This is an application for judicial review filed by Ensco Gerudi against the tax authorities’ decision in the form of a Notice of Additional Assessment dated 22 July 2020 and audit findings dated 23 October 2019, 30 January 2020 and 22 June 2020.

Background Facts

Ensco Gerudi (“Ensco”) provides offshore drilling services to the petroleum industry in Malaysia, including leasing drilling rigs, to oil and gas operators in Malaysia.

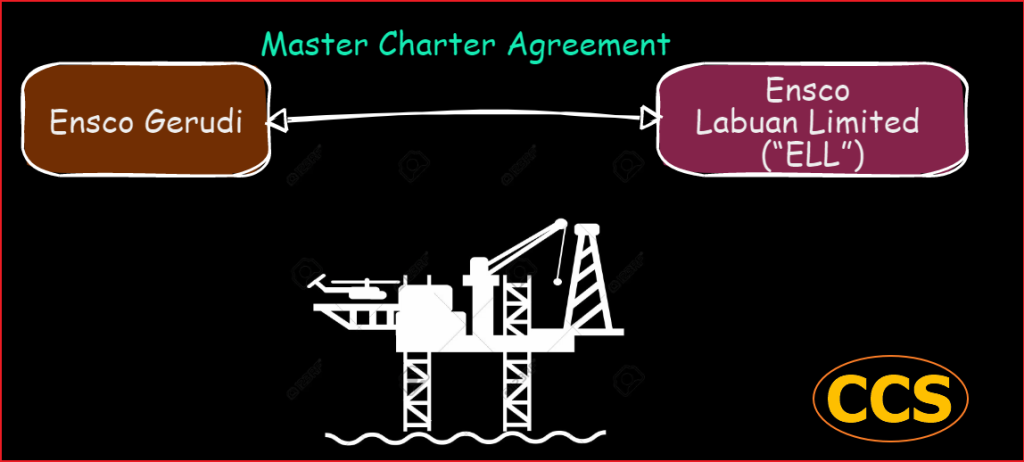

To provide these services, Ensco entered into a Master Charter Agreement dated 21.9.2006 (amended on 17.8.2011) (“Master Charter Agreement”) with Ensco Labuan Limited (“ELL”), a third-party contractor, to lease drilling rigs from ELL.

Ensco then rents out the drilling rigs to its customers.

As part of the Master Charter Agreement, Ensco agreed to pay ELL a percentage of the applicable day rate that Ensco earns from its drilling contracts with its customers for the drilling rigs.

By way of a letter dated 12.10.2018, the tax authorities initiated its audit for FY 2015 to 2017.

The tax authorities issued its first audit findings letter on 23.10.2019, where it took the position that the pricing of the leasing transactions between Ensco and ELL is not at arm’s length under s 140A of the Income Tax Act 1967 (“ITA”).

The tax authorities proposed that the profit earned by ELL should remain with Ensco by reducing the cost of the leasing asset by 20% or equivalent to the margin obtained by ELL.

Ensco disputed the tax assessment and brought the case to court for an appeals review.

In fact, before this, Ensco had encountered a tax audit conducted by the Inland Revenue Board in 2013.

TP Audit for the year of Assessment (‘YA’) 2006 [Ensco Gerudi 2013]

The dispute involves the same leasing transactions arising out of the Master Charter Agreement between Ensco and ELL.

The tax authorities invoked s 140(1)(c) ITA, and the justifications were ELL is a company under the control of Ensco plc, and ELL has no economic or commercial substance.

The tax authorities contend that:

- the economic and absolute rights over the assets (i.e., the rigs) had not been transferred to ELL, and ELL only does business with Ensco.

- the purpose of the transaction is more to benefit from the tax incentives provided.

- there was also a purported increase in the rental rate, providing the impression that Ensco is shifting profits through ELL to Ensco plc.

The tax authorities further attempted to rely on s 140(6) ITA. They alleged that Ensco and ELL are within the same group of companies, and as such, the transaction arising from the Master Charter Agreement between them was not at arm’s length.

Decision in Ensco Gerudi 2013

The learned High Court Judge, Dato’ Zaleha Binti Yusof J (as Her Ladyship then was), went on further and stated as follows:

“Merely because both companies belong to the same group of companies does not mean that the same person of [sic] entity controls them both.

Especially when the applicant is also made of Bumiputera shareholders whose interests would be unfairly disregarded, it is important to note that the shareholders of Ensco and ELL are not similar at the point of incorporation. In the circumstances, the test applicable to enable the respondent to invoke s 140(6) of Act 53 are not [sic] fulfilled in this case.”

[Emphasis Added]

Based on the finding, the Court of Appeal found that the leasing transactions between Ensco and ELL do not fall within the ambit of s 139 and s 140A ITA.

As such, the tax authorities decisions in adjusting the pricing of the leasing transactions between Ensco and ELL under s 140A ITA are illegal and in excess of its jurisdiction.

Hence, the Court of Appeal upheld the High Court’s decision in 2014.

TP Audit for the years of Assessment (‘YA’) 2015 – 2017

Four years after the judgement from the Court of Appeal, the tax authorities initiated its audit on Ensco for the years of assessment (“YAs”) from 2015 to 2017.

Evaluation and Findings

It is uncontroverted that the facts surrounding the operations of Ensco and ELL have remained the same. There has been no change in facts surrounding the management of the entities to show that there has been a shift in control since Ensco Gerudi 2013.

