1. Budget 2022 was tabled in Parliament on 29 October 2021, one of the amendments to the Income Tax Act 1967 is:

👉 Foreign-sourced income received in Malaysia will be taxed from January 1, 2022.

2. Then, everyone noticed a lot of relevant news or posts on social media

3. I’m also keeping track of this news, but I’ve discovered that there aren’t many individuals who grasp this legal change.

4. Everyone undoubtedly understands that money brought back from other countries will have to be taxed starting next year, but they don’t know how it will work.

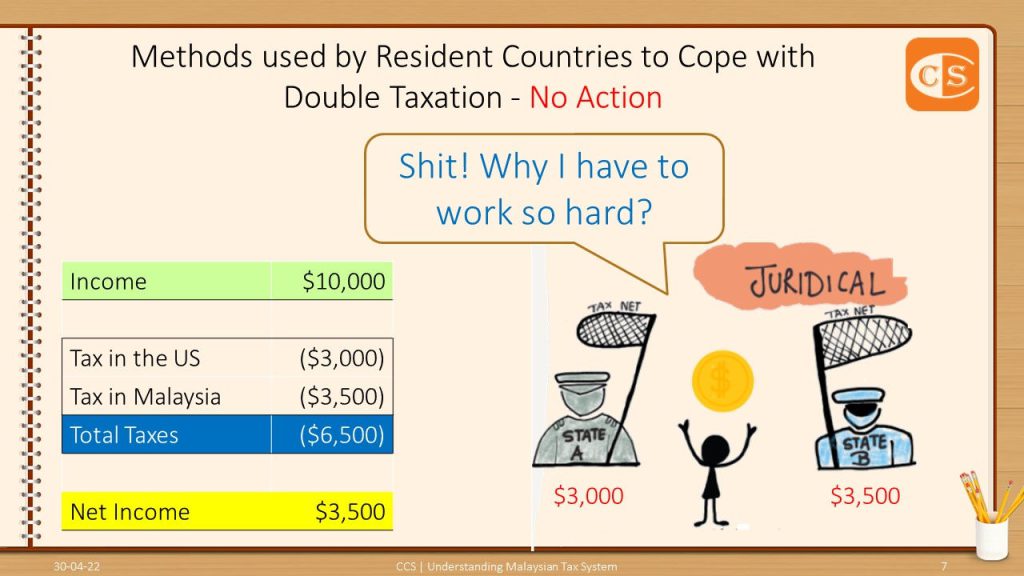

