![]() Tax Corporate Governance (TCG): Smart Strategies for Sustainable, Tax-Risk-Resilient Companies

Tax Corporate Governance (TCG): Smart Strategies for Sustainable, Tax-Risk-Resilient Companies ![]()

In today’s complex business environment, taxation has become a pressing concern for many companies.

Stricter regulations and heightened expectations mean that noncompliance can significantly jeopardize business continuity.

To ensure transparency, competitiveness, and regulatory resilience, the concept of Tax Corporate Governance (TCG) has emerged as a strategic necessity.

This approach goes beyond mere compliance—it enhances corporate reputation and stakeholder confidence.

The Inland Revenue Board of Malaysia (LHDN/HASiL) has formally introduced the Tax Corporate Governance Framework (TCGF) to guide organizations in managing tax-related risks in a structured, sustainable, and integrity-driven manner.

![]() What Is Tax Corporate Governance?

What Is Tax Corporate Governance?

At its core, TCG represents a subset of corporate governance focused specifically on tax risk management.

The TCGF enables organizations to cultivate a cooperative, transparent relationship with tax authorities, ensuring that tax reporting and compliance are both reliable and trusted.

![]() The Six Core Principles of TCGF

The Six Core Principles of TCGF

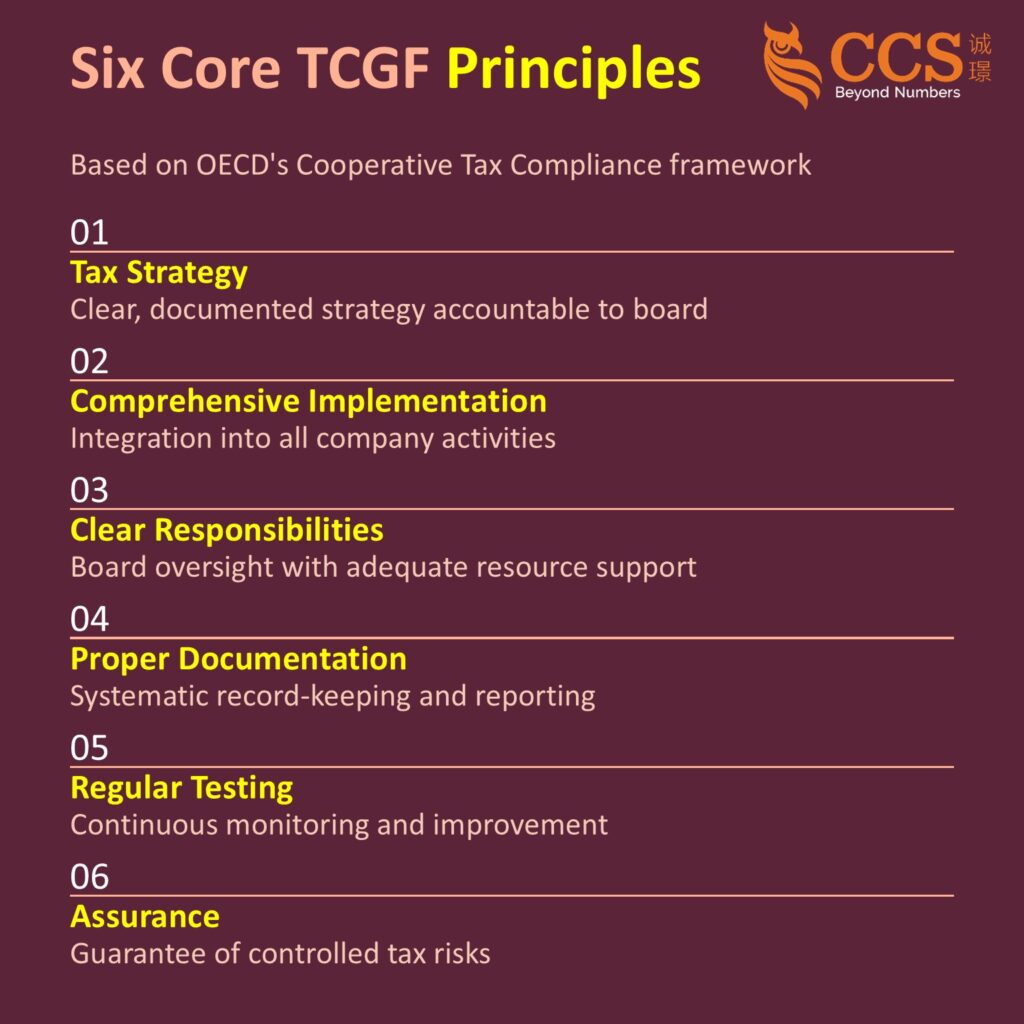

Drawing inspiration from the OECD’s Cooperative Tax Compliance model, HASiL’s TCGF is underpinned by six key principles:

1. Clear Tax Strategy

Documented and board-level-approved tax strategy that aligns with organizational objectives.

