Malaysia offers Pioneer Status (PS) as a key tax incentive to attract both foreign and local investments, aiming to stimulate economic growth, industrial development, and technological advancement across various sectors.

This incentive provides partial or total tax relief for a specified period, thereby enhancing after-tax returns and investment viability.

Here’s a detailed report on Pioneer Status tax incentives in Malaysia:

1. Legal and Institutional Framework

Pioneer Status incentives are primarily governed by several key legislations in Malaysia:

- Promotion of Investments Act 1986 (PIA 1986): This act provides the foundational definitions and mechanisms for Pioneer Status.

- Income Tax Act 1967 (ITA 1967): This act contains provisions for general and sectoral allowances related to the incentive.

- Customs Act 1967, Excise Act 1976, and Free Zones Act 1990: These acts grant authority for indirect incentives, such as customs and duty exemptions, for approved projects and zones.

The Malaysian Investment Development Authority (MIDA) is the principal Malaysian Government agency responsible for promoting investments, coordinating industrial development, and selected services sectors in the country, including the administration of Pioneer Status applications.

The Minister of International Trade and Industry (MITI) has the authority to grant pioneer status.

The Inland Revenue Board of Malaysia (IRBM) oversees the implementation and compliance for all tax incentives and processes claims.

2. Eligibility Criteria

Pioneer Status is granted to companies that are incorporated in Malaysia and are engaged in promoted activities or the production of promoted products.

Eligibility is highly sector and activity-specific, with criteria often including:

- Level of value-added.

- Technology used.

- Employment of Malaysian workers and level of high-skilled workers.

- Industrial linkages.

- Promoted Activities/Products: These are listed on MIDA’s annually updated register, reflecting government economic priorities such as high value-added manufacturing, automation, digital technology, renewable energy, biotechnology, aerospace, and medical devices.

A key criterion for enjoying tax incentives under the PIA 1986 is that a company must be ‘desirous’ of establishing or participating in a promoted activity or producing a promoted product and must not have started production.

For manufacturing companies, “production” is defined as starting to produce marketable products (including trial production), and for service companies, it’s the date of the first invoice issued for services rendered.

However, effective from July 3, 2012, Malaysian-owned manufacturing and services companies already in production may be considered if they commenced production within one year from the date of application to MIDA.

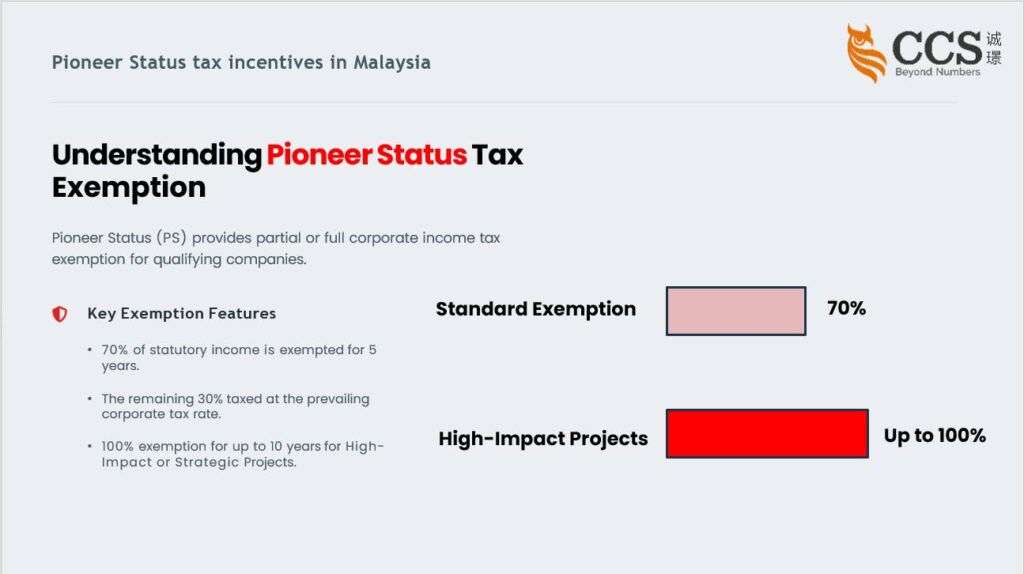

3. Benefits and Tax Relief Period

A company granted Pioneer Status generally enjoys a tax relief period of five years, commencing from its “Production Day”.

The “Production Day” is defined as the day its production level reaches 30% of its capacity or the date of the first invoice, whichever is applicable.

Standard Pioneer Status:

- A company enjoys 70% income tax exemption on its statutory income for 5 years, meaning it pays tax on the remaining 30%.

