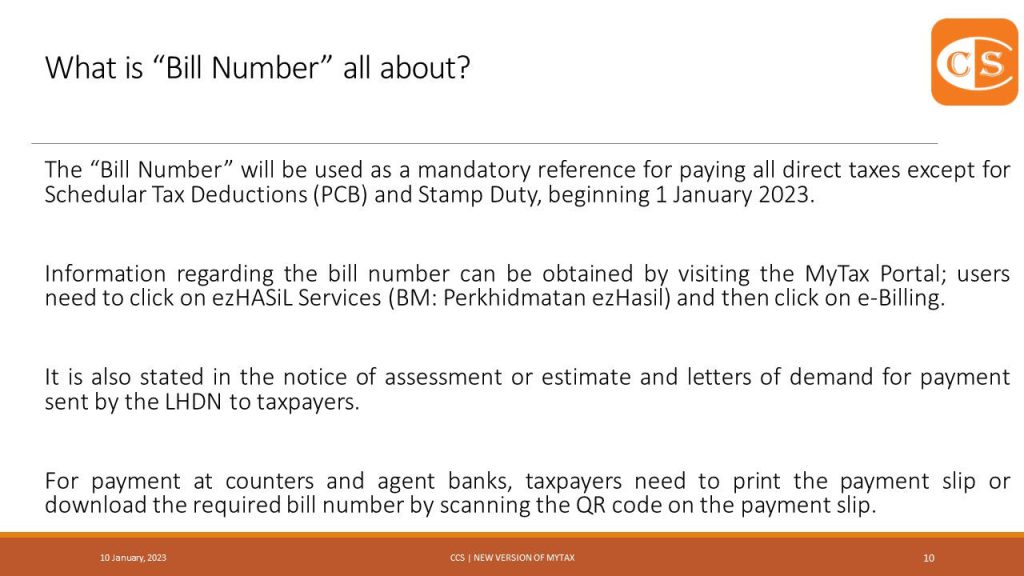

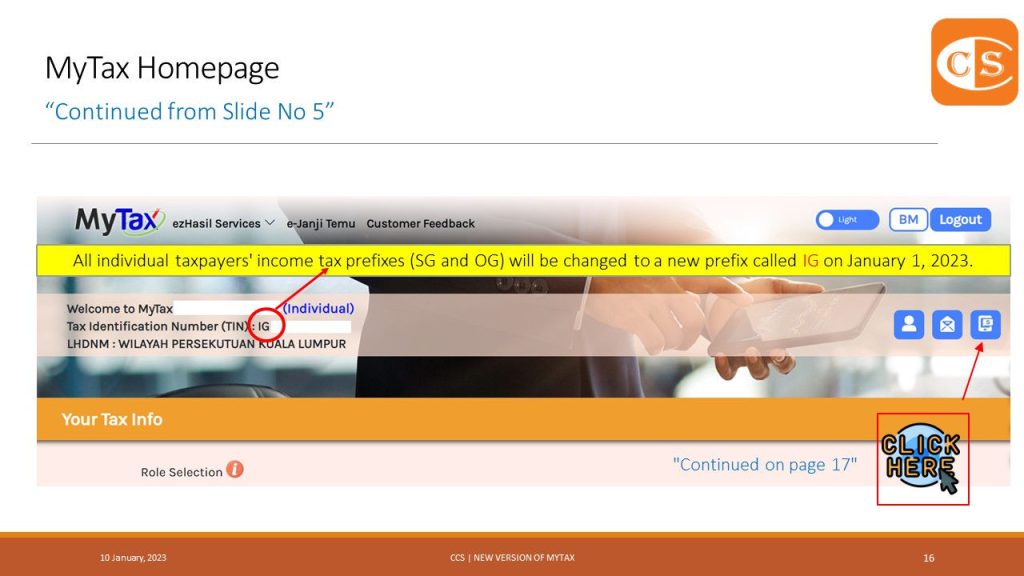

The Inland Revenue Board of Malaysia (HASiL) has recently issued a media release on 31 December 2022 stating that a BILL NUMBER will be mandatory for the payment of all direct taxes, except for Monthly Tax Deductions (MTD) and Stamp Duty, effective from 1 January 2023.

