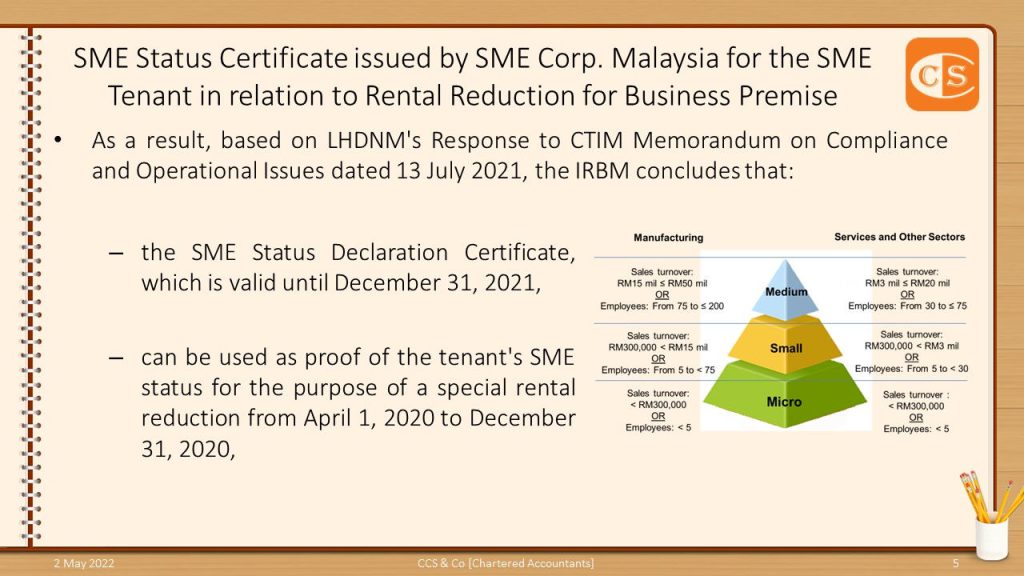

1. On September 8, 2021, the Malaysian government gazetted the following rules:

👉 Income Tax (Special Deduction for Rental Reduction to a Small and Medium Enterprise) Rules 2021 [P.U.(A) 353/2021]; and

👉 Income Tax (Special Deduction for Reduction of Rental to a Tenant Other Than a Small and Medium Enterprise) Rules 2021 [P.U.(A) 354/2021]

2. P.U.(A) 353/2021 applies where a business premise’s tenant is a small and medium enterprise (“SME”) and is assumed to have taken effect in the assessment year 2020.

3. However, a certificate by the SME Corp. Malaysia confirming the status of the small and medium enterprise as a supporting document is required.

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. 2021年9月8日,马来西亚政府在宪报中颁布了以下两个细则 [Rules]:

👉 2021年所得税 (中小型企业的租金减免特别扣除) 细则 [Income Tax (Special Deduction for Rental Reduction to a Small and Medium Enterprise) Rules 2021, P.U.(A) 353/2021];和

👉 2021年所得税 (非中小型企业租户的租金减免特别扣除) 细则 [Income Tax (Special Deduction for Reduction of Rental to a Tenant Other Than a Small and Medium Enterprise) Rules 2021, P.U.(A) 354/2021]。

2. P.U.(A) 353/2021 是在营业场所的租户是中小型企业的情况被引用,并在 2020课税年度生效。 3. 然而,租户需要提供由马来西亚中小型企业公司 [SME Corp. Malaysia ] 出具的证书,以确认中小型企业的地位。