Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022

In the exercise of the powers conferred by paragraph 154(1)(ed) of the Income Tax Act 1967 [Act 53], the Minister, on January 31, 2022, gazetted the Income Tax (Restriction on Deductibility of Interest) (Amendment) Rules 2022 (P.U. (A) 27/2022) (“Amendment Rules“) to amend the Income Tax (Restriction on Deductibility of Interest) Rules 2019 [P.U. (A) […]

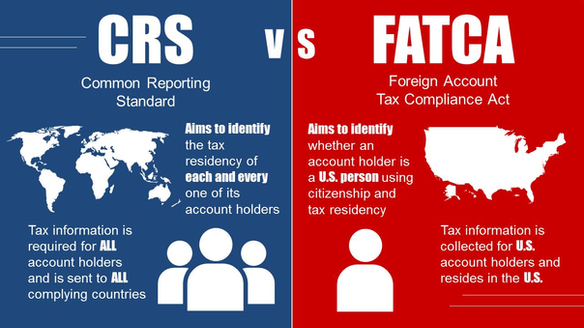

Malaysia joins 113 countries to implement the Foreign Account Tax Compliance Act (FATCA)

FATCA is one of the initiatives introduced by the United States to improve the practice of exchange of information on tax matters, especially among US persons. To know more about FATCA: For Malaysia, this bilateral initiative adds to the work it has been doing at international meetings led by the Organization for Economic Cooperation and […]

Foreign Account Tax Compliance Act (FATCA)

Understanding the laws and regulations of FATCA The global tax structure is being altered as a result of globalisation, rising economies, and more regulation, which is presenting difficult-to-overcome issues for financial institutions located all over the world. Changes of a fundamental structural nature have been made to both the Foreign Account Tax Compliance Act (FATCA) […]