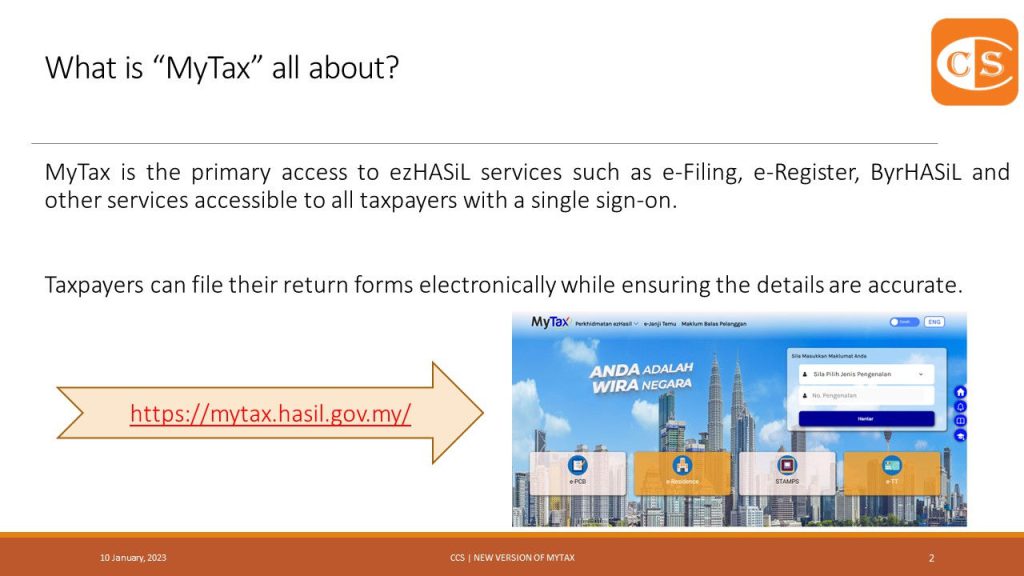

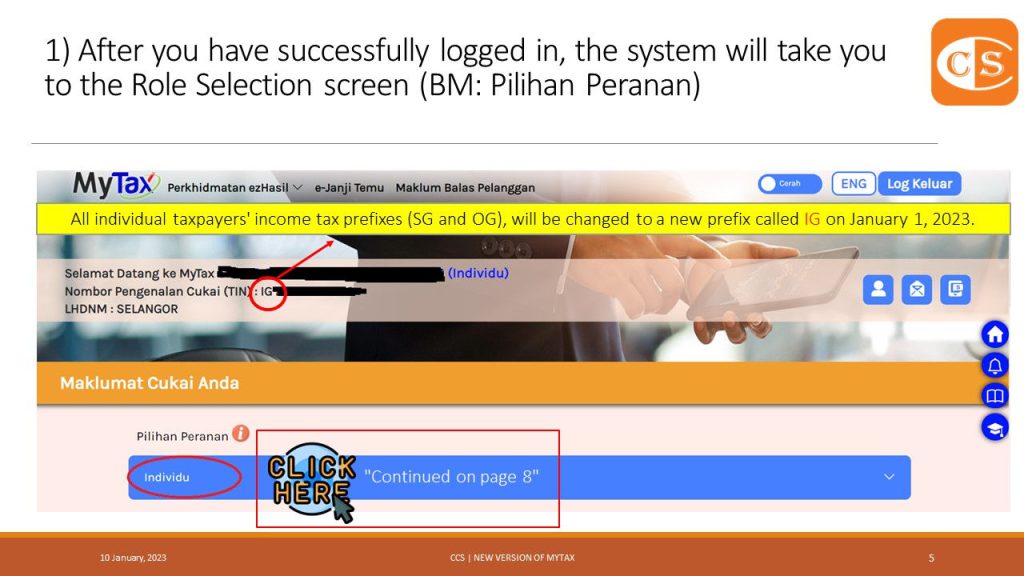

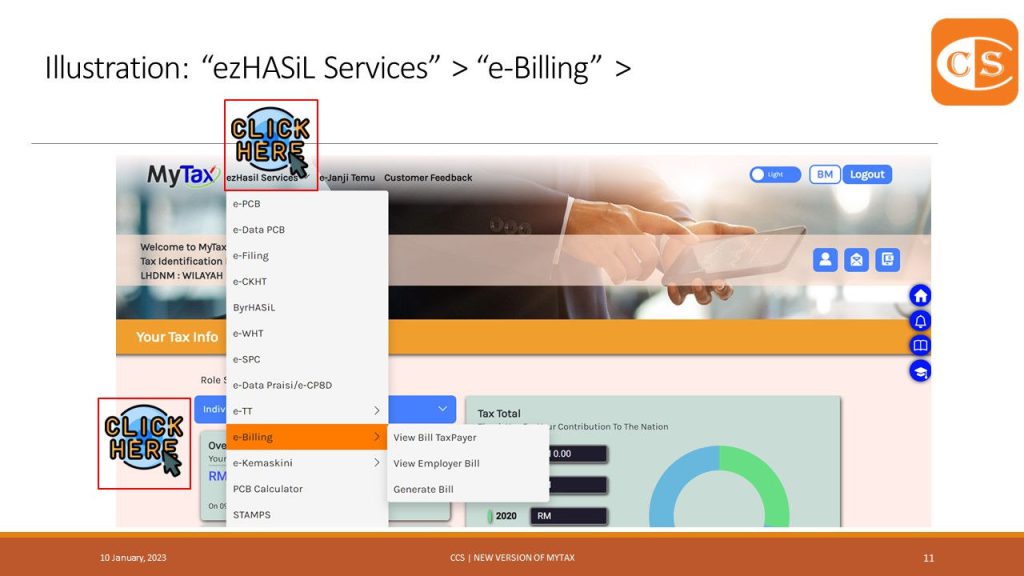

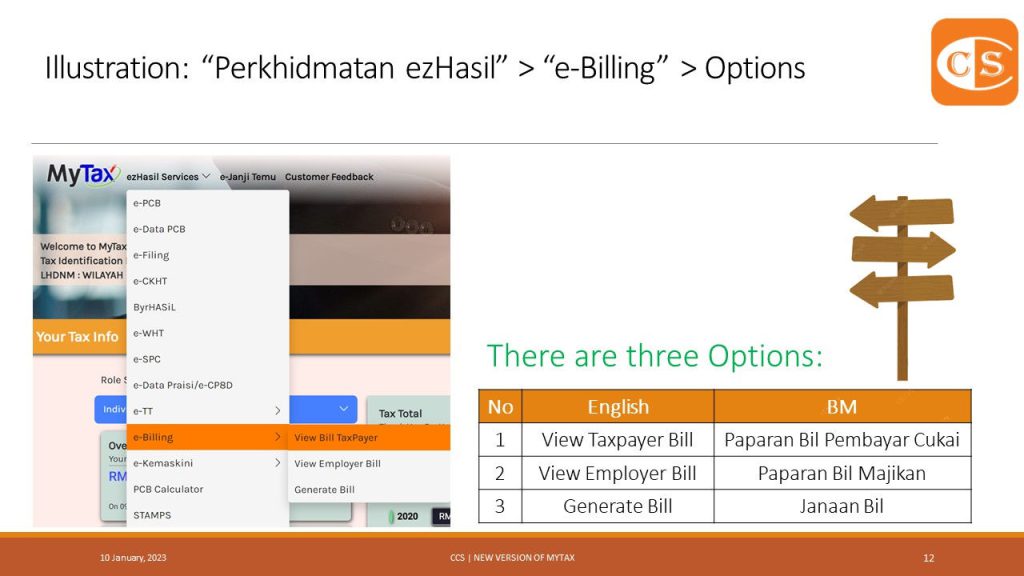

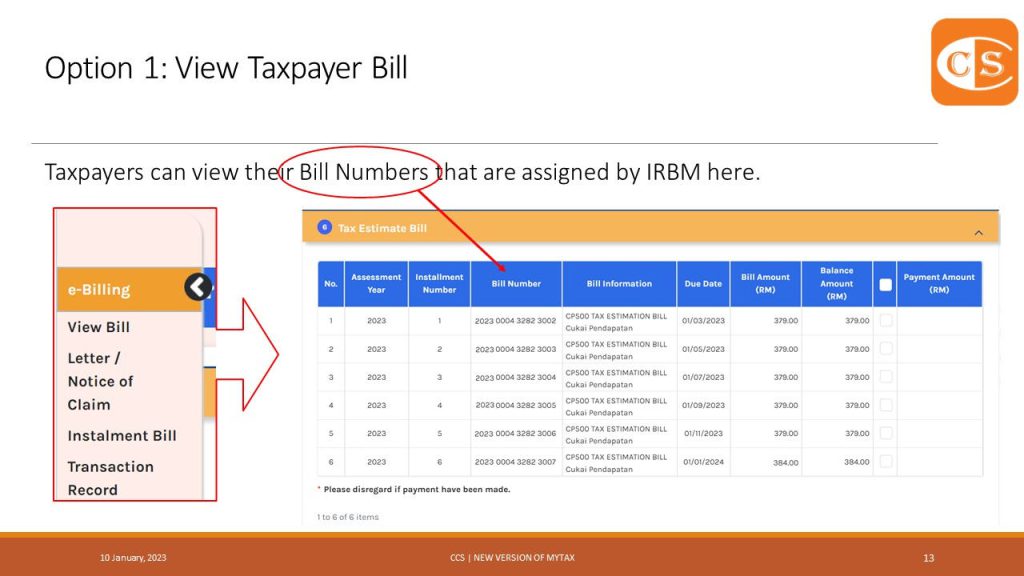

