Principal hub incentive 3.0

It was announced in the Budget 2021 that the deadline for submitting applications for the principal hub incentive will be deferred by an additional two years, to the 31st of December in 2022.

The submission deadline had previously been open until the 31st of December 2020.

In addition, in connection with the renewal of the incentive following the initial five-year period, the criteria that must be met by new companies will be loosened up.

The Malaysian Investment Development Authority (“MIDA”) has now published the “Guidelines for Principal Hub Incentive 3.0” in response to the announcement that was made earlier.

The guidelines are available from MIDA’s website [https://www.mida.gov.my/

- (Forms and Guidelines | Services Sector | Regional Operations)].

On 24 May 2022, the Minister, in the exercise of the powers conferred by paragraph 154(1)(b) read together with subsection 6(1A) and paragraph 2 of Part XVII of Schedule 1 to the Income Tax Act 1967 [Act 53], gazetted the Income Tax (The Principal Hub Incentive Scheme) Rules 2022

[P.U (A) 164].

What it is All About

A qualifying company will be subject to these Rules if it submits a written application for the Principal Hub Incentive Scheme to the Minister through the Malaysian Investment Development Authority.

The application must be received on or after January 1, 2021, and no later than December 31, 2022.

What is a Principal Hub?

A locally incorporated company that uses Malaysia as a base for conducting its regional and global businesses and operations is considered to be a principal hub. This type of company uses Malaysia as its base in order to manage, control, and support its key functions, which can include the management of risks, decision-making, strategic business activities, trading, finance, management, and human resources.

What is the “Principal Hub Incentive Scheme”?

It means an Incentive Scheme for the Qualifying Company which carries on Qualifying Activity and is approved by the Minister.

The principal hub incentive was first introduced in 2015, with the goal of making Malaysian cities more attractive to multinational companies (MNCs) looking to establish a regional hub in Southeast Asia.

This was particularly important due to the fact that the country had established a manufacturing base for MNCs from the 1980s to the 2000s.

What is the “Malaysian Investment Development Authority”?

It means the Malaysian Investment Development Authority which was established under the Malaysian Investment Development Authority(Incorporation) Act 1965 [Act 397].

