IRBM’s Response to CTIM on Forms CP 22 / CP 22A

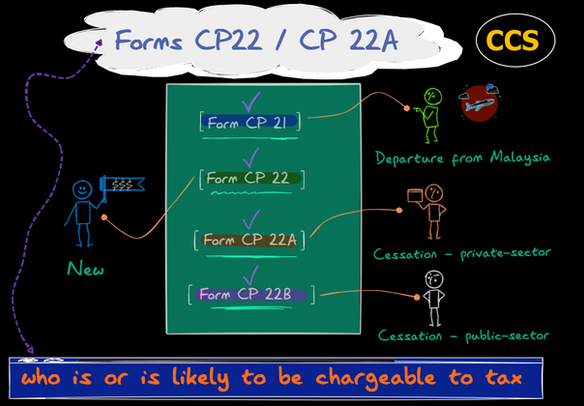

Mandatory adoption of Prescribed Forms CP 21, CP 22, CP 22A and CP 22B effective from 1 January 2022 Effective January 1, 2021, under the amendments to subsections 83 (2), (3), and (4) of the Income Tax Act 1967, Forms CP 21, CP 22, CP 22A, and CP 22B must be submitted by the employers […]

Whether Employer Can Amend Form CP22A

1. Section 83(3) of the Income Tax Act 1967 states: 👉 Where an employer is about to cease to employ an individual who is or is likely to be chargeable to tax in respect of income in respect of gains or profits from the employment or where an individual under his employment dies, the employer […]

CP22, PCB, Form E & EA, CP22A, CP21: Employer’s Liability to Employees for Tax Purposes

1. Employers have distinct responsibilities for tax purposes at various periods of an employee’s life, from the time he first joins the company until he leaves or dies, depending on the circumstances. 🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. 在税务上,从员工入职开始一直到他离职或去世,在不同的阶段,雇主都有着不同的责任。 10

Employer’s Tax Obligation Under Income Tax Act 1967

Employer’s Tax Obligation Under Income Tax Act 1967 – PDF 9

Form CP 21, CP 22, CP 22A & CP 22B

Dated: 15 January 2022 1. The prescribed forms CP21, CP22, CP22A, and CP22B will be in use from 1 January 2022; therefore, the Inland Revenue will not accept any further use of the old version of forms by employers other than those prescribed for in section 152 of the Income Tax Act 1967. 2. Also, […]

Audit Framework For Employer: Effective from October 1, 2021

1. The Audit Framework for Employer was released by Lembaga Hasil Dalam Negeri (LHDNM) on October 1, 2021, and went into effect on October 1, 2021. 2. This Framework lays forth the rights and duties of audit officers, employers, and tax agents, with the goal of ensuring that employer audits are carried out fairly, openly, […]

Notification from Employers in relation to Employees

6