2. Enterprise-wide Implementation

Tax governance should be embedded across all operations—not just advisory or isolated functions.

3. Defined Responsibilities

Clear roles from the Board to the tax department, with adequate resources assigned to ensure ownership and execution.

4. Robust Documentation

Tax governance processes must be well-documented and supported by effective reporting systems, periodically reviewed to remain relevant.

5. Continuous Testing

Policies and procedures should be continuously monitored, tested, and refined for effectiveness.

6. Governance Assurance

The framework must reassure stakeholders that tax risks are under control and that reporting is reliable.

![]() The Value Proposition of TCGF

The Value Proposition of TCGF

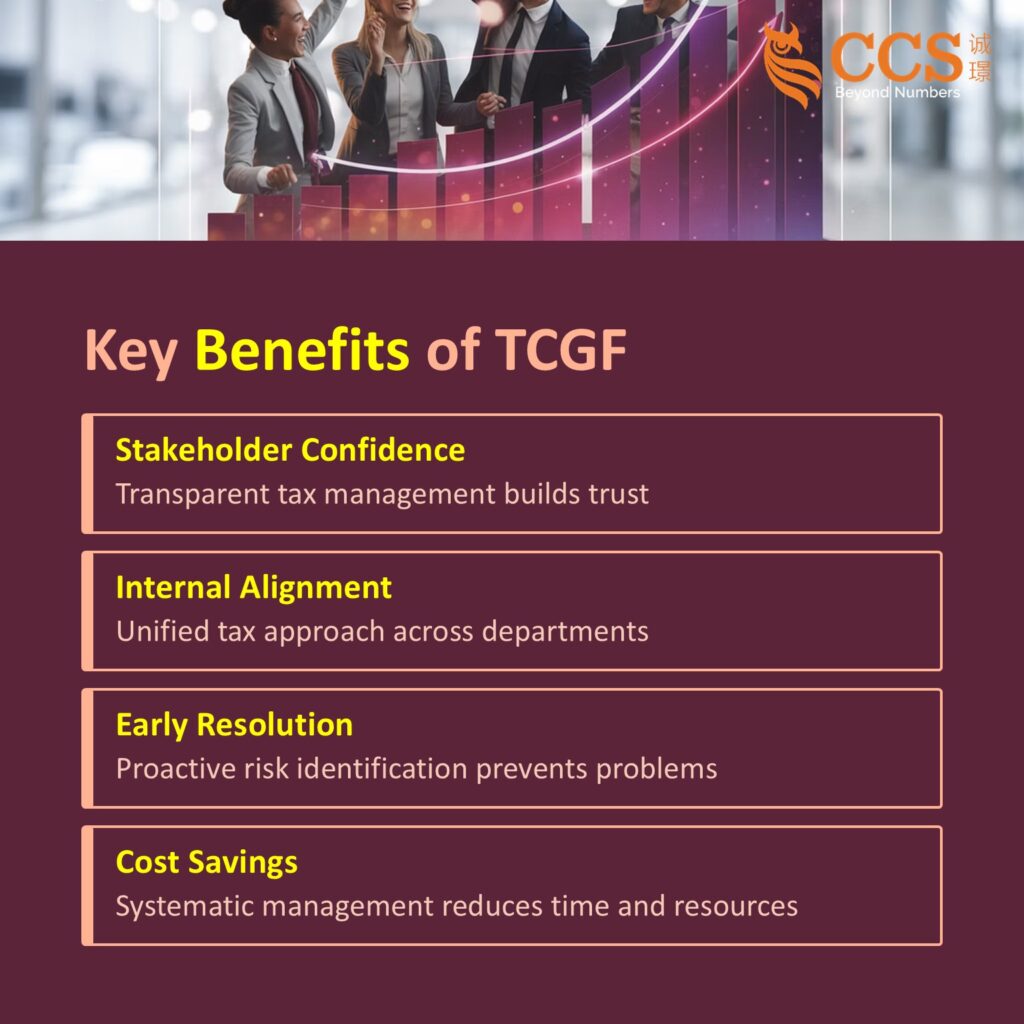

Adopting TCGF delivers significant advantages—not just for individual organizations, but for the broader economy:

![]() Proactive Risk Management: Early identification and mitigation of tax risks.

Proactive Risk Management: Early identification and mitigation of tax risks.

![]() Operational Efficiency: Treating tax governance as an enabler, not a hindrance.

Operational Efficiency: Treating tax governance as an enabler, not a hindrance.