Enhanced Pioneer Status (up to 100% exemption): Higher exemption rates and longer periods are available for projects deemed of strategic importance or in priority sectors:

- High Technology Companies: 100% income tax exemption on statutory income for a period of 5 years. These companies are engaged in promoted activities or high-technology products in new and emerging technologies.

- Strategic Projects: 100% income tax exemption on statutory income for a period of 10 years. These projects typically involve heavy capital investments, long gestation periods, high technology levels, extensive linkages, and significant economic impact.

- Small Scale Companies: 100% income tax exemption on statutory income for a period of 5 years.

- Contract Research & Development (R&D) Companies: These companies provide R&D services in Malaysia to unrelated companies. They are eligible for 100% income tax exemption on statutory income for 5 years.

- Halal Industry:

Halal Park Operators: 100% income tax exemption on statutory income for 10 years.

Halal Logistics Operators: 100% income tax exemption on statutory income for 5 years. - Oil Palm Biomass: New companies that utilize oil palm biomass to produce value-added products are eligible for 100% PS for 10 years.

- Relocation of Manufacturing Activities: Companies relocating manufacturing activities to promoted areas may receive 100% PS for 5 years.

- Industrial Linkage Programme (ILP) Vendors: Vendors manufacturing promoted products or participating in promoted activities in an ILP can receive 100% PS for 5 years, or 10 years if for the international market.

- Production of Machinery and Equipment: Companies in this sector are eligible for 100% PS for 10 years.

- Automotive Industry: Companies manufacturing critical and high value-added parts and components for the automotive industry are eligible for 100% PS for 10 years.

- Recycling Activity of Plastic: Companies undertaking recycling of plastic waste (toxic and non-toxic) may receive 70% PS for 5 years, or 85% for projects in Eastern Corridor, Sabah, and Sarawak.

- Commercialization of R&D Findings: A subsidiary company undertaking the commercialization of R&D findings (especially resource-based or non-resource-based if listed as promoted) can receive 100% tax exemption on statutory income for 10 years.

The investing (holding) company in such a project may also receive a tax deduction equivalent to the investment amount in working capital and qualifying capital expenditure for the subsidiary. - Promoted Areas: Companies located in designated promoted areas such as Sabah, Sarawak, Perlis, and the “Eastern Corridor” (Kelantan, Terengganu, Pahang, and Mersing in Johor) could receive 100% tax exemption for 5 years (for applications received by 31 December 2010), or 85% for applications received by 31 December 2005.

4. Tax Treatment during the Pioneer Period

- Statutory Income: The statutory income of a pioneer business for any Year of Assessment (YA) is determined after the deduction of capital allowances.

- Capital Allowances (CA): Unabsorbed capital allowances incurred during the pioneer period can be carried forward indefinitely and deducted from the company’s post-Pioneer Status income.

Capital expenditure incurred before the production day is deemed to have been incurred on the production day.

Public Ruling No. 10/2023 clarifies that these unutilised capital allowances related to assets acquired for the pioneer business have an unlimited carry forward period. - Losses: Accumulated losses incurred during the pioneer period can be carried forward and deducted from the post-Pioneer Status income for a period of 7 consecutive years.

For YAs effective from 2019, any unabsorbed pioneer losses after the end of the tax relief period are allowed to be carried forward for a maximum of seven consecutive YAs. - Value-added Income: Certain companies, particularly those involved in activities of national and strategic importance, high-technology medical device testing, reinvestment in palm oil, or other specific promoted activities, must compute their income based on ‘value-added income’ for tax exemption purposes.

- Separate Accounts: Pioneer companies are required to maintain separate accounts for their pioneer business, distinct from any other business activities they may undertake, to ensure accurate determination of exempt income and tracking of capital allowances and losses.

5. Application and Management

- Application Process: Applications for Pioneer Status are submitted to MIDA, typically online via the InvestMalaysia portal.

- Pioneer Certificate: After approval, a company must apply to the Minister for a pioneer certificate within 24 months, specifying the production day and confirming compliance with conditions.

A company can enjoy PS for multiple promoted activities or products and hold multiple pioneer certificates. - Extension: A pioneer company may be granted an extension of the tax relief period for another five years, starting immediately after the initial period ends, subject to meeting specific requirements and criteria.

- Withdrawal, Cancellation, and Surrender: Pioneer Status can be withdrawn by the Minister if the company fails to comply with terms or conditions.

A pioneer certificate can be cancelled, making the company ineligible for incentives from the effective date of cancellation, with any previously refunded tax recovered.

