The term “Digital Currency,” which is also known as “Cryptocurrency,” refers to a blockchain-based digital asset that can be bought, sold, and traded on a variety of platforms.

Bitcoin was the first cryptocurrency ever created, all the way back in 2008 and was issued in 2009.

Since that time, a wide variety of people and businesses worldwide have been mining and trading more cryptocurrencies, such as Ethereum, XRP, Tether, Dogecoin, Ripple, etc.

Although cryptocurrencies are legal in Malaysia, they are not considered legal tender.

Different countries and regions worldwide have adopted various approaches regarding how Digital Currency should be taxed.

Guidelines on Taxation of Electronic Commerce

The Inland Revenue Board of Malaysia (IRBM) has introduced guidelines on the taxation of e-commerce that were published on 1 January 2013.

With the evolvement of e-commerce transactions (e-CT), IRBM has published updated Guidelines on Taxation of Electronic Commerce Transactions (the 2019 Guidelines), replacing the earlier guidelines dated 1 January 2013

This new guideline provides some guidance on income tax treatment regarding e-CT. Key terms defined by the 2019 Guidelines include:

“Digital Currency” means a digital representation of value recorded on a distributed digital ledger, whether cryptographically-secured or otherwise, that functions as a medium of exchange and is interchangeable with any money, including through the crediting or debiting of an account.

“Digital Token” means a digital representation recorded on a distributed digital ledger, whether cryptographically-secured or otherwise.

Scope of Charge

Generally, income tax is imposed on the income of any person accruing in or derived from Malaysia.

The 2019 Guidelines state, “any income concerning e-CT is deemed to be derived from Malaysia if it is associated with any activities in Malaysia regardless of whether that income is received in Malaysia or otherwise.”

Scope of Tax Liability for Business

The 2019 Guidelines stipulate that for business income, where the business operations are carried on in Malaysia, the income attributable to those business operations is deemed to be derived from Malaysia.

Guidelines on the tax treatment of Digital Currency Transactions

IRBM is aware of the importance of providing a more in-depth discussion on how taxes should be applied to Digital Currencies and Digital Tokens.

Therefore, to provide more direction on the tax treatment under the Income Tax Act of 1967, IRBM clarified taxpayers by issuing guidelines on the tax treatment of Digital Currency Transactions (“the DCT Guidelines“) on August 26, 2022.

The following paragraphs make up the new 14-page Guidelines:-

- Introduction

- Interpretation

- Income Tax Treatment

- Acquisition Cost of Digital Currency

- Digital Currency with No Published Value

Income Tax Treatments

In general, the taxability of transactions involving digital currency in Malaysia is determined by Section 3 of the Income Tax Act 1967, which states that any income accruing in or derived from Malaysia or income received in Malaysia from outside Malaysia is subject to taxation.

The whole object of the Income Tax Act is to tax income, and it is, therefore, an exercise of utmost importance for a taxpayer to distinguish the nature of a particular receipt, as Malaysia does not tax capital gain, only revenue gains arising from the disposal of digital currency is taxable.

