Review of Income Tax Rate for Micro, Small and Medium Enterprises

Update: The Ismail Sabri Government Budget is no longer applicable. Malaysia’s national budget for 2023 was re-tabled again in February 2023. To Download Revised Budget 2023 Speech and some other related publications – https://www.ccs-co.com/post/budget-2023-malaysia-madani Current Position A Company or Limited Liability Partnership (LLP) that has a paid-up capital of RM2.5 million and below with an […]

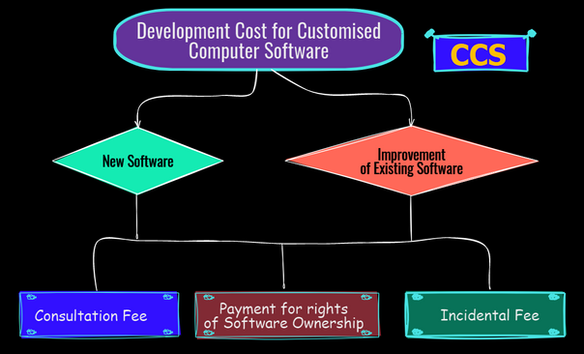

IRBM’s Response to CTIM’s Development Cost for Customised Computer Software

Income Tax (Capital Allowance) (Development Cost for Customised Computer Software) Rules 2019 On 3 October 2019, the Minister, in the exercise of the powers conferred by paragraphs 154(1)(b), 33(1)(d) and paragraphs 10 and 15 of Schedule 3 to the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Capital Allowance) (Development Cost for Customised […]