Some of the issues

To determine:-

- Are the decision in Ensco Gerudi 2013 binding on the parties and the tax authorities’ Decisions to raise tax assessments for the YAs 2012 – 2017 illegal and over its jurisdiction?

- Does the same third person control the Ensco and ELL?

- Has the tax authorities a duty to give reasons for its decisions and if so, has the tax authorities breached that duty?

Issue No 1: Are the decision in Ensco Gerudi 2013 binding on the parties and the tax authorities’ Decisions to raise tax assessments for the YAs 2012 – 2017 illegal and over its jurisdiction?

It is trite law that the Court’s decisions are binding on the Executive.

In Metacorp Development v. Ketua Pengarah Hasil Dalam Negeri [2011] 10 MLRH 854; Dato’ Rohana Yusuf J (as Her Ladyship then was) rightly encapsulated the principle as follows:

“Thus the failure of the respondent to follow the decision of the Superior Courts in Penang Realty as well as Lower Perak renders its decision defective.

These two cases are binding authorities on the respondent, being an arm of the executive.

Also, based on the doctrine of stare decisis, this court is bound by the superior court’s decisions. Since the respondent’s decision is not based on the legal authorities of the Superior Courts, such a decision is in excess of its jurisdiction. “

In Magnum Holdings Sdn Bhd v. Ketua Pengarah Hasil Dalam Negeri [2018] 3 MLRH 125, the taxpayer was assessed by the Respondent in 2017 on a similar legal issue concerning the deductibility of dividend and interest income which had already been decided by the High Court in 2001 (albeit for earlier years of assessments).

In this regard, the High Court held that the Respondent acted in excess of its jurisdiction to act in defiance of the judgments of the Courts:

“There is no issue concerning the principles enunciated by the abovementioned cases.

However, in the present application, the applicant complains that the DGIR has failed to apply for the legal position in Multi-Purpose Holdings Bhd v. Ketua Pengarah Hasil Dalam Negeri [2001] (involving the same parties) and that the legal interpretation of that case binds the DGIR.

Since the DGIR had refused to apply the decision in Multi-Purpose, then the DGIR had exceeded his jurisdiction.”

Since the same issues have already been determined in Ensco‘s favour by both the High Court and Court of Appeal, the Court again finds that the tax authorities had exceeded its jurisdiction and acted unlawfully when it failed to give due consideration to the earlier decisions of the Superior Courts of Malaysia.

Issue No 2: Does the same third person control the Ensco and ELL

The compositions of the shareholdings supplied by Ensco are reproduced as follows:

For Ensco Gerudi

| Shareholder | Ordinary Shares | Preference Shares | % of Ordinary Shares |

| Ensco Oceanics Company LLC | 980,000 | / | 49 |

| Ensco Offshore International Company | / | 1,850,000 | 0 |

| Pacific Reward Sdn Bhd | 60,000 | / | 3 |

| Crimsonbay Sdn Bhd | 480,000 | 650,000 | 24 |

| Prominent Vision Sdn Bhd | 480,000 | / | 24 |

| Total | 2,000,000 | 2,500,000 | 100 |

For ELL

| Shareholder | Ordinary Shares | Preference Shares | % of Ordinary Shares |

| Ensco Overseas Limited | 1,000 | / | 100 |

| Total | 1,000 | / | 100 |

Strict interpretation of the language of the law must be strictly adhered to, and where a taxing Act is concerned, the Federal Court in National Land Finance Co-operative v. DGIR [1993] had stated the followings:

“…in a taxing Act, one has to look merely at what is clearly said. There is no room for any intendment. There is no equity in tax. There is no presumption as to a tax. Nothing is to be read in; nothing is to be implied. One can only look fairly at the language used…”

It is the finding of the Court that the leasing transactions between Ensco and ELL do not fall within the ambit of s 139 and s 140A ITA.

As such, the tax authorities’ Decisions in making the adjustments to the pricing of the leasing transactions between Ensco and ELL under s 140A ITA are illegal and beyond its jurisdiction.

Issue No 3: Has the tax authorities a duty to give reasons for its decisions and if so, has the tax authorities breached that duty?

It can be taken as trite law that, as a public decision-making body, the tax authorities are obliged to give reasons for its decision. In Kesatuan Pekerja-pekerja Bukan Eksekutif Maybank Bhd v. Kesatuan Kebangsaan Pekerja-pekerja Bank & Anor [2017] the Federal Court held as follows:

“[86] It is also settled public law principle and principle of natural justice that a public decision-making body is underobligedive reasons for its decision. Indeed, a reasoned decision can be an additional constituent of the concept of fairness… Giving the reason is also one of the fundamentals of good administration.

(…)

[89] In exercising his powers and/or discretion and making a decision under s 12 of TUA 1959, the DG must have a reason for that decision. It is not a fanciful decision, and discretion can never be exercised willy-nilly. In that position, it is reasonable and appropriate to imply that he should have given a reason/s for his decision. He did not do so, for he was under the erroneous belief (as stated in his affidavit in reply) that he has “kuasa budi bicara yang mutlak”. He has not.”

[Emphasis Added]

The decision of the High Court

The High Court granted orders regarding Ensco’s application allowing an appeal.

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Therefore, any reliance on such information is strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/