The EPF strives to grow their members’ retirement savings while continuously developing a wide range of products and services to support their journey towards a comfortable retirement.

Individuals who are employed, self-employed or business owners can opt to contribute based on their own requirements.

As a member, you are eligible not only to enjoy annual dividends on your retirement savings and the many withdrawal options and benefits that come with being an EPF Member but also entitle to tax relief under the Income Tax Act 1967 section 49(1).

Income Tax Act 1967

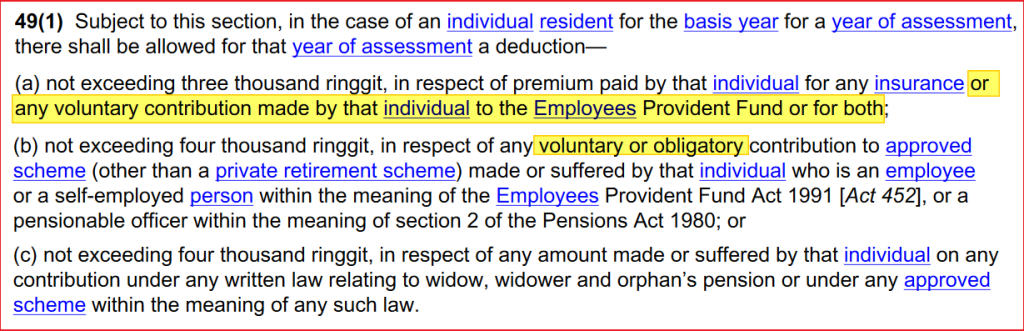

Section 49(1) is read as follows:

S. 49(1)(a) amended by Act 845 of 2023, s. 5(a)(i), effective for the year of assessment 2023 and subsequent years of assessment, by inserting “or any voluntary contribution made by that individual to the Employees Provident Fund or for both” after “any insurance.”

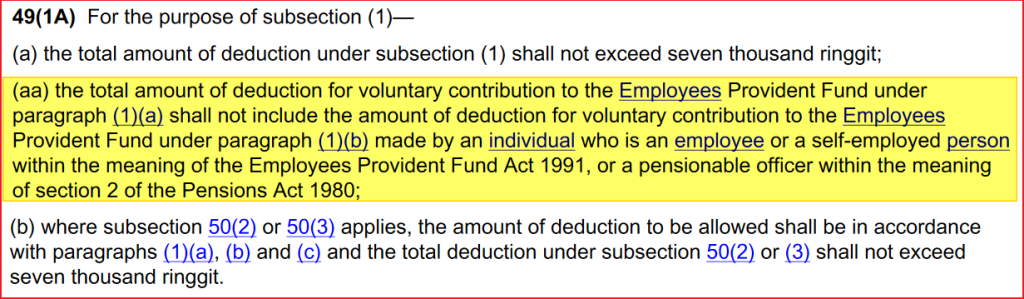

Section 49(1A) is read as follows:

S. 49(1A)(aa) inserted by Act 845 of 2023, s. 5(b)(i), effective for the year of assessment 2023 and subsequent years of assessment.

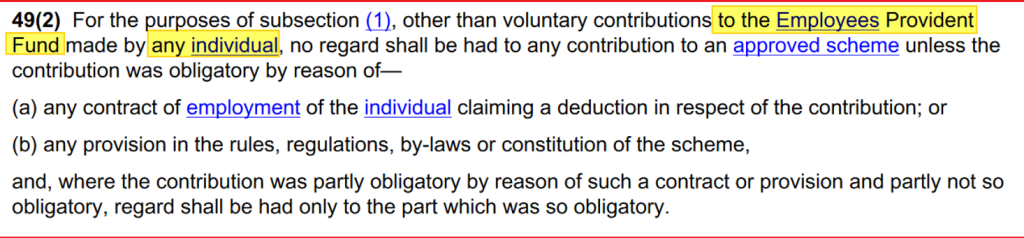

Section 49(2) is read as follows:

S. 49(2) amended by Act 845 of 2023, s. 5(c)(i), effective for the year of assessment 2023 and subsequent years of assessment, by inserting “to the Employees Provident Fund” after “other than voluntary contributions”. S. 49(2) amended by Act 845 of 2023, s. 5(c)(ii), effective for the year of assessment 2023 and subsequent years of assessment, by substituting “any individual” for “a self-employed person within the meaning of the Employees Provident Fund Act 1991 or a pensionable officer within the meaning of section 2 of the Pensions Act 1980”.