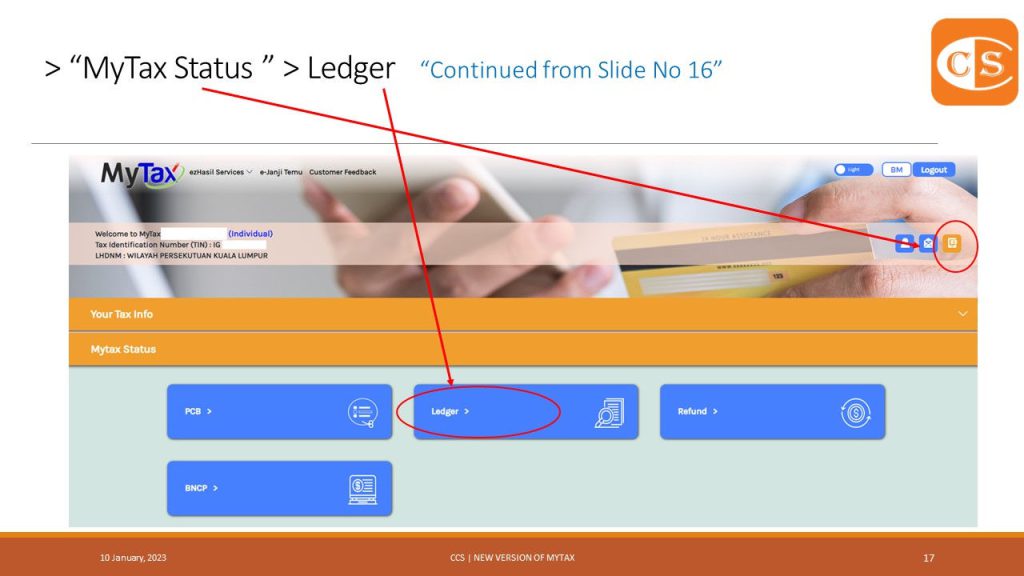

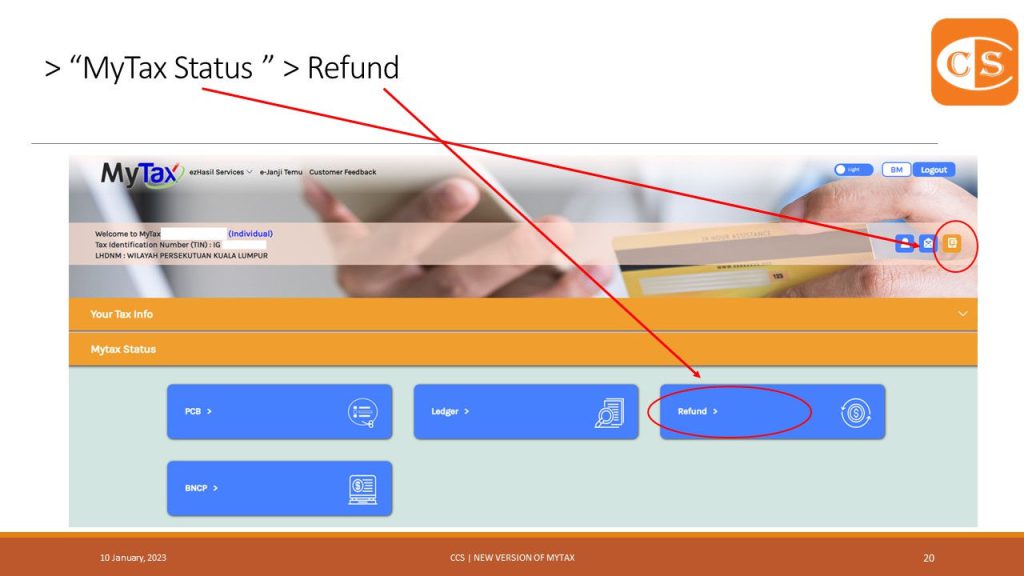

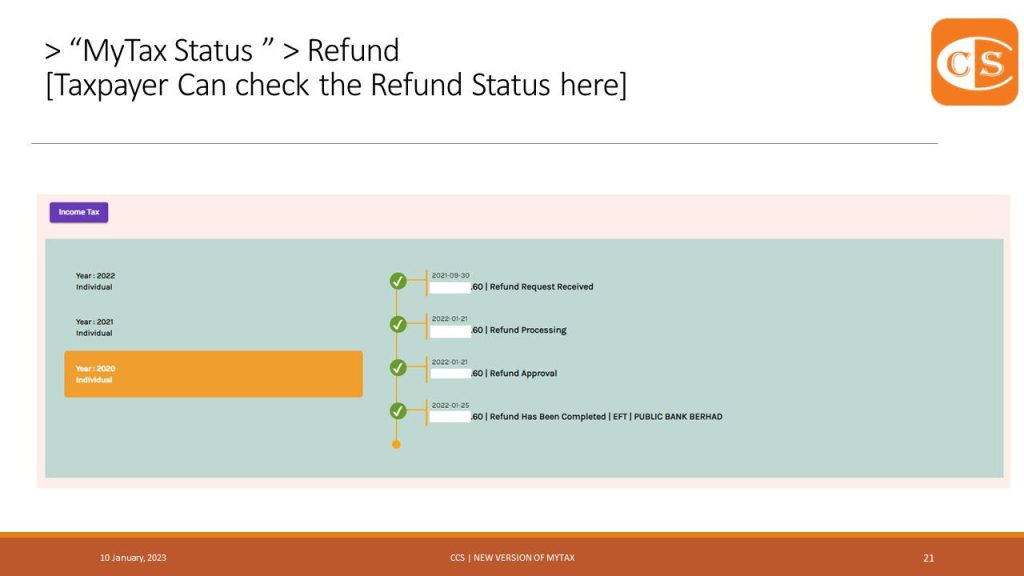

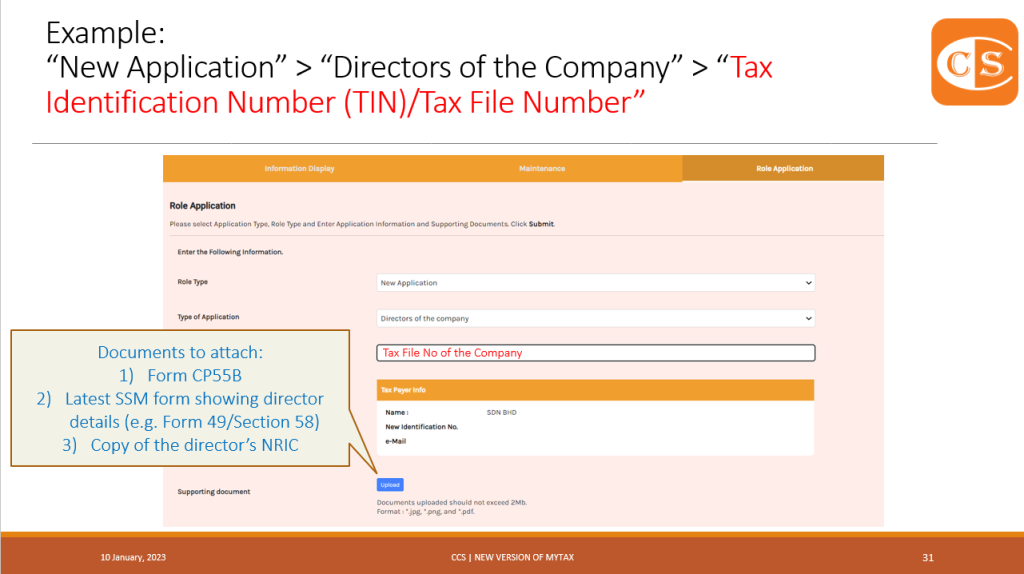

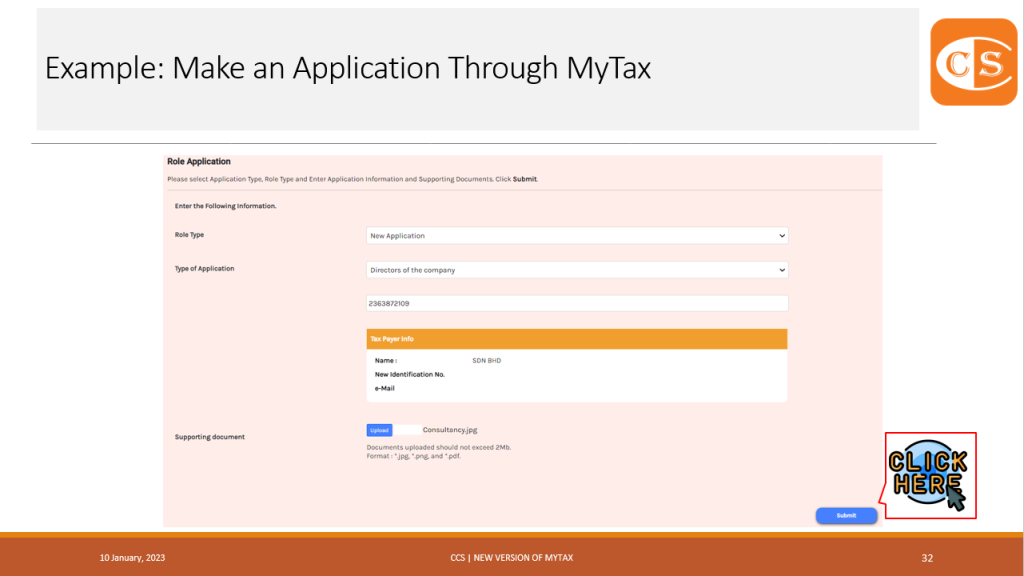

