The income tax exemption on FSI received by any person (other than a resident company engaging in banking, insurance, or sea or air transport) was removed for all Malaysian-resident taxpayers from January 1, 2022, following the Finance Act 2021.

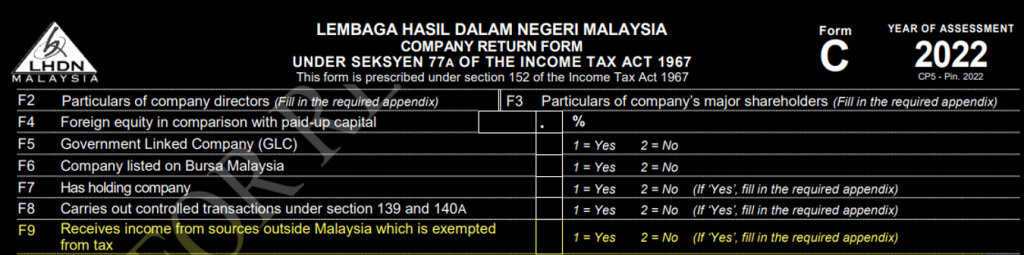

As a result, the Inland Revenue Board (IRB) has amended the Corporate Income Tax Return (Form C) for the year of assessment (YA) 2022.

One of the most important amendments is the addition of a column (item F9) that asks, “Does the company receives income from sources outside Malaysia which is exempted from tax?”

The taxpayer must now enter:

- ‘1’ in the box for ‘Yes’ if the company receives income from sources outside Malaysia exempted from tax and complete other information as required in the appendix.

- ‘2’ in the box for ‘No’ if not relevant.

IRBM’s Response to Clarification Sought

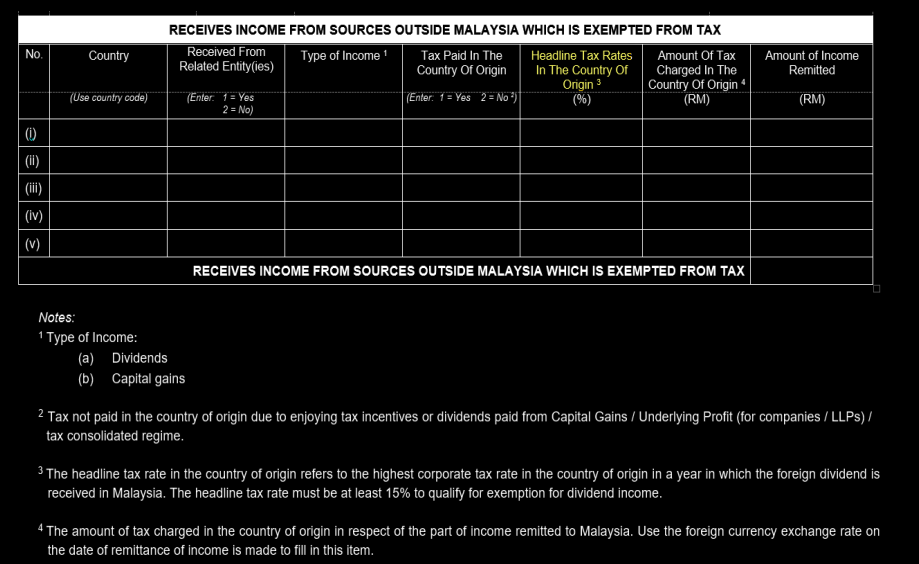

The Inland Revenue Board of Malaysia (IRBM) Operations Department has recently clarified the following concerning the completion of item F9 in Form e-C 2022:-

- Foreign-sourced income received in Malaysia in the 2022 basis period before 1 January 2022 must be included in item F9.

- Example: Basis period before 1 January 2022

- A Malaysian resident company with a basis period ending 31 March 2022 also needs to include foreign-sourced income it received in Malaysia from 1 April 2021 to 31 December 2021 in item F9 of Form C 2022.

- Example: Basis period before 1 January 2022

- Information on “Headline Tax Rates In The Country Of Origin (%)” and “Amount Of Tax Charged In The Country Of Origin” (RM) is non-mandatory in respect of foreign-sourced income received in Malaysia before 1 January 2022.

- However, IRBM encourages taxpayers to fill it out if taxpayers have the information, even though it is non-mandatory.

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Therefore, any reliance on such information is strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/