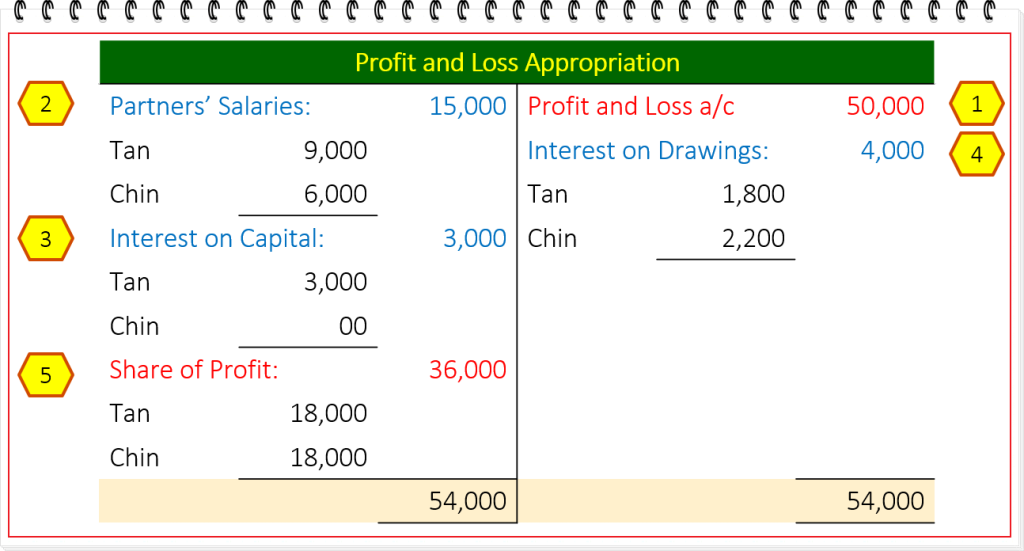

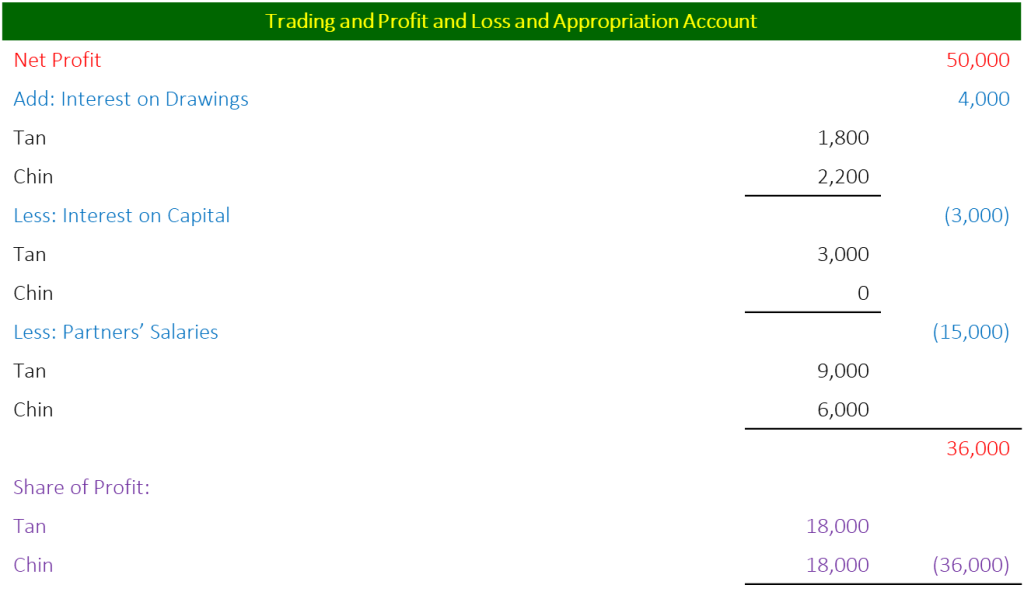

Appropriation Account

It continues from the profit and loss account and illustrates how the profit or loss will be treated between the partners.

Elements that fall under the purview of the appropriation account:

- Partners’ Salary

- Interest on Capital

- Interest on Drawings

- Share of the remaining Profit/(Loss)

拨款账户

拨款账户是从损益账户延续出来的,主要说明合伙人之间何处理利润或损失。

属于拨款账户范围内的要素:

- 合伙人的工资

- 资本的利息

- 提款的利息

- 剩余利润/(亏损)的份额

Example / 例子

By December 31 at the end of the first year, the partnership realized a net profit of RM50,000. Tan and Chin had agreed to a 50:50 split in their partnership agreement.

到第一年年底的12月31日,合伙企业获得 50 千令吉的净利润。

陈和秦在他们的合伙协议中同意50:50的分成。

Drawings Account

Each partner has their own drawings account.

A drawing account is a type of accounting record maintained to keep track of the money that the owners of a company pull.

A drawing account is most commonly utilised by sole proprietorships and partnerships.