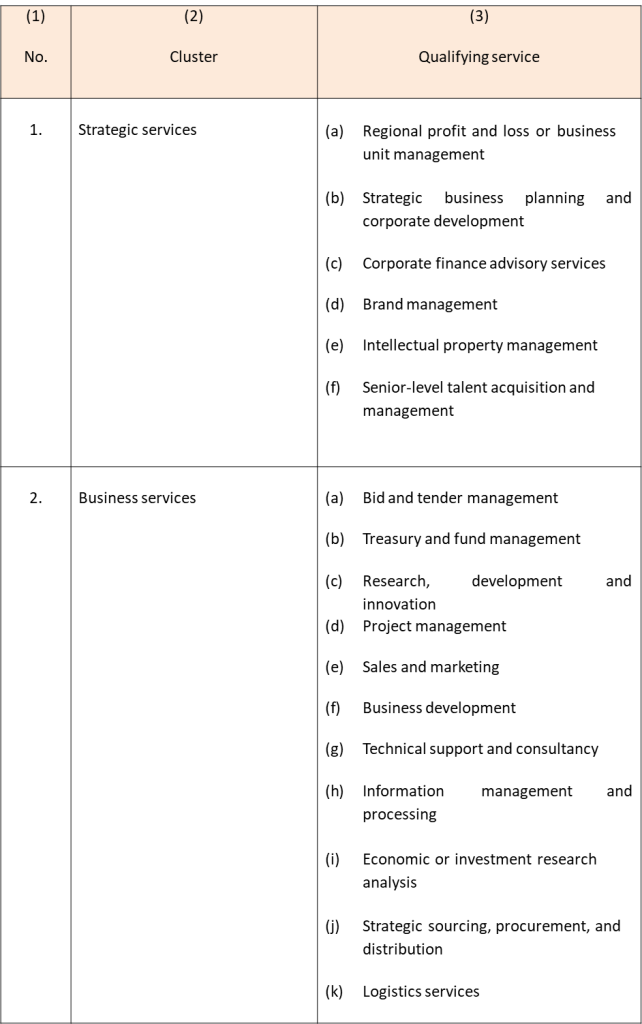

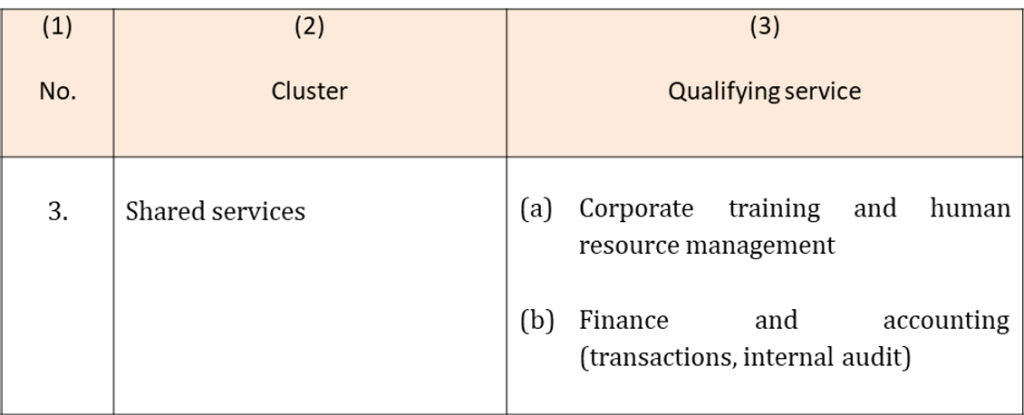

What are the Qualifying Activities for principal hubs in Malaysia?

It is an activity that fulfills the eligibility condition prescribed by the Minister as provided under rule 4.

The qualifying activities are as follows:

What is the “Qualifying Company”?

It is a new company or an existing company that fulfills the eligibility condition imposed by the Minister under the Income Tax Act 1967 (‘ITA’) and the 2022 Rules.

Rule 3 of the 2022 Rules provides that a new company must:

- be incorporated under the Companies Act 2016 (‘CA 2016’) and resident in Malaysia;

- have a paid-up capital of more than RM2,500,000; and

- be established to carry on a qualifying activity, which:

- does not have an existing entity or related entity in Malaysia before the application referred to in rule 2 was made [Category 1]; or

- has an existing entity or related entity in Malaysia which has not carried on a qualifying activity in Malaysia before the qualifying company’s application for approval as a principal hub under the Scheme [Category 2].

Rule 3 of the 2022 Rules provides that an existing company must:

- be incorporated under the CA 2016 and resident in Malaysia;

- already be operating in Malaysia and carrying on a manufacturing or services activity other than the qualifying activity before the qualifying company’s application for approval as a principal hub under the Scheme; and

- have a paid-up capital of more than RM2,500,000.

