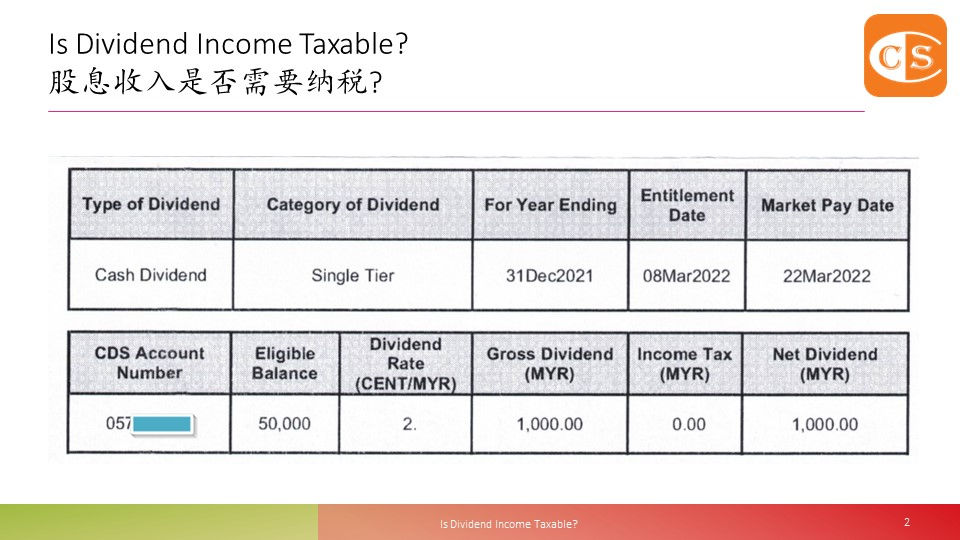

1. Malaysia has a single-tier taxation structure:

👉 Dividends are tax-exempt in shareholders’ hands.

👉 Dividends distributed to shareholders are not required to be taxed, and no tax credits will be available to reduce the shareholders’ tax liability.

2. Join our Telegram – https://t.me/YourAuditor

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 马来西亚的税收结构是单层的: 👉 股息在股东手中是免税的。 👉 因此,分配给股东的股息股东不需要再纳税,也不会有税收抵免来减少股东的税负。

2. 不知不觉,又到了个人所得税申报的季节了,你是否准备好了呢?

3. 如果你还在为自己的个人所得税忧心,不妨报名参加 《#FormBE报税 A-Z 全攻略》线上课程 – https://lnkd.in/eW48FhNH #看看上过的学员留言 – https://lnkd.in/ePkna3me 🔰🔰🔰🔰🔰🔰🔰🔰🔰🔰