The Inland Revenue Board (IRB) has released on its website revised Technical Guidelines in Bahasa Malaysia, titled “Garis Panduan Berhubung Layanan Cukai Ke Atas Pemaju Atau Badan Pengurusan Bagi Penyenggaraan Dan Pengurusan Bangunan Dan Harta Bersama” (Guidelines), dated 18 July 2022.

These Guidelines represent a significant revision to the earlier Guidelines (“Old Guideline”) dated 21 May 2012, which it supersedes. These new Guidelines are now in effect.

Establishment, management period, responsibilities, rights and other matters related to the developer or management body (*) for maintenance and the management of buildings and common property are regulated by different legislation in Peninsular Malaysia, Labuan, Sabah and Sarawak as follows:

- Peninsular Malaysia and Labuan – Strata Management Act 2013

- Sabah – Land (Subsidiary Title) Enactment 1972; and

- Sarawak – Strata Management Ordinance 2019 (Chapter 76).

(*) For the New Guideline, the meaning of “Management Body" includes Joint Management Body ("JMB"), Management Corporation ("MC") and Subsidiary Management Corporation ("Sub-MC").

In the past, the Old Guideline did not apply to JMB in the states of Sabah and Sarawak.

The New Guideline no longer mentions that Sabah and Sarawak are excluded from the scope of its application to JMB now.

The purpose of these Guidelines was, in a nutshell, to explain the tax treatments that apply to developers and management bodies (i.e. JMBs, MCs, or Sub-MCs) for the maintenance and management of buildings and common property.

Non Taxable Income

The New Guideline reiterates that the “mutuality principle” is applicable between the owners of the property (referred to as “parcel owner”) and the developer or management body during the period the building and common property are maintained and managed by the developer or management body.

The basic principle underlying the principle of mutuality is that no one can make a profit out of himself. The principle provides that where several persons contribute to a common fund created and controlled by them for a common purpose, any surplus arising from using that fund for the common purpose is not income. On the other hand, revenue received from external sources, that is, sources that are not members, is not considered mutual income and is not, as a result, subject to the mutuality principle. As a result, such income is subject to taxation.

In light of this, according to Section 53A of the Income Tax Act 196, neither the maintenance charges nor the contributions to the sinking fund nor any other receipts resulting from the joint management between the parcel owner and the developer or management body are liable to income tax. The attributable expenses or capital expenditure will similarly be disregarded for tax purposes.

The surplus is not taxable because it only represents an excess of parcel owners’ contributions over expenses and, therefore, their own money returnable to them.

Taxable Income

Rental income received from parcel owners on cafeterias operated in common areas and interest income are examples of taxable income not subject to the mutuality principle.

Other examples of taxable income include income received from non-parcel owners for the use of common property such as halls, cafeterias, gyms, and swimming pools.

Deductible Expenses

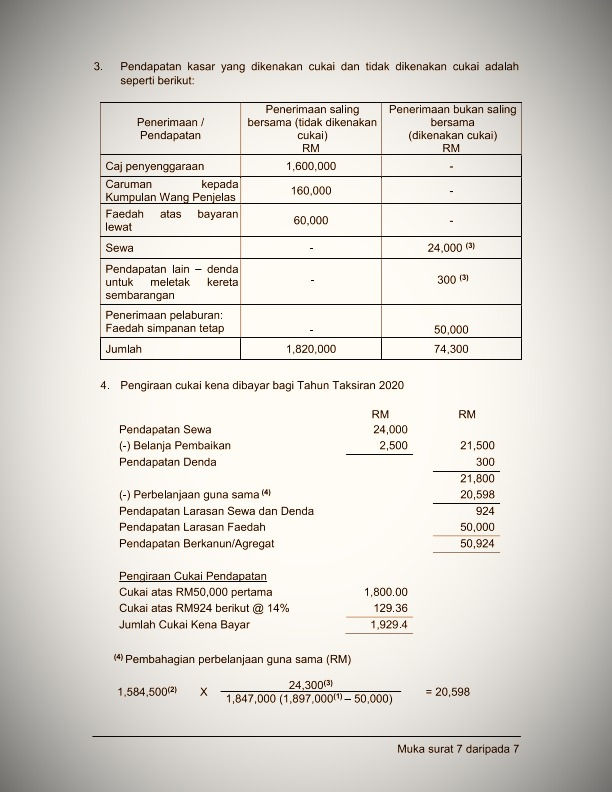

The following formula, which is taken from the Income Tax (Deduction Relating to Transaction with Non-Members for Club, Association, or Similar Institution) Rules 2011 [P.U.(A) 360/2011], can be used to apportion common expenses that are attributable to income from parcel owners and non-parcel owners:

Tax Rates

Management Body

The taxable income of management bodies is taxed at scale rates that apply to individuals as in Paragraph 1, Part I, Schedule 1 of the ITA. But a management body is not eligible for personal reliefs that apply to individuals when computing their chargeable income.

Developer

A developer is subject to the Prevailing Tax Rates applicable to companies, as prescribed under Paragraphs 2, 2A or 2B, Part 1 of Schedule 1 of the ITA.

Additionally, a developer must keep separate accounts for its business and the maintenance and management of buildings and common property.

Example

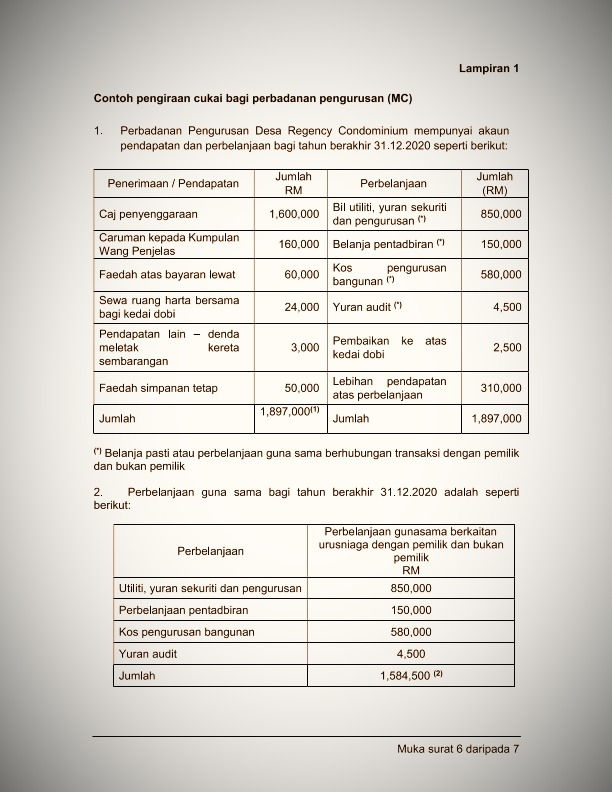

An example illustrating the apportionment of the common expenses is in Appendix 1 to the New Guideline.

Disclaimer: The information in this article should not be construed as legal advice, and we assume no responsibility or liability for any decisions made or actions taken from this article should not be construed as legal advice, and we assume no responsibility or liability for decisions made or actions taken as a result of reading this article.

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Any reliance on such information is therefore strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/