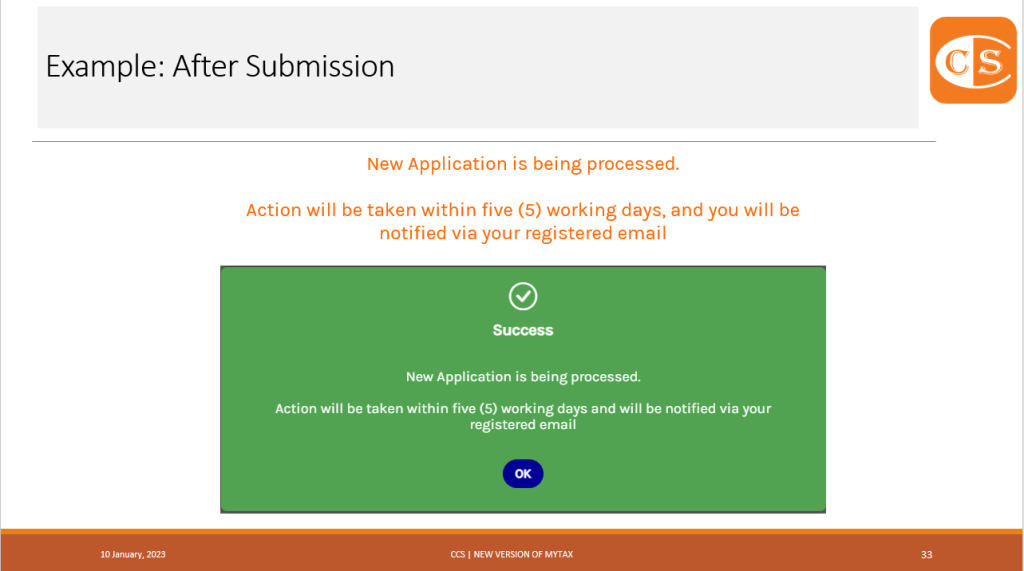

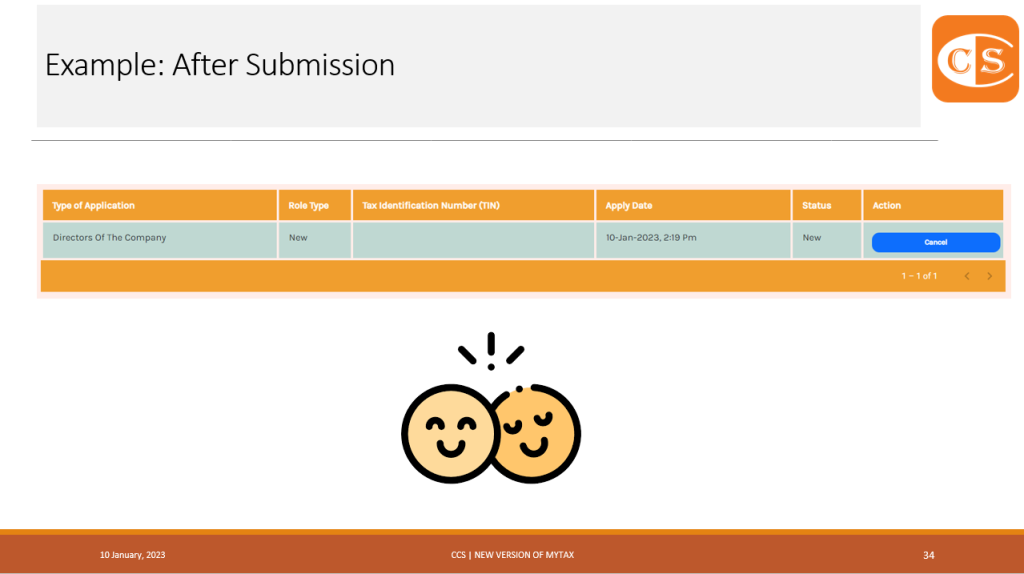

The BILL NUMBER can be obtained by visiting the MyTax portal or from the notice of assessment/estimate and payment claim letters sent by HASiL.

