.

Response of IRBM on September 9, 2022

Refer to IRBM’s response for Issue No 1.

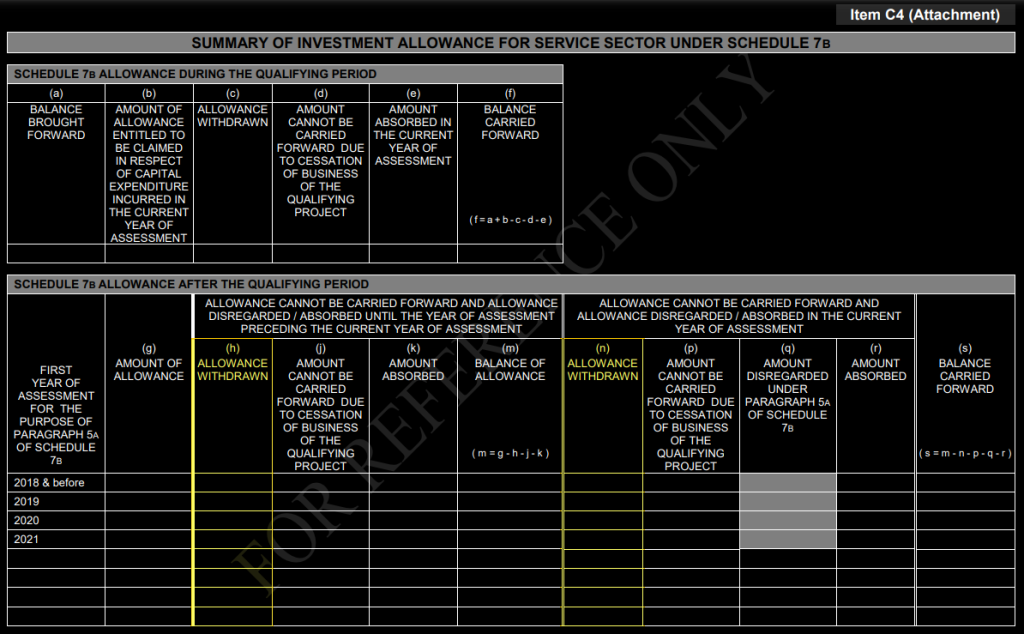

Issue No 6: Summary of Investment Allowance for Service Sector Under Schedule 7B [Attachment C4]

On Items h and n – Allowance Withdrawn

Issues

Schedule 7B of the ITA does not have provisions for the withdrawal of allowances.

Feedback / Proposal of CTIM

- To remove items “h” and “n” from the Attachment

Response of IRBM on September 9, 2022

The Income Tax Act of 1967, Schedule 3, Paragraph 2 provides the Minister with authority to approve written applications for service sector investment allowances and to set such terms and conditions as it sees proper.

As a consequence, the company is not qualified to make a claim for the sector investment allowance service if any of the conditions are violated.

Therefore, maintaining Columns “h” and “n” is important because it is necessary to fill in these columns if a company that has claimed service sector investment allowances in previous years of assessment is found to be in violation of the conditions established by the Minister in the current year, which renders the company ineligible to claim the sector investment allowance (This occurs when the Minister discovers that the company has violated the conditions set forth by the Minister in the current year.)

In addition, columns “h” and “n” also need to be maintained in parallel with the existence of columns “c”.

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Any reliance on such information is therefore strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/