30 – Is Depreciation a Fixed Cost

Bookkeeping – Everyone Can Do It – 30 – Is Depreciation a Fixed Cost – PDF 1. 说到折旧,对于大多数的折旧方法而言,是一种固定成本,因为每年的金额是固定的,不管企业的活动水平是否改变。 2. 生产单位法是这个法则的一个例外。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. For most depreciation methods, depreciation is a fixed cost because the amount is fixed each year, regardless of changes in the level of activity of the business. 2. The units of […]

26 – Types of Depreciation – Diminishing Balance Method

Bookkeeping – Everyone Can Do It – 26 – Types of Depreciation – Diminishing Balance Method – PDF 1. 这种方法是一种稍微复杂的资产折旧方式,它可以让你在购买资产后立即注销更多的价值,而在以后的日子里则逐渐减少注销。 2. 但是,如果折旧率不精准的话,在资产的使用寿命结束时可能会出现无法提供完整的折旧的情况。 3. 此外,在使用这种方法时,应考虑资产的使用年限。如果一项资产在一年中只使用了两个月,则只对这两个月进行折旧。 4. 公式: 年初的账面价值 * 折旧率 5. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. This method is a slightly more complicated way to depreciate an asset. It lets you write off more of an asset’s value […]

27 – Types of Depreciation – Units of Production Depreciation

Bookkeeping – Everyone Can Do It – 27 – Types of Depreciation – Units of Production Depreciation – PDF 1. 生产单位法是一种直接的方法,根据设备的工作量来折旧。 2. 术语”生产单位”既可以指设备的产出,如:小工具,也可以指设备运行的小时数。 3. 公式: (资产成本 – 剩余价值) / 使用期限内所生产出的单位 4. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. The units of production method is a straightforward way to depreciate equipment depending on the amount of work it performs. 2. […]

12 – Purchase on Credit

Bookkeeping – Everyone Can Do It – 12 – Purchase on Credit – PDF 1. 现在让我们来看这样一个例子,假设一家公司赊购 [Purchase on Credit] 存货。该公司以后要支付的发票金额是5千令吉。 2. 这项交易影响到两个账户,一个资产账户 [Asset Account],一个负债账户 [Liability Account]。 3. 资产账户,即存货,增加了5千令吉,该账户应相应地被借记 [Debited] 。也有必要增加负债账户,即应付账款 [Accounts Payable],该账户应贷记 [Credited] 5千令吉。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Now let us look at an example where a company purchases [Purchase […]

13 – Purchase on Cash

Bookkeeping – Everyone Can Do It – 13 – Purchase on Cash – PDF 1. 一家榴莲批发公司用 2千令吉的现金购买库存。库存账户 [Inventory Account] 和现金账户 [Cash Account] 这两个资产账户 [Asset Accounts] 都受到这项交易的影响。 2. 库存账户增加了 2千令吉,该账户应该因此而被借记 [should be debited]。现金账户减少了,应该贷记 [should be credited] 2千令吉以反映这一点。 3. 在插图中阅读更多内容 4. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A durian wholesale company used RM2,000 in cash to purchase […]

14 – Sale on Credit

Bookkeeping – Everyone Can Do It – 14 – Sale on Credit – PDF 1. 一家公司向客户赊账销售了价值15千令吉的原材料。 2. 这项交易影响到一个资产账户 [Asset Accounts] 和一个收入账户 [Revenue Accounts]。 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A company sells raw materials worth RM15,000 on credit to a customer. 2. This transaction impacts one of the Asset Accounts and one of the […]

15 – Sale on Cash

Bookkeeping – Everyone Can Do It – 15 – Sale on Cash – PDF 1. 一家公司向客户出售货物,并在交易后立即收到6千令吉的全部现金。 2. 这项交易影响到一个资产账户 [Asset Accounts] 和一个收入账户 [Revenue Accounts]。 3. 现金账户 [Cash Account] 增加了6千令吉,会计师在会计软件中输入了一个借方条目。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A company sells goods to clients and receives the whole amount of RM6,000 in cash right away from […]

16 – Unearned Revenue

Bookkeeping – Everyone Can Do It – 16 – Unearned Revenue – PDF 1. 一些提供服务或商品的公司,如出租空间、提供保险服务或出版刊物,可能会提前收钱。 2. 这些公司的收入在赚取之前就已经收到并记录了。“未赚取的收入”是用来描述这些类型收入的术语。 3. 我们必须承认的是,在服务或商品的使用寿命期间, “未赚取的收入”已经产生,并导致所有者权益 [owners’ equity] 的增加。因此,我们将“未赚取的收入”归类为负债,因为日后公司有义务向客户提供服务或商品。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Some companies offering services or goods, such as renting out space, providing insurance services, or publishing publications, may collect money in advance. 2. […]

17 – Prepaid Expenses

Bookkeeping – Everyone Can Do It – 17 – Prepaid Expenses – PDF 1. 租金、保险和期刊是一些公司被要求提前付款的服务或商品的例子。 2. 这些公司在获得相关服务或商品之前,就以及作出了相关的支出。 3. 这些费用被称为”预付费用”。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Rent, insurance, and periodicals are examples of services or goods for which some companies require payment in advance. 2. These companies reported expenses before some benefits have […]

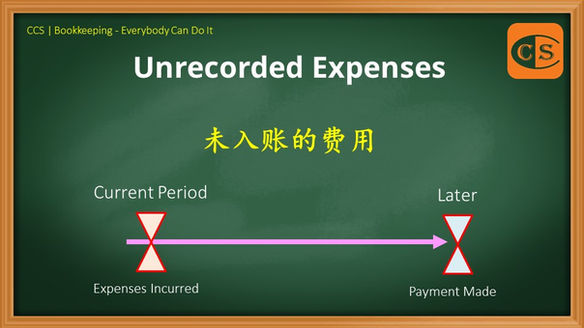

18 – Unrecorded Expenses (Part 1)

Bookkeeping – Everyone Can Do It – 18 – Unrecorded Expenses (Part 1) – PDF 1. 会计原则要求在费用发生时予以记录,而不考虑付款的时间,因为这影响到所有者权益。 2. 未入账的费用是指在当期发生但后来才支付的费用。 3. 当月赚取的工资但在下个月支付,就是一个很典型的“未入账的费用”的例子 4. 另一个常见的例子是,为银行贷款所支付的利息以及水电费的支出。 5. 在插图中阅读更多内容 6. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Accounting principles require that expenses be recorded when they are incurred, regardless of when the payment is made as this affects owners’ equity. […]