Withdrawals made by owners of companies (Incorporated under Companies Act 2016) or Limited Liability Partnership that are taxed as separate entities often need to be accounted for either as wages or as dividends or share of profits.

To close the books at the end of the year, Credit each partner’s drawing account and debit each partner’s Capital Account or Current Account for the balance in that same partner’s drawing account.

提取账户

每个合伙人都会有自己的提取账户。

提款账户是一种会计记录,用于记录公司所有者所提取的资金。

独资企业和合伙企业最常使用提款账户。

作为独立实体纳税的公司(根据2016年公司法令成立的公司)或有限责任合伙公司的所有者的提款,往往需要作为工资或股息或利润份额进行核算。

在年底结账时,将每个合伙人的提款账户记入贷方,并将同一合伙人的提款账户中的余额借入每个合伙人的资本账户 [Capital Account] 或往来账户 [Current Account]。

Capital Accounts

Each of the partners will have its own capital accounts.

The capital accounts may either be:

- Fluctuating Capital Accounts – all of the items from the appropriation account are transferred into the partners’ Capital Accounts.; the drawings account of each partner is closed off to the partners’ capital accounts.

- Fixed Capital Accounts – the capital account balances do not change unless a partner contributes more capital. The elements in the Appropriation Account now get entered into the partners’ Current Accounts.

资本账户

每个合伙人都会有自己的资本账户。

资本账户可以是:

- 波动资本账户 — 拨款账户的所有项目都转入合伙人的资本账户 [Capital Accounts];因此每个合伙人的提款账户清算后,会转移到合伙人的资本账户。

- 固定资本账户 — 资本账户的余额不发生变化,除非有合伙人投入更多的资本。拨款账户中的项目现在被输入到合伙人的往来账户 [Current Accounts] 中。

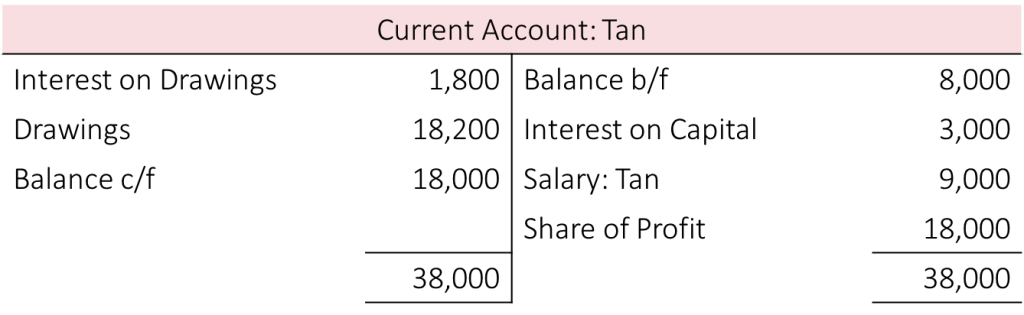

Current Account

In a partnership where the Capital accounts are fixed, each partner will have their Current Account.

These accounts are used to complete the double entry from the Appropriation Account (salaries, interest on capital, interest on drawings, profit or loss sharing).

The drawing account of each partner is transferred to the current account.

Any interest that accrues on a loan that the partner has provided to the company is also credited to the current account for the partners.

BE CAREFUL! The profit or loss account will show the interest paid to a partner on a loan given to the company as a regular business expense.

往来账户

在资本账户固定的合伙企业中,每个合伙人都会有自己的往来账户 [Current Account]。

这些账户用于完成拨款账户(工资、资本利息、提款利息、利润或亏损分配)的双重分录。

每个合伙人的提款账户被转入往来账户。

合伙人提供给公司的贷款所产生的任何利息也记入合伙人的往来账户。

请注意! 利润或亏损账户将显示支付给合伙人的贷款利息,作为常规业务费用。

Example / 例子

What is the difference between capital and current accounts?

There is, to some extent, no distinction between the two. The total amount of a partner’s capital equals the sum of the balances on both their current and capital accounts.

There is, in a certain sense, no distinction between the two. The aggregate amount of a partner’s capital equals the sum of the balances on both their capital account and their current account.

In actuality, however, it is more practical to maintain two distinct accounts: one for the amount of money each partner contributed to the partnership (known as the capital account), and another for the amount of money each partner has made as a result of the partnership’s involvement in various commercial endeavours (the current account).

As a result, the balance in the capital account is often unchanging, whereas the balance in the current account is calculated as the current total of appropriations plus the share of residual profit or loss, less drawings.

资本账户和往来账户之间有什么区别?

在某种意义上,这两者之间没有区别。一个合伙人的资本总额等于其往来账户和资本账户的余额之和。

但实际上,保持两个不同的账户更为实际:一个是每个合伙人向合伙企业出资的金额(称为资本账户),另一个是每个合伙人因合伙企业参与各种商业活动而赚取的金额(往来账户)。

因此,资本账户的余额往往是不变的,而往来账户的余额是按当前拨款总额加上剩余利润或亏损份额,减去提款计算的。