Sales Tax (Imposition of Sales Tax in respect of Designated Areas) (Amendment) Order 2023

The Minister, under section 50 of the Sales Tax Act 2018 [Act 806], has issued the Sales Tax (Imposition of Sales Tax in Respect of Designated Areas) (Amendment) Order 2023. This Order comes into effect on 1 April 2023 and may be cited as such. The Sales Tax (Imposition of Sales Tax in Respect of […]

ASEAN Harmonised Tariff Nomenclature and ATIGA Amendment (No 2) Order 2023

The Minister has made a Gazette Order to exercise the powers conferred by subsection 11(1) of the Customs Act 1967 [Act 235]. The order is titled “Customs Duties (Goods of ASEAN Countries Origin) (ASEAN Harmonised Tariff Nomenclature and ASEAN Trade in Goods Agreement) (Amendment) (No. 2) Order 2023”. It will come into operation on 1 […]

ASEAN Harmonised Tariff Nomenclature and ATIGA Amendment Order 2023

Customs Duties (Goods of ASEAN Countries Origin) (ASEAN Harmonised Tariff Nomenclature and ASEAN Trade in Goods Agreement) (Amendment) Order 2023 has been issued by the Minister in accordance with the Customs Act 1967 [Act 235]. The Order, which comes into effect on 1 April 2023, amends the First Schedule of the Customs Duties (Goods of […]

Customs (Customs Ruling) (Amendment) Regulations 2023

A Customs ruling is a ruling provided by the Customs Department following a request by a trader, agent or individual. It is a binding ruling issued in writing by the Director General of Customs and can serve as a guide regarding duty liabilities involved in business activities such as: Customs rulings are issued for: IN […]

Excise (Customs Ruling) (Amendment) Regulations 2023

Excise Duty is a tax imposed on certain goods imported into or manufactured in Malaysia. IN exercise of the powers conferred by subsection 85(2) of the Excise Act 1976 [Act 176], the Minister makes Excise (Customs Ruling) (Amendment) Regulations 2023. The amendments include substituting certain phrases and deleting Schedules A, B, and C from the […]

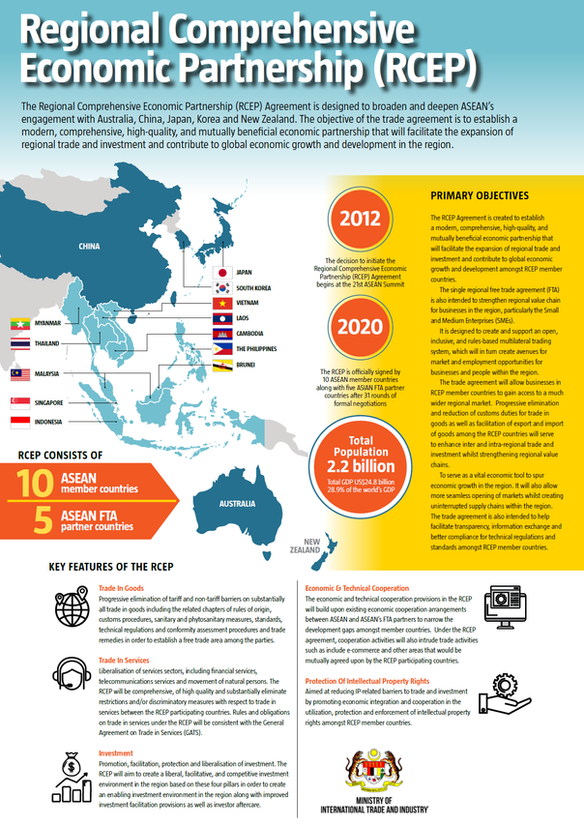

Customs Duties (Goods under the RCEP Agreement (Amendment) Order 2023

The Malaysian government has issued the Customs Duties (Goods under the Regional Comprehensive Economic Partnership Agreement) (Amendment) Order 2023, which comes into effect on March 15, 2023. This order amends the Customs Duties (Goods under the Regional Comprehensive Economic Partnership Agreement) Order 2022. The changes involve substituting references to the Customs Duties Order 2017 with […]

Foreign Currency Exchange Rate for Foreign-Source Income received in Malaysia

Effective 1 January 2022, the tax exemption for foreign-sourced income (“FSI”) received by Malaysian residents provided for under Para 28 was removed following the Budget 2022 made on 29 October 2021. The removal of the tax exemption for foreign-sourced income received by Malaysian residents implies that this type of income will be taxable in Malaysia, […]