![]() Executive Confidence: Senior management makes informed decisions with tax risks effectively managed.

Executive Confidence: Senior management makes informed decisions with tax risks effectively managed.

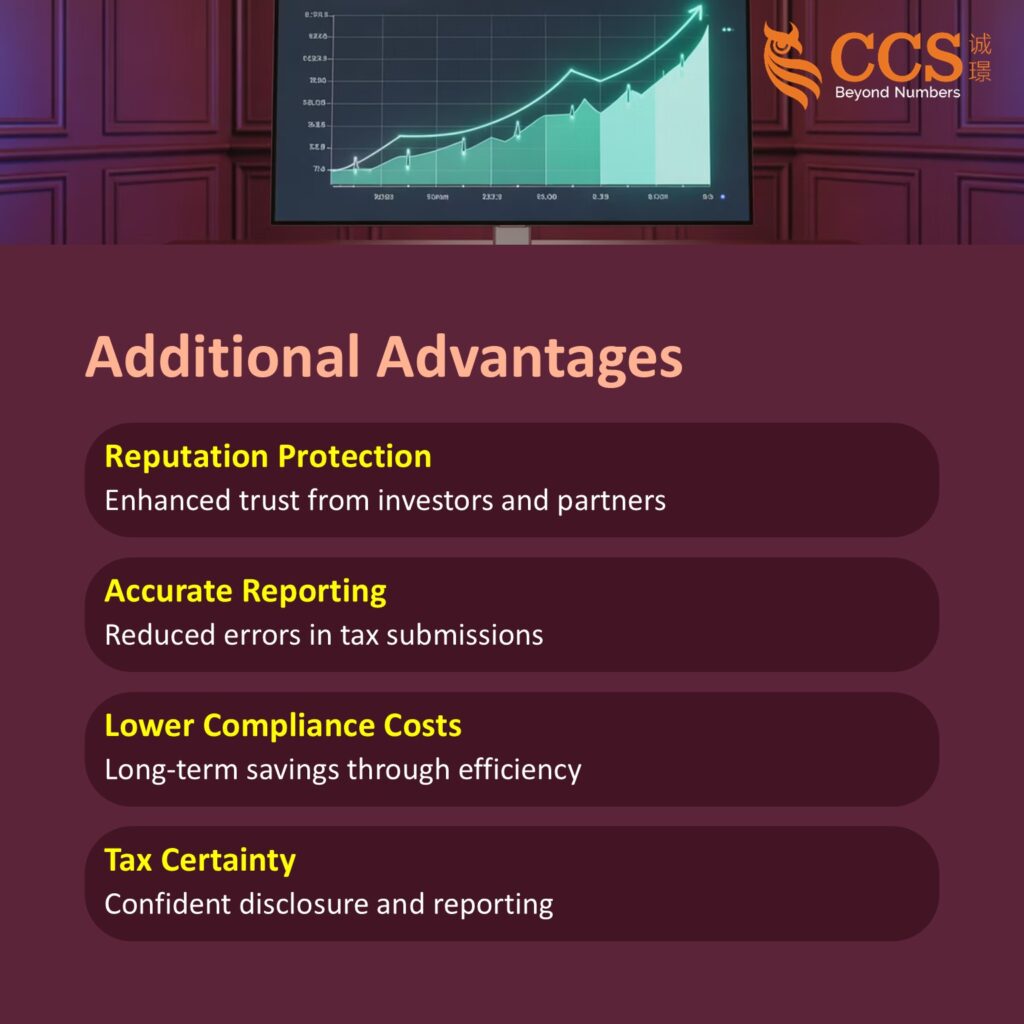

![]() Reputational Security: Transparent tax practices bolster investor and stakeholder trust.

Reputational Security: Transparent tax practices bolster investor and stakeholder trust.

![]() Integrity in Tax Reporting: Accurate and compliant disclosures reduce potential missteps.

Integrity in Tax Reporting: Accurate and compliant disclosures reduce potential missteps.

![]() Lower Cost of Compliance: Streamlined procedures reduce resource burden.

Lower Cost of Compliance: Streamlined procedures reduce resource burden.

![]() Assured Disclosure: Confident and consistent tax reporting.

Assured Disclosure: Confident and consistent tax reporting.

Collectively, TCGF transforms tax from a compliance burden into a strategic asset, enhancing competitiveness, sustainability, and public trust.

![]() National and Global Impacts

National and Global Impacts

TCGF isn’t merely a compliance checklist—it serves as a strategic investment.

It ensures companies remain resilient, ethical, and relevant in an increasingly scrutinized corporate landscape.

Proper implementation supports investor confidence, strengthens economic growth, and reinforces Malaysia’s corporate governance standards.

