Notification of Functions of Company Director and Director’s Representative in MyTax for Submission

Starting from 1 January 2023, taxpayers with the role of Company Director in MyTax can appoint representatives online. The appointed representative must possess a Tax Identification Number (TIN) and an Individual Digital Certificate. The Inland Revenue Board of Malaysia (LHDNM) reserves the right to obtain a letter of appointment for the representative, which should be […]

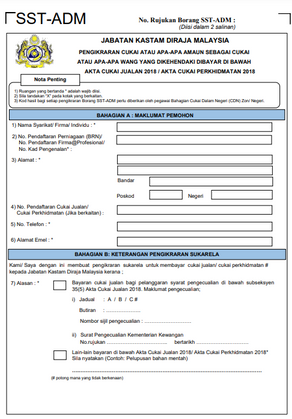

Form SST-ADM & Form SST-ADM 2:Voluntary Declaration of Taxes Under Sales Tax and Service Tax Act

The Royal Malaysian Customs Department (RMCD) has issued the following forms on its MySST website on 1 August 2023. Here is a summary of the SST-ADM and SST-ADM 2 forms: SST-ADM Purpose: For voluntary declaration to pay sales or service tax to Royal Malaysian Customs Department. Used when: SST-ADM 2 Purpose: For voluntary declaration to […]

LHDNM to Enforce Mandatory Use of e-Tax Services in Stages from 1 September 2023

In line with technological transformation and digitisation of tax services, the Inland Revenue Board of Malaysia (LHDNM) will enforce mandatory use of e-Services for online tax services through the MyTax portal starting 1 September 2023. This is to empower and sustain the digitisation of service delivery to the public. The implementation supports the government’s aim […]

Steps for Tax Firms to Prepare for TAeF 2.0 Transition

The Inland Revenue Board of Malaysia (LHDNM) has issued a notice informing tax agents and tax firms of the upcoming launch of the new TAeF 2.0 system in November 2023. The enhanced Tax Agent e-Filing system aims to improve the efficiency and integration of tax e-services through the MyTax portal. In preparation for the transition, […]

Income Tax (Exemption) (No. 3) Order 2023:New Principal Hubs

IN exercise of the powers conferred by paragraph 127(3)(b) of the Income Tax Act 1967 [Act 53], the Minister makes the Income Tax (Exemption) (No. 3) Order 2023 [P.U. (A) 252/2023]. This Order, alongside the earlier Income Tax (Exemption) (No. 2) Order 2023, was gazetted by the Minister of Finance to provide tax incentives for […]