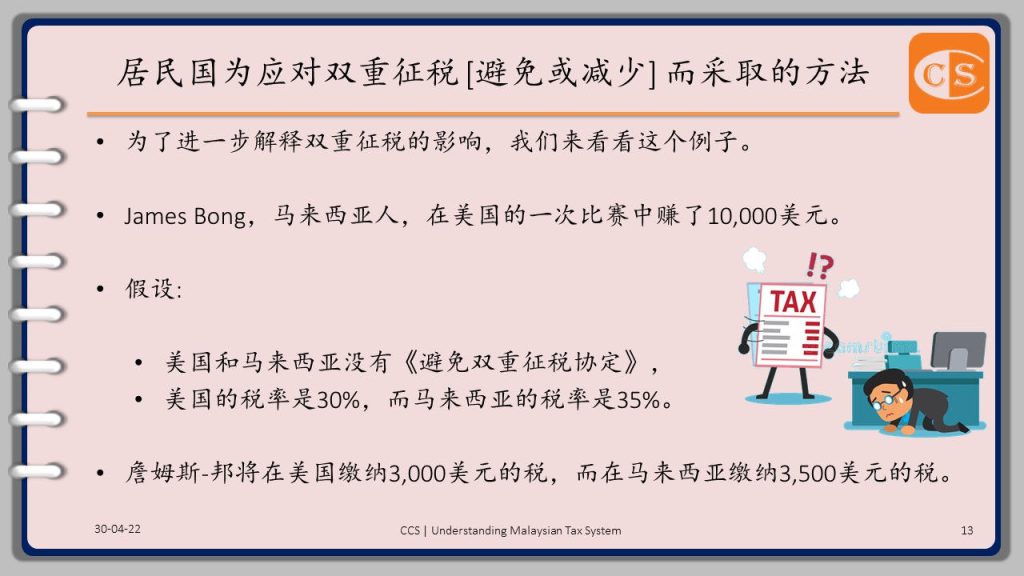

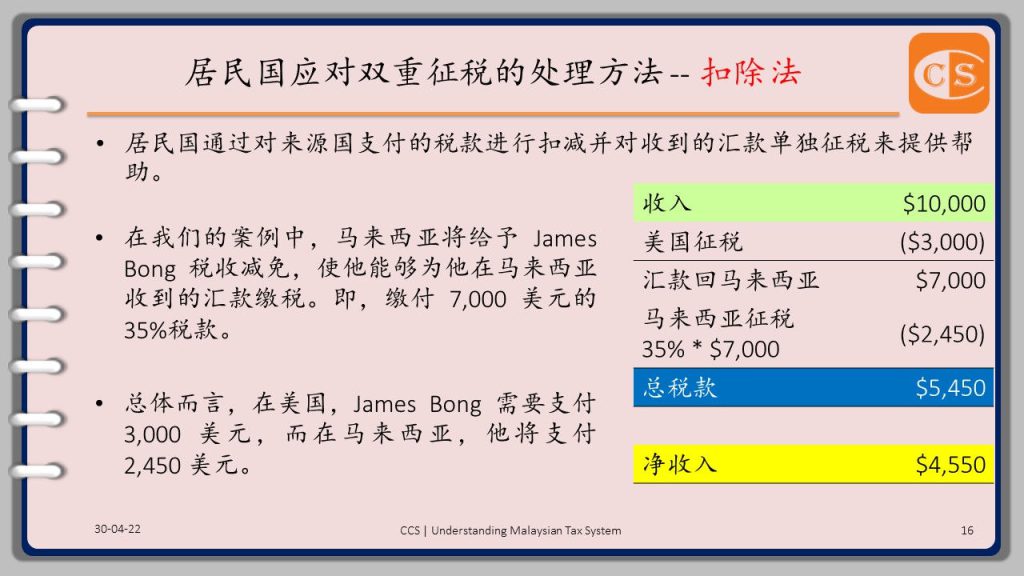

5. Some individuals are even concerned about being taxed twice.

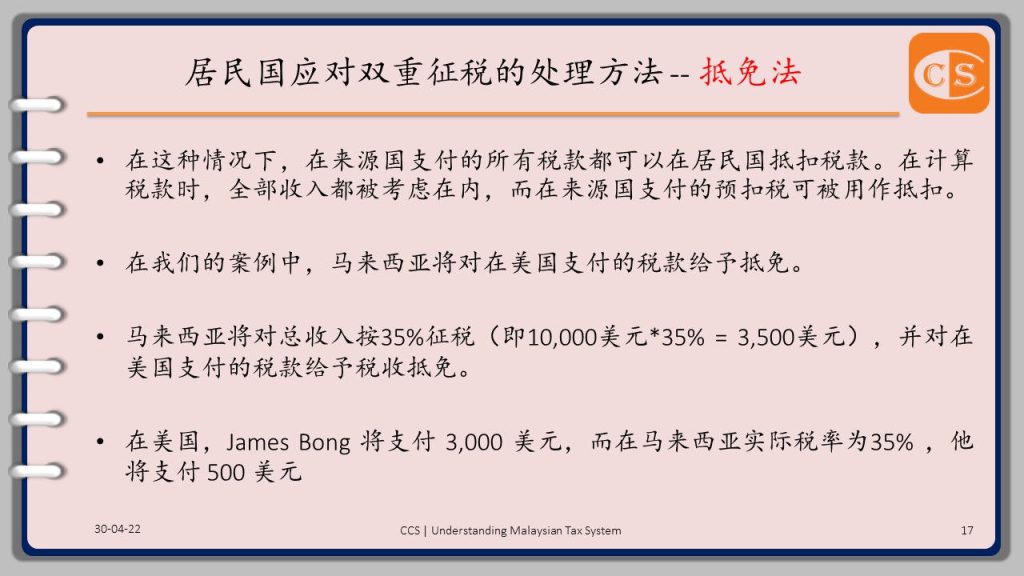

6. Today, I’ll discuss the methods that a resident country might use to avoid double taxation.

7. In fact, on this issue, I’ve authored a number of articles:

👉 If you are thinking to master this subject, I would recommend that you read all of the articles I’ve published thoroughly.

👉 If you are having trouble digesting and understanding it, I recommend that you contact me or your tax professional for assistance.

🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻

1. 在提交2022年预算案时,政府所作出的宣布 ; 从2022年1月1日起,在马来西亚获得的来源自国外的收入将被征税。

2. 一时间,大家都在社交媒体上看到许多相关的报导或分享

3. 我也都有在跟进这些报导,然而我却发现,能够读懂这项法律修订的并不多

4. 截至目前为止,大家只是大概知道,从明年开始,从外国带回来的钱,需要征税,但是对于实际上的操作并不了解

5. 甚至也有人在担心,是否会双重被征税

6. 今天我就来和大家谈谈,一般居民国应对双重征税的态度及方法 7。 针对这个课题,我已经写了相当多的文章:

👉 如果你想掌握这门知识,我建议你把我所写过的文章细读

👉 如果你没能读懂,那么我建议你有需要的时候,可以找我或你们的税务顾问咨询

#税法之道博大精深,#建议大家深度学习

🌸🌸🌸🌸🌸🌸🌸🌸🌸🌸

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

1. Issue No. 103/2021: Finance Bill 2021 Highlights – No more Exemption on Foreign Sourced Income remitted to Malaysia [2021年财政法案亮点 – 源自外国汇入马来西亚的收入,不再获得豁免] https://lnkd.in/eCS24pA3

2. What Is International Tax? [什么是国际税收] https://lnkd.in/eiuiC4f4

3. International Organizations involved In International Tax – OECD [涉及国际税收的国际组织 – 经合组织] https://lnkd.in/e_uDSM-S

4. International Organizations involved In International Tax – G 20 [涉及国际税收的国际组织 – G 20] https://lnkd.in/ehZnNjwh

5. International Organizations involved In International Tax – G20/OECD Inclusive Framework, World Bank Group & IMF [涉及国际税收的国际组织] https://lnkd.in/eKdW5UdE

6. International Organizations involved In International Tax – The UN [涉及国际税收的国际组织] https://lnkd.in/ermXNTq2

7. Residence Jurisdiction vs. Source Jurisdiction [来源地管辖权 vs. 居民管辖权] https://lnkd.in/eCit6_dc

8. Jurisdiction to Tax – The logic behind “Source Jurisdiction / Territorial Concept.” [税收管辖区 – “来源地管辖权”背后的逻辑] https://lnkd.in/eyp-SY_k

9. Jurisdiction to Tax – The logic behind “Residence Jurisdiction.” [税收管辖区 – “居民地管辖权”背后的逻辑] https://lnkd.in/eyzTrxpN

10. The Principle of Territorial-Residence Jurisdiction [属地兼属人管辖原则] https://lnkd.in/ehXXBXmd

11. Special Income Remittance Programme to Malaysian Residents – No more Exemption on Foreign Sourced Income remitted to Malaysia [马来西亚居民收入汇款特别计划 – 源自外国汇入马来西亚的收入,不再获得豁免] https://lnkd.in/ez4bpY3W