The amendment now allows:

- for tax relief not exceeding RM3,000 for premiums paid by an individual for any insurance or voluntary contribution to the Employees Provident Fund (EPF) or both.

- for tax relief not exceeding RM4,000 for voluntary or obligatory contributions made or suffered by an individual to an approved scheme (other than a private retirement scheme). This applies to employees, self-employed persons, or pensionable officers as defined in Section 2 of the Pensions Act 1980.

In the past, Section 49(1)(b) only represented the obligatory contribution to the EPF. However, under the latest amendments, Section 49(1)(a) and (b) now allow voluntary EPF contributions to be eligible for tax relief.

Illustration 1: Private sector employees/ Public Sector employees who elect for EPF

When you contribute 11% of your monthly salary to the EPF, your employer will contribute another 12% or 13% of your salary (the statutory contribution rate is subject to changes by the government) to your EPF savings. However, either you or your employer or both may contribute at a rate exceeding the statutory rates.

The provision under subsection 49(1) of the Employment Act is eligible to be claimed by the employee in both situations below:-

- An employee informs their employer to increase their monthly contribution from 11% to 15%, with the additional 4% voluntary.

- An employee chooses to make self-contributions to EPF at the end of the year in addition to the mandatory deduction from their regular employment income.

Illustration 2: Self-employed individuals/ Retirees/ Pensionable civil servants who opt to contribute to EPF voluntarily

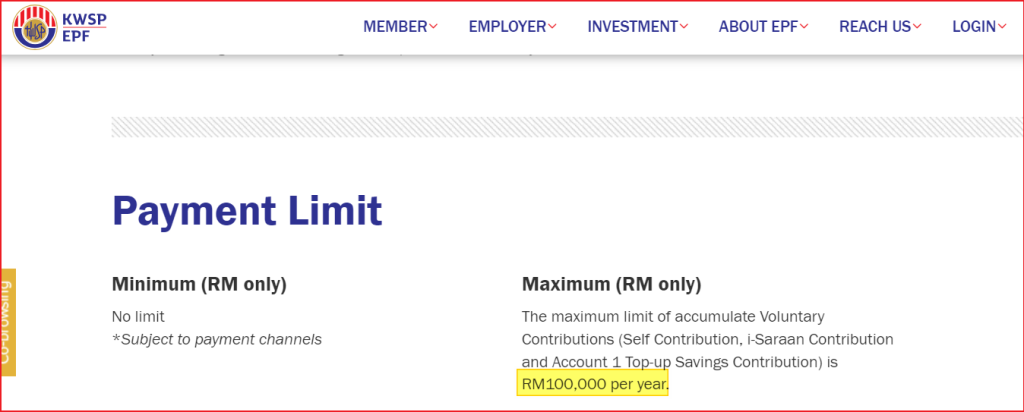

According to the guidelines on the EPF website, an individual can make a maximum voluntary contribution of RM100,000 per year, which can be a single contribution or accumulated from multiple contributions (Self Contribution, i-Saraan Contribution and Account 1 Top-up Savings Contribution).

Assuming that a self-employed individual or retiree chooses to make a one-time contribution of RM100,000 to EPF at the end of the year, they are eligible to claim RM7,000 in voluntary EPF relief.

This relief consists of RM4,000 under Section 49(1)(b) for voluntary EPF contributions and RM3,000 under Section 49(1)(a) for voluntary relief.

Disclaimer:

The articles, templates, and other materials on our website are provided only for your reference.

While we strive to ensure that the information presented is current and accurate, we cannot guarantee the completeness, reliability, suitability, or availability of the website or its content, including any related graphics. Consequently, any reliance on this information is entirely at your own risk.

If you intend to use the content of our videos and publications as a reference, we recommend that you take the following steps:

- Verify that the information provided is current, accurate, and complete.

- Seek additional professional opinions, as the scope and extent of each issue, may be unique.

免责声明:

我们网站上的文章、模板和其他材料只供参考。

虽然我们努力确保所提供的信息是最新和准确的,但我们不能保证网站或其内容,包括任何相关图形的完整性、可靠性、适用性或可用性。因此,您需要承担使用这些信息所带来的风险。

如果你打算使用我们的视频和出版物的内容作为参考,我们建议你采取以下步骤:

- 核实所提供的信息是最新的、准确的和完整的。

- 寻求额外的专业意见,因为每个问题的范围和程度,可能是独特的。

Keep in touch with us so that you can receive timely updates

请与我们保持联系,以获得即时更新。

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/