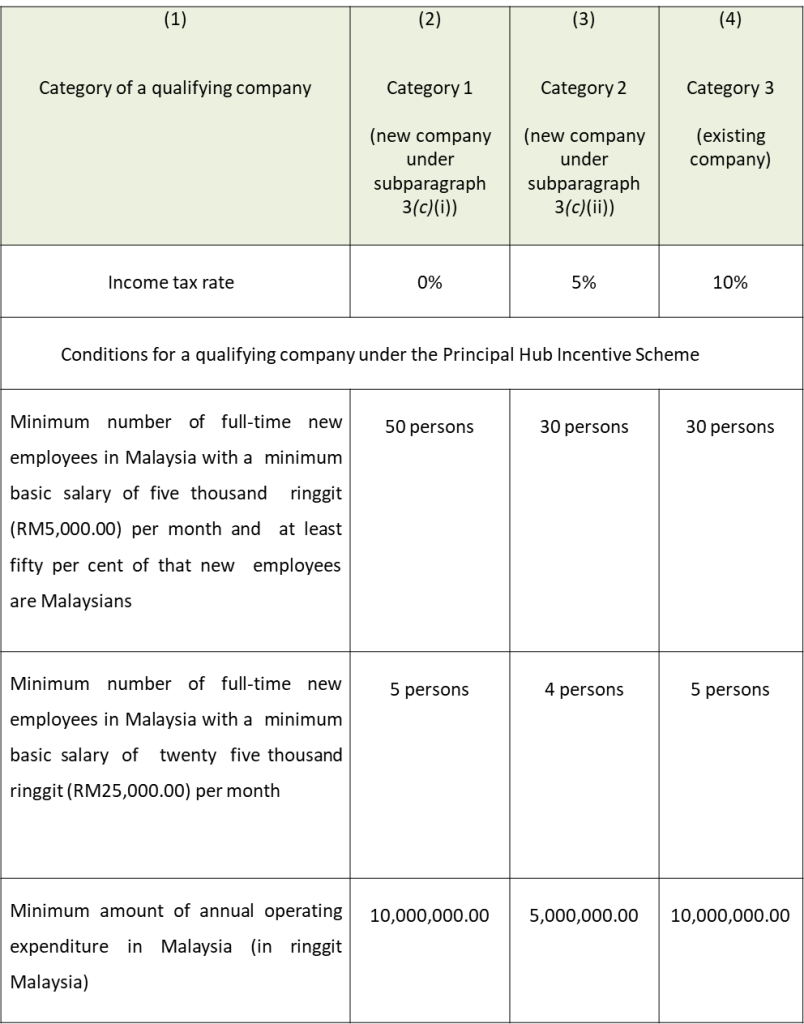

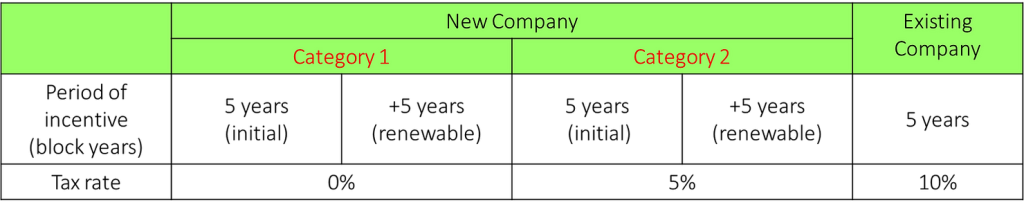

The Tax Incentive

The incentive, if granted, will be for a period of 5 consecutive years of assessment.

The rate of income tax that shall be charged under the 2022 Rules is as follows::