12. Double Taxation vs. Double Non-Taxation [双重征税 vs. 双重不征税] https://lnkd.in/etfYgkXK

13. Legal International Double Taxation [法律性国际双重征税] https://lnkd.in/e8zX9kP2

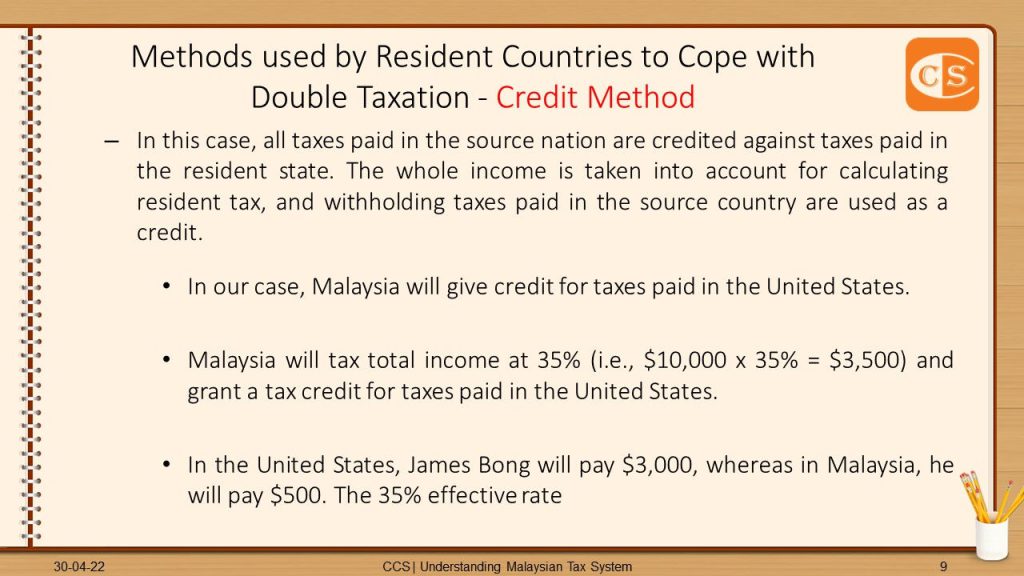

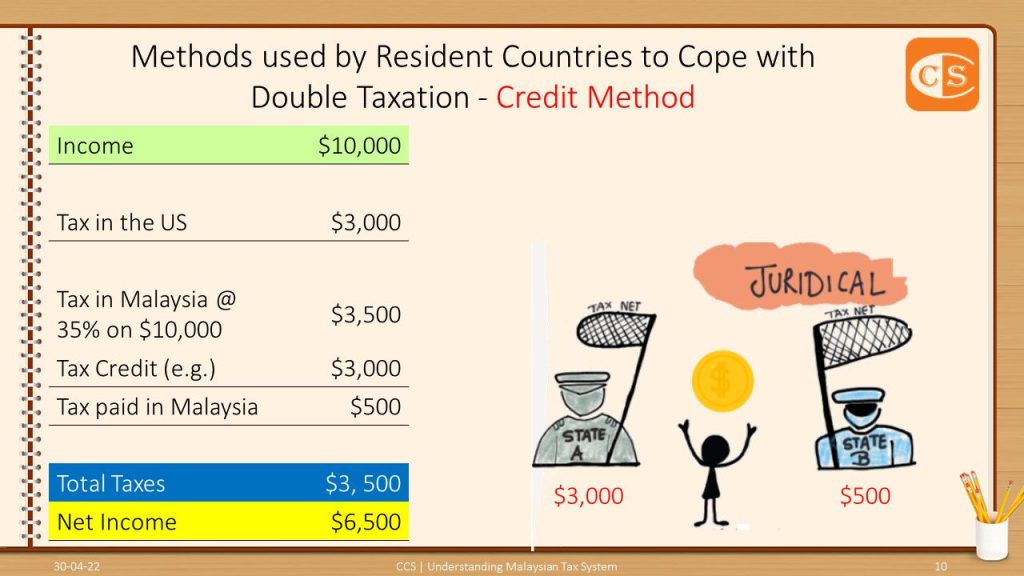

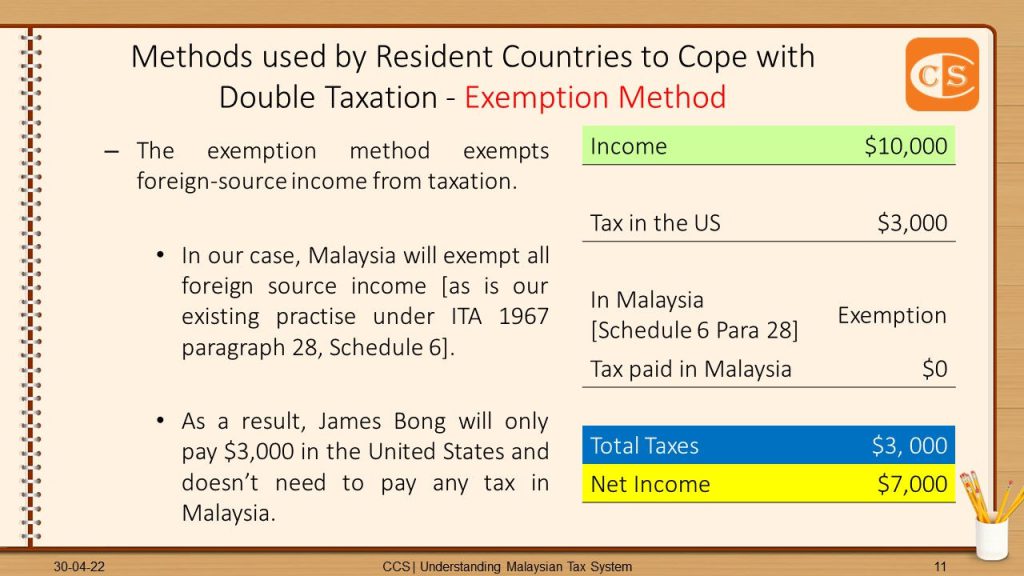

14. Methods used by Resident Countries to Cope with Double Taxation [居民国应对双重征税的方法] https://lnkd.in/e77aSCnE

15. Economic International Double Taxation [经济性国际双重征税] https://lnkd.in/ewWDxjZ3

16. Income Tax Treatment of Pensions (Provident Fund) [退休金或公积金@所得税处理] https://lnkd.in/eJVNzteR

17. Defining Residence [居民身份@界定] https://lnkd.in/eHfK49iB 18. An Individual’s Tax Residence under s 7(1)(a) ITA 1967 [1967年所得税法令第7(1)(a)条 @ 居民身份] https://lnkd.in/eJHAdE_D

19. An Individual’s Tax Residence under s 7(1)(b) ITA 1967 [1967年所得税法令第7(1)(b)条 @ 居民身份] https://lnkd.in/eT5HcfWH

20. An Individual’s Tax Residence under s 7(1)(b) ITA 1967 -Temporary Absences [1967年所得税法令第7(1)(b)条 @ 居民身份 – – 暂时性不在] https://lnkd.in/erW_Jxwd

21. Tax Residence under s 7(1)(c) ITA 1967 [1967年所得税法令第7(1)(c)条 @ 居民身份] https://lnkd.in/eMw82gE9

22. Tax Residence under s 7(1)(d) ITA 1967 [1967年所得税法令第7(1)(d)条 @ 居民身份] https://lnkd.in/eeYZy7Nq

23. Tax Residence under s 7(1A)ITA 1967 – A ‘day.’ [1967年所得税法令第7(1A)条 @ 居民身份: 一天的定义] https://lnkd.in/eS4JVgCr

24. Move to tax Foreign-Sourced Income in Malaysia is not a surprise [马来西亚对源自国外的收入征税 的举措并不令人意外] https://lnkd.in/e-kqYmuq

25. Special Income Remittance Programme to Malaysian Residents [源自外国汇入马来西亚的收入 特别报税方案] https://lnkd.in/eqhVhXda

26. Work on board, e.g. as a sailor, Subject to Tax? [在船上工作,如水手 中 Tax 吗] https://lnkd.in/ee6bgchw

