125.-Income-Tax-Deduction-for-Expenses-in-relation-to-Secretarial-Fee-and-Tax-Filing-Fee-Amendment-Rules-2021Download

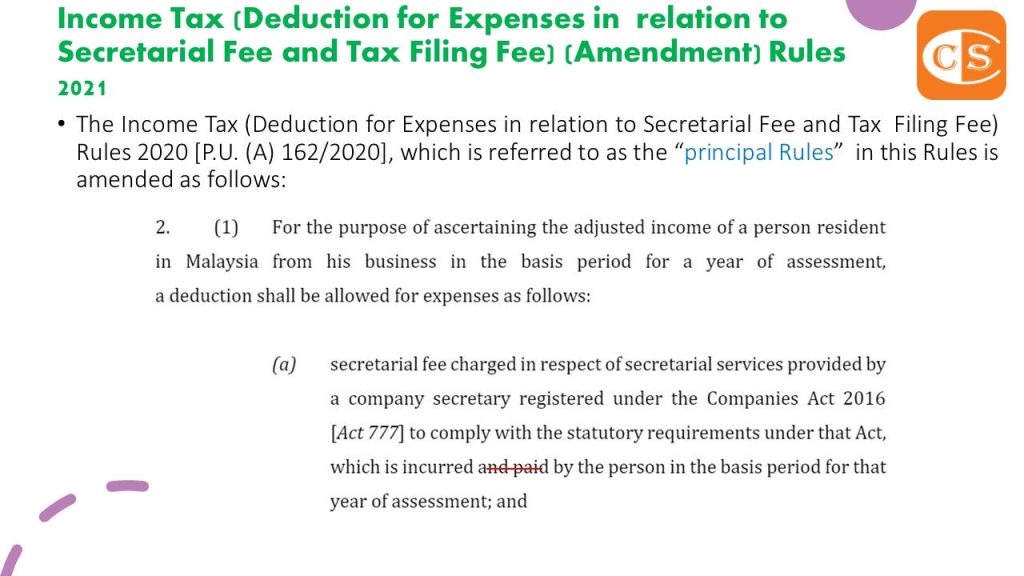

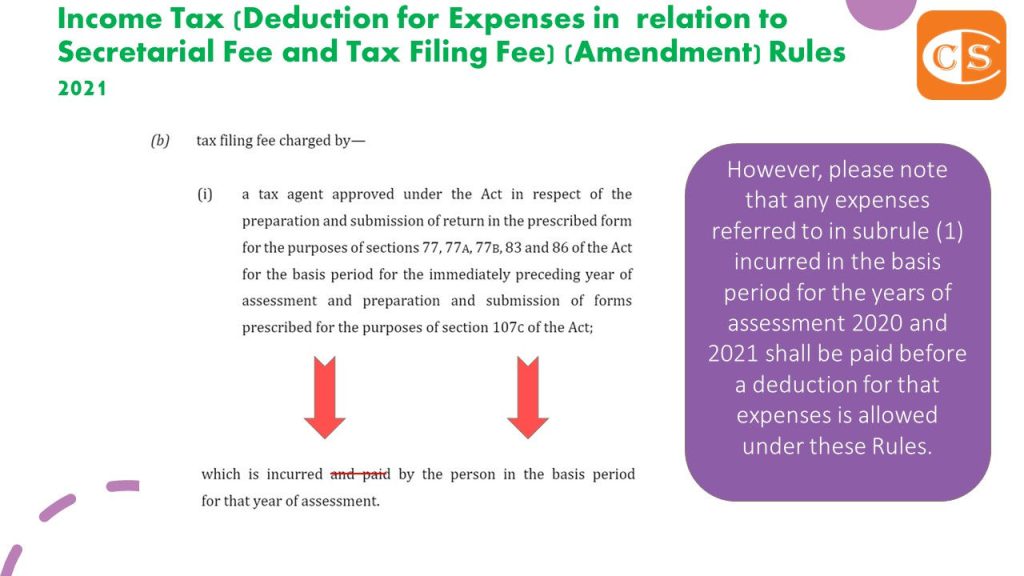

1. On 24 December 2021, the Minister, in the exercise of the powers conferred by paragraph 154(1)(b)read together with paragraph 33(1)(d) of the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee) (Amendment) Rules 2021 [P.U. (A) 471].

2. These Rules have an effect from the year of assessment 2022.

3. Join our Telegram: http://bit.ly/YourAuditor

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. 2021 年 12 月 24 日,部长行使 1967 年所得税法令第 154(1)(b) 段与 第 33(1)(d) 段所赋予的权力,在宪报颁布了2021年所得税(与秘书和报税有关的费用扣除)(修订)细则 [PU (A) 471]。

2. 本细则从 2022 课税年度起生效。

3. 加入我们的 Telegram:http://bit.ly/YourAuditor 🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