29 – Why Should We Care to Record Depreciation

Bookkeeping – Everyone Can Do It – 29 – Why Should We Care to Record Depreciation – PDF 1. 我们现在明白了什么是折旧,如何计算折旧,计算折旧所需的信息,以及也看了如何计算折旧的例子。 2. 让我们来看看为什么我们要关注折旧问题。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. After understanding what depreciation is, how to calculate it, the information required to calculate it, and looking at examples of how to calculate depreciation, we can go on to […]

30 – Is Depreciation a Fixed Cost

Bookkeeping – Everyone Can Do It – 30 – Is Depreciation a Fixed Cost – PDF 1. 说到折旧,对于大多数的折旧方法而言,是一种固定成本,因为每年的金额是固定的,不管企业的活动水平是否改变。 2. 生产单位法是这个法则的一个例外。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. For most depreciation methods, depreciation is a fixed cost because the amount is fixed each year, regardless of changes in the level of activity of the business. 2. The units of […]

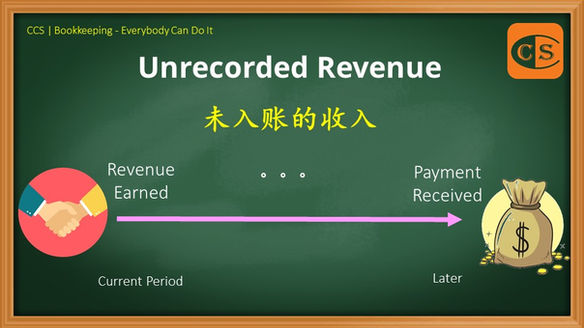

20 – Unrecorded Revenue

Bookkeeping – Everyone Can Do It – 20 – Unrecorded Revenue – PDF 1. 根据权责发生制会计 [Accrual Basis of accounting],收入应记录在赚取收入的期间,无论何时才收到客户的付款。 2. 通过这种方式,收入与收入发生期间的支出相匹配。 3. 当我们说“未入账的收入”时,我们指的是在本期赚取,但要等到之后才收到钱的收入。 4. 贷款的利息收入是其中一种例子。 5. 在插图中阅读更多内容 6. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. According to the Accrual Basis of accounting, revenues should be recorded for the period in which they are earned, regardless of […]

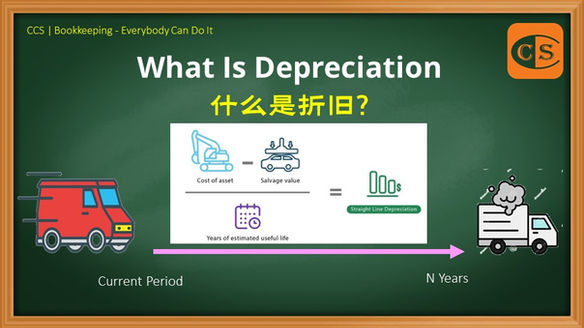

21 – What Is Depreciation

Bookkeeping – Everyone Can Do It – 21 – What Is Depreciation – PDF 1. 折旧的定义是系统化地减少固定资产的记录成本,直到该资产的价值为零或在会计界眼中看来可以忽略不计。 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Depreciation is defined as the systematic reduction of the recorded cost of a fixed asset until the asset’s value is zero or negligible in the eyes of the accounting profession. […]

22 – What kind of Assets can you Depreciate

Bookkeeping – Everyone Can Do It – 22 – What kind of Assets can you Depreciate – PDF 1. 根据会计标准,资产必须满足一些条件,我们才会计提折旧 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. According to accounting standards, some requirements must be met before we can depreciate them 2. Please read more in the illustration 3. Join our Telegram – […]

23 – Useful Life

Bookkeeping – Everyone Can Do It – 23 – Useful Life – PDF 1. 针对使用期限,马来西亚财务报告准则 [MFRS] 第116条第6段作出了诠释 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Paragraph 6 of MFRS 116 provides an interpretation of the useful life 2. Please read more in the illustration 3. Join our Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 Bookkeeping – Everybody […]

24 – What is a Depreciation Schedule

Bookkeeping – Everyone Can Do It – 24 – What is a Depreciation Schedule – PDF 1. 折旧表是一个表格,显示您的每项资产在一定时期内的折旧额 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A Depreciation Schedule is a table that shows you how much each of your assets will be depreciated over the course of a given period 2. Please read […]

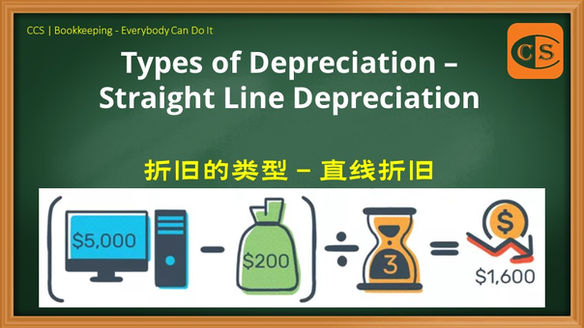

25 – Types of Depreciation – Straight Line Depreciation

Bookkeeping – Everyone Can Do It – 25 – Types of Depreciation – Straight Line Depreciation – PDF 1. 直线法是最常见(也是最简单)的固定资产折旧方法。这种方法将价值平均分配给资产的使用期限。 2. 公式: (资产成本 – 剩余价值) / 使用寿命 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. The straight-line method is the most common (and easiest) method of depreciating a fixed asset. This divides the value evenly over the asset’s useful […]

12 – Purchase on Credit

Bookkeeping – Everyone Can Do It – 12 – Purchase on Credit – PDF 1. 现在让我们来看这样一个例子,假设一家公司赊购 [Purchase on Credit] 存货。该公司以后要支付的发票金额是5千令吉。 2. 这项交易影响到两个账户,一个资产账户 [Asset Account],一个负债账户 [Liability Account]。 3. 资产账户,即存货,增加了5千令吉,该账户应相应地被借记 [Debited] 。也有必要增加负债账户,即应付账款 [Accounts Payable],该账户应贷记 [Credited] 5千令吉。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Now let us look at an example where a company purchases [Purchase […]

13 – Purchase on Cash

Bookkeeping – Everyone Can Do It – 13 – Purchase on Cash – PDF 1. 一家榴莲批发公司用 2千令吉的现金购买库存。库存账户 [Inventory Account] 和现金账户 [Cash Account] 这两个资产账户 [Asset Accounts] 都受到这项交易的影响。 2. 库存账户增加了 2千令吉,该账户应该因此而被借记 [should be debited]。现金账户减少了,应该贷记 [should be credited] 2千令吉以反映这一点。 3. 在插图中阅读更多内容 4. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A durian wholesale company used RM2,000 in cash to purchase […]