Companies may also voluntarily surrender their Pioneer Status or certificate with written notice to the Minister.

6. Recent Developments and Strategic Context

- OECD BEPS Initiative:

Malaysia supports the OECD Base Erosion and Profit Shifting (BEPS) initiative.

In line with Action 5 (Countering Harmful Tax Practices), there has been a review of tax incentives, leading to the exclusion of royalties and Intellectual Property (IP) income from incentives and the implementation of stricter eligibility conditions. - New Investment Incentive Framework (NIIF): Scheduled for a Q3 2025 launch, the NIIF aims to promote high-value, technology-driven investments. It will offer custom concessionary tax rates (potentially 0% to 20%) for companies in cutting-edge digital, circular economy, EVs, IR4.0, health technology, and regional headquarters projects.

The framework will prioritize “economic clusters” with location-based tax relief for investments that demonstrate measurable economic spillover. - Special Economic Zones (SEZs): Various SEZs in Malaysia offer specific fiscal incentives, including income tax exemptions ranging from 70% to 100% for up to 10 or 15 years, along with other benefits.

Examples include the Johor-Singapore Special Economic Zone (JS-SEZ) and the Forest City Special Financial Zone, which offer tailored tax rates and exemptions for specific activities and knowledge workers.

Understanding the complex eligibility criteria and application procedures is crucial for companies seeking to benefit from Malaysia’s Pioneer Status incentives.

It is advisable to engage in early strategic planning and seek guidance from tax authorities or professional advisors.

马来西亚推出先驱地位(PS)作为关键税收优惠政策,旨在吸引国内外投资,推动各领域经济增长、产业发展及技术进步。

该政策在特定期限内提供部分或全部所得税减免,从而提升投资者的税后收益和投资可行性。

以下是马来西亚先驱地位(PS)税收优惠的详细报告:

1. 法律与制度框架

先驱地位(PS)优惠主要受马来西亚以下核心法令规范:

- 1986年投资促进法令(PIA 1986):该法令确立先驱地位(PS)的基础定义与运作机制。

- 《1967年所得税法》(ITA 1967):该法令包含与激励措施相关的普遍性及行业性税收减免条款。

- 《1967年海关法》《1976年国产税法》及《1990年自由区法》:这些法令授权对获批项目及区域实施间接激励措施,如关税与国产税豁免。

马来西亚投资发展局(MIDA)是马来西亚政府负责投资促进、工业发展协调及特定服务业的主管机构,包括先驱地位(PS)申请的审批管理。

国际贸易与工业部部长(MITI)拥有授予先驱地位(PS)的最终审批权。

马来西亚内陆税收局(IRBM)负责监督所有税收优惠政策的执行合规性并处理相关申报事宜。

2. 资格标准

先驱地位授予在马来西亚注册成立且从事促进活动或生产促进产品的企业。

资格认定高度依赖行业与活动特性,常见标准包括:

- 附加值水平。

- 采用技术。

- 雇佣马来西亚工人及高技能工人比例。

- 产业关联度。

- 促进活动/产品:相关清单载于马来西亚投资发展局(MIDA)年度更新的登记册,反映政府经济优先领域,包括高附加值制造业、自动化、数字技术、可再生能源、生物技术、航空航天及医疗器械等。

根据《1986年投资促进法令》,享受税收优惠的关键条件是企业必须“有意愿”开展或参与促进活动、生产促进产品,且尚未启动生产。

对制造企业而言,“生产”定义为开始制造可销售产品(含试产);对服务企业则指首次开具服务发票之日。

但自2012年7月3日起,马来西亚本土制造及服务企业若在向马来西亚投资发展局提交申请后一年内投产,亦可纳入考量范围。

3. 优惠政策与税收减免期

获批先驱地位的企业通常享有五年税收减免期,自其“投产日”起算。“投产日”定义为:生产水平达到产能30%之日或首张发票开具日(以较早者为准)。

标准先驱地位:

- 企业可享受法定收入70%的所得税豁免,为期五年,即仅对剩余30%收入纳税。

增强型先驱地位(最高100%免税):对具有战略意义或属于优先领域的项目提供更高免税比例及更长免税期:

- 高科技企业:法定收入享受五年100%所得税免税。

此类企业需从事新兴技术领域的推广活动或高科技产品研发。 - 战略项目:法定收入享受10年100%所得税豁免。

此类项目通常涉及重资本投入、长期培育周期、高技术门槛、广泛产业链关联及显著经济效益。 - 小型企业:法定收入享受5年100%所得税豁免。

- 合同研发公司:为马来西亚境内非关联企业提供研发服务的企业,可享受法定收入5年100%所得税豁免。

- 清真产业:

清真园区运营商:法定收入享受10年100%所得税豁免。

清真物流运营商:法定收入享受5年100%所得税豁免。 - 油棕生物质:利用油棕生物质生产增值产品的新企业,可享受10年100%生产税豁免。

- 制造业迁移计划:将生产活动迁至促进区的企业,可享受5年100%生产税豁免。

- 工业联动计划(ILP)供应商:在ILP中生产促进产品或参与促进活动的供应商可享受5年100%生产税减免,面向国际市场者可延长至10年。

- 机械设备制造:该领域企业可享受10年100%生产税减免。

- 汽车制造业:生产汽车行业关键性及高附加值零部件的企业,可享受100%所得税减免(PS)10年。

- 塑料回收业务:从事塑料废料(含毒性与非毒性)回收的企业,可享受70%所得税减免(PS)5年;位于东部走廊、沙巴及砂拉越的项目可获85%减免。

- 研发成果商业化:从事研发成果商业化的子公司(特别是资源型或非资源型项目若被列为推广项目)可享受10年100%法定收入免税。

该项目的投资(控股)公司还可获得相当于子公司营运资金及合资格资本支出投资额的税款抵免。 - 促进区:位于沙巴、砂拉越、玻璃市及“东部走廊”(吉兰丹、登嘉楼、彭亨及柔佛州麻坡)等指定促进区的企业,可享受5年100%免税(2010年12月31日前申请)或85%免税(2005年12月31日前申请)。

4. 先驱期税务处理

- 法定收入:先驱企业的法定收入在扣除资本减免后确定。

- 资本减免(CA):先驱期内未抵扣的资本减免可无限期结转,用于抵扣企业先锋期结束后产生的收入。

生产日前发生的资本支出视为生产日发生。

第10/2023号公开裁决明确,与先驱业务购置资产相关的未抵扣资本减免可无限期结转。 - 亏损:先驱期产生的累计亏损可在连续7年内结转抵扣先驱地位终止后的收入。

自2019年起生效的课税年度中,税收优惠期结束后未抵扣的先驱亏损,可连续结转最多七个课税年度。 - 增值收入:特定企业(尤其是从事国家战略性重要活动、高科技医疗器械检测、棕榈油再投资或其他特定促进活动的企业)须依据“增值收入”计算免税收入。

- 独立账目:先锋企业须为先锋业务设立独立账目,与其他经营活动分开核算,以确保免税收入的准确认定及资本折旧与亏损的追踪。

5. 申请与管理

- 申请流程:先驱地位申请需提交至马来西亚投资发展局,通常通过InvestMalaysia门户网站在线提交。

- 先驱证书:获批后,企业须在24个月内向部长申请先驱证书,明确生产日期并确认符合条件。

企业可针对多项推广活动或产品享受先驱地位,并持有多份先驱证书。 - 延期:先驱企业若满足特定要求和标准,可在初始期满后立即获得五年税收减免期延期。

- 撤销、取消与放弃:若企业违反条款或条件,部长可撤销其先驱地位。

先驱证书一旦取消,企业自取消生效日起丧失享受激励资格,此前退还的税款将被追回。

企业亦可通过书面通知部长自愿放弃先驱地位或证书。

6. 最新动态与战略背景

- 经合组织BEPS行动计划:

马来西亚支持经合组织税基侵蚀与利润转移(BEPS)行动计划。

根据行动方案5(打击有害税收实践),已对税收优惠政策进行审查,将特许权使用费及知识产权(IP)收入排除在优惠范围外,并实施更严格的资格条件。 - 新投资激励框架(NIIF):

计划于2025年第三季度启动,旨在促进高价值、技术驱动型投资。

该框架将为尖端数字技术、循环经济、电动汽车、工业4.0、健康科技及区域总部项目的企业提供定制化优惠税率(可能为0%至20%)。

该框架将优先支持“经济集群”,对能产生可量化经济溢出效应的投资提供地域性税收减免。 - 经济特区(SEZs):

马来西亚各经济特区提供专项财政激励,包括为期10至15年的70%至100%所得税减免及其他优惠。

典型案例包括柔佛-新加坡经济特区(JS-SEZ)和森林城金融特区,针对特定产业活动及知识型工作者提供定制化税率与免税政策。

企业若欲享受马来西亚先驱企业地位激励政策,必须深入理解复杂的资格标准与申请流程。

建议企业尽早开展战略规划,并寻求税务机关或专业顾问的指导。

#看趋势看财税看CCS