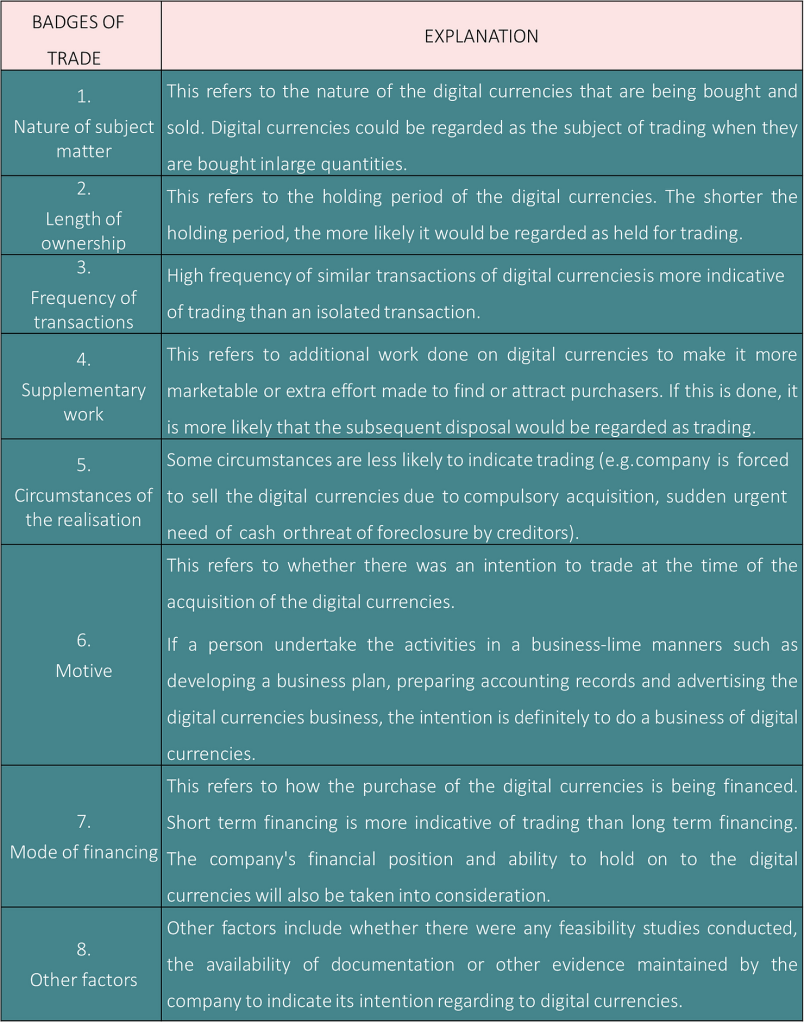

A description of how IRBM determines digital currencies’ gain as a capital or revenue gain is as follows:

Appendix A

The Guidelines stipulate no single badge is a decisive pointer to the existence of a trade. It should be weighed up with all the relevant factors.

So, Tax or Not?

1) The Tax Implications of Trading of Digital Currencies

As is the case with the trading of stocks, businesses that purchase and sell digital currencies as part of their regular business operations will be subject to taxes on the profits generated from trading in digital currencies.

Example 1:

- ABC Sdn Bhd is in the business of buying and selling digital currencies.

- On 11 September 2021, the company purchased 100 units of Coin Y for RM1,000,000 and sold 50 units of Coin Z for RM1,700,000.

- Since ABC Sdn Bhd is carrying a business of trading digital currencies:

- the selling of Coin Z for RM1,700,000 should be reported as sales, and

- the cost of purchasing Coin Y is deductible.

- If the company makes a loss, such loss is tax deductible.

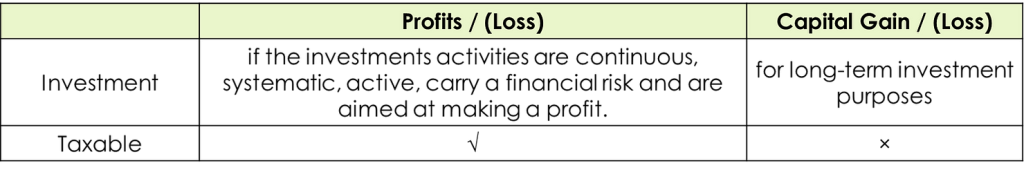

2) The Tax Implications of Investment in Digital Currencies

The factors to consider in determining whether the gain is capital or revenue are described in Appendix A.

Example 2:

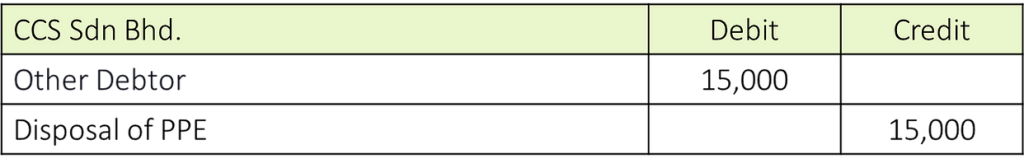

- ABC Enterprise bought used equipment from CCS Sdn Bhd for 1 unit of digital currency B.

- At the point of transaction, 1 unit of digital currency B is equivalent to RM15,000.

- ABC Enterprise shall recognise the used equipment as an asset for the business at the value of RM15,000.

- The value of the digital currency received for the equipment (RM15,000) is recognised as equipment sales by CCS Sdn Bhd.

- After 3 years, the value of the digital currency B increases from RM15,000 to RM30,000.

- Digital currency B has been disposed of by CCS Sdn Bhd and the gain on disposal of digital currency B amounted to RM15,000.