Taxpayers can make online payments or visit HASiL Payment Centre counters and agent banks.

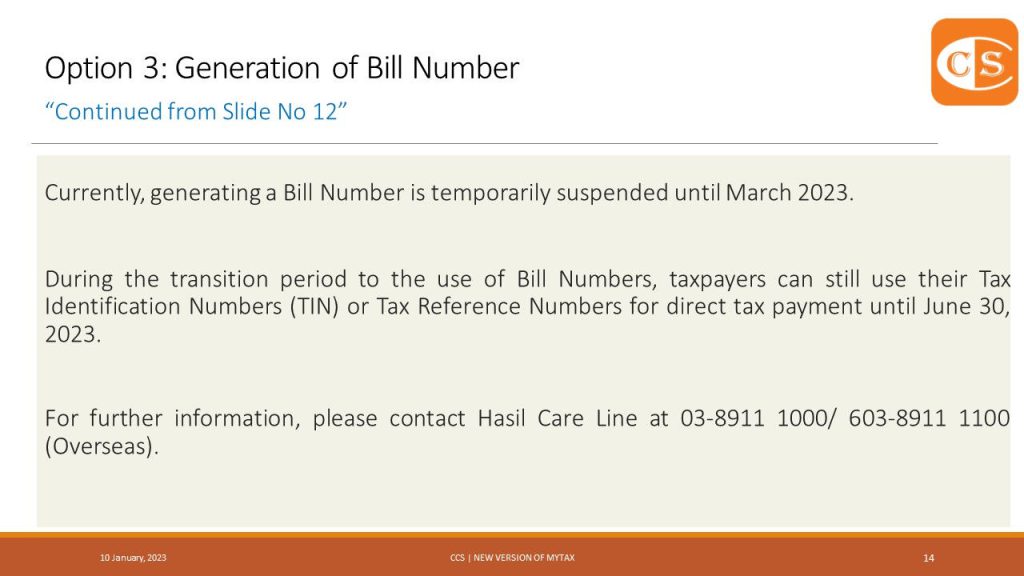

During the transition period until 30 June 2023, taxpayers can still use their Tax Identification Number (TIN) or Tax Reference Number for direct tax payment.

This media release aims to ensure proper tax treatment for qualifying direct taxes.

Reference

Our website's articles, templates, and material are solely for you to look over. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Therefore, any reliance on such information is strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/