27. Work onboard – Deeming Provisions of Employment Income [船员 – 就业收入认定条款 ] https://lnkd.in/eZv55cdV

28. What Exactly is Considered a Taxable Remittance: 1 – Introduction

[究竟什么才会被认为是”应税汇款”: 1 – 概述] https://lnkd.in/eKVzZqeQ

29. What Exactly is Considered a Taxable Remittance: 2 – Definition & Examples of Remittances

[究竟什么才会被认为是”汇兑”: 2 – “汇兑”的定义及例子] https://lnkd.in/ewmKMjC5

30. What Exactly is Considered a Taxable Remittance: 3 – How do I know What Income or Gains I Have Remitted?

[究竟什么才会被认为是”汇兑”: 3 – 我如何知道 我汇兑了哪些收入或收益?] https://lnkd.in/esiM6_ZX

31. What Exactly is Considered a Taxable Remittance: 4 – Should I Remit or Not?

[究竟什么才会被认为是”汇兑”: 4 – 我是否应该汇兑?] https://lnkd.in/exSEf5nq

32. Tax Residents to be exempted from tax on the foreign-sourced income until Dec 31, 2026 [税务居民源自国外的收入将被免征税至2026年12月31日] https://lnkd.in/eAu5rcJK

33. Termination of Special Income Remittance Program [最新消息 – 源自海外收入特别汇款计划] https://lnkd.in/euW8CJzm

🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼

#当你以我们的视频及刊物上的内容作为税务事务处理的参考时,你需要:

✅ 查询相关资料是否依然合时、准确和完整;和

✅ 寻求本身独立的专业意见,因为各别案例所涉及的范围和层面皆不同。 When you apply the content in our videos and publications as a reference, you need to:

🅾️ check the information contained therein, whether it’s up-to-date, accurate and complete, and

🅾️ seek your independent professional advice because the scope and extent involved in each case are different.

🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳🌳

👉 Stay in touch with us

1. Website ✍️ https://www.ccs-co.com/

2. Telegram ✍️ http://bit.ly/YourAuditor

3. Instagram ✍ http://tiny.cc/rojzrz

4. Blog ✍ https://lnkd.in/e-Pu8_G

5. Google ✍ https://lnkd.in/ehZE6mxy