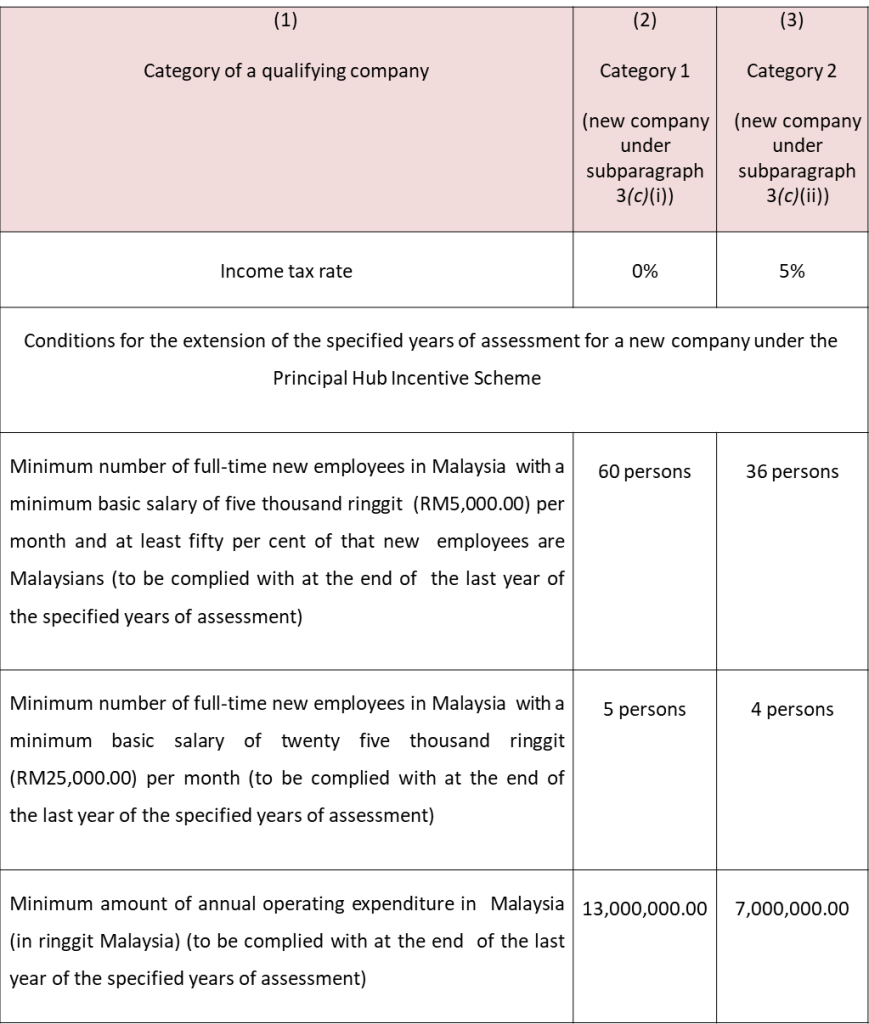

Extension of Specified Years of Assessment for a New Company

The Minister may extend the specified years of assessment for a new company for another period of five years of assessment subject to the new company fulfilling all conditions imposed by the Minister as specified in the approval letter and any other conditions as specified in Schedule 3 as follows:-

In Summary:

Exclusion and Non-Application

- Income derived from the intellectual property (Note 1) from a qualifying activity shall not be included in ascertaining the statutory income of a qualifying company as the income shall be subject to tax under the ITA.

- A qualifying company that has made a claim for relief, exemption, deduction, or incentive (Note 2)under certain provisions of the ITA or the Promotion of Investments Act of 1986 is excluded from the application of the 2022 Rules.

Note 1

- A qualifying company owns an intellectual property right if the qualifying company is the owner or the licensee of the right;

- royalties or other income is derived from an intellectual property right if it is receivable as consideration for the commercial exploitation of that right; and

- “intellectual property right” means a right arising from any patent, utility innovation and discovery, copyright, trademark, and service mark, industrial design, layout-design of the integrated circuit, secret processes or formulae and know-how, geographical indication, and the grant of protection of a plant variety, and other like rights, whether or not registered or registrable.

Note 2

- has made a claim for reinvestment allowance under Schedule 7A to the Act or investment allowance the for service sector under Schedule 7B to the Act;

- has been granted an incentive under the Promotion of Investments Act 1986 [Act 327];

- has been granted an exemption under paragraph 127(3)(b) or subsection 127(3A) of the Act; or

- has been approved by the Minister an incentive scheme under any rules made under section 154of the Act; or

- has made a claim for deduction under any rules made under section 154 of the Act except—

- the rules in relation to an allowance under Schedule 3 to the Act;

- the Income Tax (Deduction for Audit Expenditure) Rules 2006 [P.U.(A) 129/2006];or

- the Income Tax (Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee) Rules 2020 [P.U. (A) 162/2020].