Understanding the laws and regulations of FATCA

The global tax structure is being altered as a result of globalisation, rising economies, and more regulation, which is presenting difficult-to-overcome issues for financial institutions located all over the world.

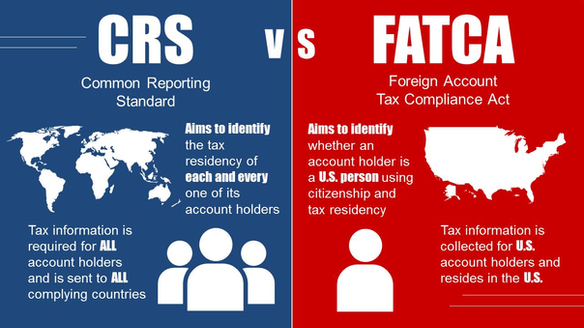

Changes of a fundamental structural nature have been made to both the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) as part of the efforts of the US government to increase worldwide tax compliance.

What exactly is FATCA?

The Foreign Account Tax Compliance Act, also known as FATCA, is a law that was passed to collect information on citizens of the US who avoid taxes in the United States while living abroad.

It requires banks and other foreign institutions (“FIs“) located outside of the US to disclose information about their customers who are citizens of the US and hold accounts at those institutions.

The goal of the Foreign Account Tax Compliance Act is to prevent US “Person” taxpayers from evading US taxes through the use of personal accounts held at foreign financial institutions and investment vehicles. In this regard, Malaysia is aiding the United States in implementing the Foreign Account Tax Compliance Act.

What is a US Person?

Definition of a US Person includes the following:

- US citizen or nationality, including an individual born in the US who has not given up his/ her US citizenship (maybe a resident in another country)

- US resident or green card holder

- US passport holder

The Act mandates

- Identify people living in the United States who have financial accounts in other countries, as well as investors from other nations who have investments in the United States;

- Performing due diligence procedures on customers to determine their FATCA status, covering both individual and entity customers

- Report on US Individual and Legal Entity’s foreign financial assets, including US individuals who exercise control over the Legal Entity; and

- Impose 30% withholding tax on any US FDAP* source income paid to recalcitrant and NPFI customers.

* U.S FDAP source income examples are annuities, dividends, emoluments, interest, premiums, remunerations, rental, salary, wages, etc.

What precisely is the CRS?

The Common Reporting Standard (CRS), which was developed by the Organization for Economic Co-operation and Development (OECD), is the global reporting standard for the Automated Exchange of Information (AEOI).

Therefore, Common Reporting Standard (CRS) is a new information-gathering and reporting requirement for financial institutions in participating countries/jurisdictions to help fight against tax evasion and protect the integrity of tax systems.

The purpose of the CRS is to provide tax authorities with a more accurate picture of the taxable financial assets held by their residents who are located outside of their home country.

The FATCA and the CRS appear to share some similarities, but there are important distinctions between the two. CRS is substantially broader in scope and requires a united, cross-team effort to assure readiness and compliance.

You are free to go on to the following post now that you have an understanding of what FATCA is:

- Malaysia joins 113 countries to implement the Foreign Account Tax Compliance Act (FATCA)

- https://www.ccs-co.com/post/malaysia-joins-113-countries-to-implement-the-foreign-account-tax-compliance-act-fatca

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Any reliance on such information is therefore strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/