- If CCS Sdn Bhd’s holding of the digital currencies B satisfies the criteria of capital gains, the disposal is not subject to ITA 1967.

3) The Tax Implications of Digital Currencies Mining

In general, miners of Digital Currencies will be subject to taxation in two different scenarios:

- when they are awarded Digital Currency as a reward for their mining activity, and

- when they sell or otherwise exchange the reward tokens.

Concerning (1)

- According to the DCT Guidelines, if a taxpayer’s mining activities constitute a trade or business, the taxpayer has to recognise gross income upon receipt of the reward tokens in an amount equal to the fair market value of the coins at the time of receipt. Expenses relating to the business will be tax deductible, and losses incurred will be allowed.

- Similarly, if a taxpayer performs mining activities as an employee, payments made in cryptocurrency are treated as wages subject to Monthly Tax Deductions (MTD) Rules.

Concerning (2)

- The taxability of a miner’s profit from the disposal of payment tokens would depend on whether or not the gain is capital or revenue in nature and is based on badges of trade.

Example 3:

- First Taxable Event

- Adam mines Bitcoin and receives 6 tokens when the price per coin is $20,000.

- If we assume that Adam’s mining activities constitute a trade or business, the $120,000 ($20,000 x 6) worth of Bitcoin he receives will be treated as income and subject to tax at prevailing tax rates.

- Second Taxable Event

- Adam may trigger a second taxable event upon the sale of the reward tokens, with the amount of gain (or loss) equaling the difference between the sales price and the gross income recognised when Adam initially received the coins in exchange for mining activities.

- Assume that Adam sold three of the Bitcoin tokens three years later when the price per coin was $60,000. Adam would recognize a gain of $120,000 ([$60,000 x 3 tokens] – [$20,000 x 3 tokens]).

- Since Adam held the three Bitcoins for more than three years, or if this is the only transaction made by Adam in the past 3 years, his holding of the Bitcoins satisfies the criteria of capital nature; the disposal is not subject to ITA 1967.

Other Tax Implications

Mere acquisition and disposal of digital currencies

When a person buys digital currencies such as Bitcoin and Ether merely as part or full payment of any goods and services, the situation does not give rise to taxation.

Example 4:

Fakhri wants to attend a show at Istana Budaya.

The organiser offers a discount of 20% of the ticket price if payment is made using digital currencies.

Fakhri buys digital currency equivalent to the discounted ticket price and pays the organiser.

Receiving digital currencies as a result of free distribution or splitting

A person may receive digital currency for free as a promotion or marketing tool or split existing digital currency such as airdrop and hardfork.

These tokens are not income to the recipient, thus not taxable at the time of receipt.

Gains from the disposal of these tokens in the future will be taxable if the gains are revenue in nature.

Tokens are given in exchange for certain Goods or Services

A person may receive digital currency in exchange for certain goods or services.

The above may be subject to income tax. The value of the goods or services is determined based on the value of the digital currencies at the point of transaction.

Gains from the disposal of these tokens in the future will be taxable if the gains are revenue in nature.

The Acquisition Cost of Digital Currency

For taxation purposes, the acquisition cost of digital currencies must be determined in Ringgit Malaysia (RM).

As digital currencies are treated as intangible assets for taxation purposes, any digital currency in a company’s possession, therefore, needs to be valued in Ringgit Malaysia (RM).

The acquisition cost of digital currency is determined based on the First In, First Out (FIFO) principle unless the taxpayer is able to prove otherwise.

If the acquisition cost of the current asset cannot be determined, the digital currency will be valued using fair value, i.e. at the rate in force on the day of the transaction and based on the acceptable and verifiable digital currency exchanges

Digital currency with no published value

If Digital Currency is received in exchange for property or services and that Digital Currency is not traded on any Digital Currency exchange and does not have a published value, then the fair value of the Digital Currency received is equal to the fair value of the property or services exchanged for the digital currency when the transaction occurs.

What are some best practices for handling Digital Currency?

The most important thing you can do is maintain detailed records of your Digital Currency. Documents that need to be kept concerning digital currency include:

- records to determine the nature of the transaction – including whitepaper

- records to determine the value of a digital currency based on the online exchange

- date of transaction

- name of the other party, i.e. digital currency address

- receipts of purchase/ transfer of digital currency

- exchange records

- other records such as records of agents, wallet keys, software

- bank statements

- receipts/invoices of business expenses

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Any reliance on such information is therefore strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/