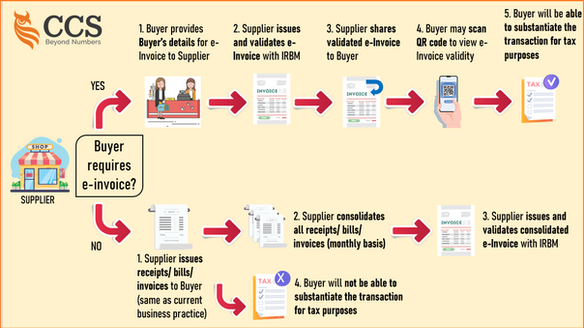

When a buyer requests for an e-invoice, the process is as follows:

1) Buyer must provide their details for e-Invoice to Supplier

2) Supplier then issues and validates e-invoice with IRBM.

The supplier will receive a validated e-Invoice in PDF from IRBM via the MyInvois Portal.

3) Upon validation, the supplier shares the validated e-invoice (embedded with a QR code provided by IRBM) with the buyer.

4) Buyer may scan QR code to view e-Invoice validity

5) The buyer will be able to substantiate the transaction for tax purposes

However, if the buyer does not request an e-invoice for the transaction:

1) Supplier issues receipts/ bills/ invoices to the buyer (same as their current business practice)

2) Supplier consolidates all receipts/ bills/ invoices (monthly basis)

3) Supplier then issues and validates consolidated e-Invoice with IRBM within 7 calendar days after month-end

4) In this situation, the buyer cannot substantiate the transaction for tax purposes. Then, later, the eligibility for tax deduction may be lost.

当买方提出要电子发票时,其流程如下:

1) 买方必须向供应商提供电子发票的详细信息

2) 供应商随后开创电子发票,并经 IRBM 验证。

供应商将通过 MyInvois 门户网站,收到 IRBM 发送的 PDF 格式的验证电子发票。

3) 验证后,供应商与买方共享经验证(内嵌 IRBM 提供的二维码)的电子发票。

4) 买方可扫描二维码 (QR Code) 查看电子发票的有效性。

5) 以税务为目,买方可以核实该交易

但是,如果买方不要求为交易提供电子发票,那么供应商应该采取的措施如下:-

1) 供应商只向买方开出收据/账单/发票(就跟现在的做法一样)

2) 供应商合并所有收据/账单/发票(每月一次)

3) 供应商在月末后 7 天内,开出合并电子发票,让 IRBM 验证

4) 在这种情况下,买方无法为税务目,核实有关交易。那么日后,不排除将失去扣税的资格。

Attachments | 附件:

e-invoice Guideline version 2.1 | 电子发票指南 [ 2.1 版本] – 28.10.2023

e-invoice Specific Guideline version 1.1 | 电子发票具体指南 [ 1.1 版本] – 28.10.2023

e-Invoice Catalogue | 电子发票目录 – 12.10.2023

e-invoice Guideline version 2.0 | 电子发票指南 [ 2.0 版本] – 29.9.2023

e-invoice Specific Guideline version 1.0 | 电子发票具体指南 [ 1.0 版本] – 29.9.2023

e-Invoice Catalogue | 电子发票目录 – 29.9.2023

Other related articles that you might find interesting:-

Revised E-Invoicing Implementation Timeline: Impacts and Challenges for Businesses

e-Invoice by CCS, Chartered Accountants | 电子发票 – CCS 会计事务所

e-Invoicing Guidelines for the year 2023 are now accessible starting 21 July 2023

A comparison of the key aspects between the e-Invoice model via MyInvois and via API Portal

Transitioning to e-Invoices: Assessing the Options for Your Business [What Businesses Need to Know]

Pre-Submission: e-Invoice Submission Requirements via MyInvois Portal & API

MyInvois Made Easy: Step-by-Step e-Invoicing on the Portal

马来西亚内陆税收局 (IRBM) 2023 年电子发票指南快速略读

e-Invoice Guideline Year 2023 Inland Revenue Board of Malaysia: Interpretation of Abbreviations

(中文版)马来西亚内陆税收局 2023 年电子发票指南 | e-Invoice Guideline Year 2023 Inland Revenue Board of Malaysia

The Eight Key Steps to Issuing E-Invoices | 开电子发票的八大步骤

Format of an e-invoice | 电子发票的格式

电子发票改变您的企业 | Transform Your Business with E-Invoicing: An Insight-Sharing Session on IRBM Guidelines

Budget 2024 Speech: On e-invoicing

Sample of Malaysian e-invoicing