![]() International Alignment and Updates

International Alignment and Updates

Global Momentum: TCG reflects a broader trend toward improved tax transparency and cooperative compliance globally, aligned with OECD and other international standards.

April 2025 Revised Guidelines: On 11 April 2025, LHDN issued updated versions of the TCGF, including detailed guidelines and FAQs, clarifying participation criteria, documentation requirements, and review protocols for self- and independent reporting.

![]() Final Thoughts

Final Thoughts

The era of reactive tax compliance may be over.

With TCGF, companies are encouraged to transition toward proactive, strategy-aligned tax governance.

It not only supports internal resilience but also elevates corporate integrity and national economic reputation.

Embracing TCGF is therefore both a defensive shield against tax risk and a pathway to sustainable corporate excellence.

![]() 税务公司治理(TCG):打造可持续、抗税风险企业的智能策略

税务公司治理(TCG):打造可持续、抗税风险企业的智能策略 ![]()

在当今复杂的商业环境中,税务已成为众多企业的紧迫关切。

更严格的法规与更高的期望意味着违规行为可能严重危及业务连续性。

为确保透明度、竞争力及监管韧性,税务公司治理(TCG)理念已成为战略必需。

该方法不仅限于合规要求,更能提升企业声誉与利益相关方信心。

马来西亚内陆税收局(LHDN/HASiL)已正式推出税务公司治理框架(TCGF),旨在引导企业以系统化、可持续且诚信为本的方式管理税务相关风险。

![]() 何谓税务公司治理?

何谓税务公司治理?

本质上,TCG是公司治理的子集,专注于税务风险管理。

TCGF使企业能够与税务机关建立合作透明的关系,确保税务申报与合规性既可靠又可信。

![]() TCGF六大核心原则

TCGF六大核心原则

借鉴经合组织(OECD)合作纳税遵从模式,马来西亚内陆税收局的TCGF建立在六项关键原则之上:

1. 明确税务战略

制定经董事会批准的书面税务战略,并与组织目标保持一致。

2. 全企业实施

税务治理应贯穿所有运营环节——而非仅限于咨询或孤立职能。

3. 明确职责划分

从董事会到税务部门的职责清晰界定,配备充足资源确保责任落实与执行到位。

4. 完善文档体系

税务治理流程须详实记录,依托高效报告系统支撑,并定期审视以保持时效性。

5. 持续验证机制

持续监控、测试并优化政策流程的有效性。

6. 治理保障

该框架必须让利益相关方确信税务风险可控且报告可靠。

![]() TCGF的价值主张

TCGF的价值主张

采用TCGF将带来显著优势——不仅惠及单个组织,更将造福整体经济:

![]() 主动风险管理:早期识别并缓解税务风险。

主动风险管理:早期识别并缓解税务风险。

![]() 运营效能提升:将税务治理视为助力而非阻碍。

运营效能提升:将税务治理视为助力而非阻碍。

![]() 高管决策信心:通过有效管控税务风险,助力高层管理层做出明智决策。

高管决策信心:通过有效管控税务风险,助力高层管理层做出明智决策。

![]() 声誉保障:透明的税务实践增强投资者与利益相关方信任。

声誉保障:透明的税务实践增强投资者与利益相关方信任。

![]() 税务报告诚信:准确合规的披露减少潜在失误。

税务报告诚信:准确合规的披露减少潜在失误。

![]() 降低合规成本:简化流程减轻资源负担。

降低合规成本:简化流程减轻资源负担。

![]() 确保披露质量:实现自信且一致的税务报告。

确保披露质量:实现自信且一致的税务报告。

总体而言,TCGF将税务从合规负担转化为战略资产,提升企业竞争力、可持续性及公众信任。

![]() 国家与全球影响

国家与全球影响

TCGF不仅是合规清单,更是战略性投资。

它确保企业在日益受审视的企业环境中保持韧性、道德与竞争力。

正确实施可增强投资者信心,促进经济增长,并强化马来西亚公司治理标准。

![]() 国际接轨与更新动态

国际接轨与更新动态

全球趋势:TCG契合经合组织等国际标准,反映全球提升税务透明度与协作合规的普遍趋势。

2025年4月修订指南:2025年4月11日,马来西亚税务局发布TCGF更新版本,包含详细指南与常见问题解答,明确了自主申报与独立申报的参与标准、文件要求及审核流程。

![]() 结语

结语

被动税务合规的时代或将终结。

TCGF推动企业向主动型、战略导向的税务治理转型。

这不仅增强内部韧性,更提升企业诚信度与国家经济声誉。

拥抱TCGF既是抵御税务风险的防御盾牌,亦是通往可持续企业卓越的必经之路。