“Section 152A – Electronic Medium” is read as follows:-

152A(1) [Form prescribed to be furnished electronic transmission]

Any person or class of persons—

- shall, if so required under this Act; or

- may, if so allowed by the Director General,

furnish any form prescribed under this Act on an electronic medium or by way of an electronic transmission.

152A(2) [Conditions and specification]

For the purposes of subsection (1), the conditions and specifications under which any prescribed form is to be furnished shall be as determined by the Director General.

152A(3) [Authorise in writing]

For the purposes of subsection (1), a person may authorise in writing a tax agent to furnish on his behalf any form prescribed under this Act in the manner provided for in subsection (1).

152A(4) [Presumption]

A form prescribed under this Act furnished in accordance with subsection (3) on behalf of any person shall be presumed to have been furnished on that person’s authority, until the contrary is proved, and the person shall be deemed to be cognizant of its contents.

152A(5) [Application of s 152A(3)]

Where subsection (3) applies—

- the person who authorises the tax agent shall make a declaration in the form prescribed under this Act stating that—

- the tax agent is authorised to furnish the form to the Director General on his behalf and

- the information provided by him to the tax agent for the preparation of the form is true and correct;

- the tax agent shall make a declaration in the form furnished in accordance with subsection (1) stating that—

- the form is prepared in accordance with the information given by the person;

- he has received a declaration made by the person under paragraph (a);-

- the person shall keep and retain in safe custody the form being the hard copy of the form so furnished, and that copy shall be made under processes and procedures which are designed to ensure that the information contained in the form shall be the only information furnished in accordance with this section;

- the hard copy shall be signed by the person, and

- the hard copy in paragraph (c) and the declaration made under paragraph (a) shall be kept and retained for a period of seven years from the end of the year of assessment in which the form is furnished.

152A(6) [Deemed furnished]

Any form referred to in subsection (1) is deemed to have been furnished by a person to the Director General on the date on which acknowledgement of receipt of the form is transmitted electronically by the Director General to the person.

Section 152A, in simple terms, deals with the electronic submission of forms prescribed under the tax law.

Here’s a breakdown:

- Electronic Submission Requirement: Any person may be required or allowed to submit any form specified under the tax law in an electronic format or through electronic transmission, as directed by the tax authorities.

- Conditions and Specifications: The Director General determines the specific conditions and details regarding how these prescribed forms should be submitted electronically.

- Authorisation through Tax Agent: Any person can authorise a tax agent in writing to submit forms on their behalf in the prescribed electronic manner. When this authorisation is given, the tax agent is assumed to have acted on behalf of the individual until proven otherwise.

- Declarations Required: Both the person authorising the tax agent and the tax agent themselves are required to make declarations confirming the accuracy and truthfulness of the information provided and the preparation of the form.

- Retention of Hard Copy: In cases where a tax agent is authorised, the person is required to retain a hard copy of the submitted form and the corresponding declaration, signed by the person, for a specified period (usually seven years) from the end of the assessment year in which the form was submitted.

- Deemed Furnished: The form is considered officially submitted on the date the tax authority electronically acknowledges the receipt of the form.

This section facilitates the electronic submission of tax-related forms, allowing for a more streamlined and efficient process while ensuring the necessary authorisations and declarations are in place.

The proposed amendment to Section 152A introduces a new subsection, specifically subsection (3A). Let’s break down the implications of this amendment:

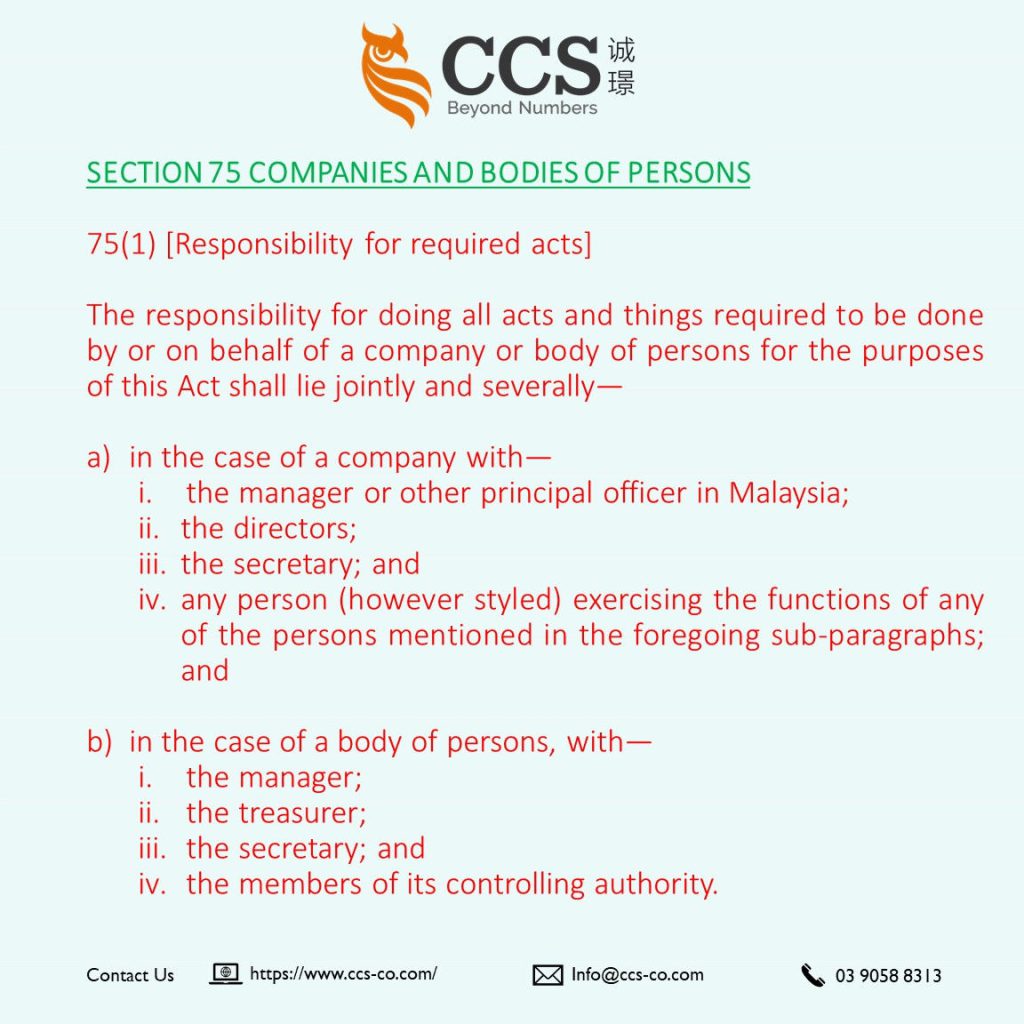

- Authorisation for Employees: The key addition is that, under the proposed (3A), a person mentioned in subsection 75(1) can now provide written authorisation for an employee to submit any form required under the tax law on their behalf in the manner specified in subsection (1) of Section 152A.

- Impact on Section 152A: This amendment broadens the scope of individuals who can delegate the electronic submission of tax forms to their employees. Previously, the section focused on authorising tax agents. Now, it explicitly includes employees, potentially offering more flexibility to individuals who may prefer to delegate this responsibility to an employee within their organisation.

- Tax Impact: The impact on tax procedures lies in the enhanced flexibility for individuals who fall under subsection 75(1). They can now empower employees to handle the electronic submission of prescribed forms, possibly streamlining organisational administrative processes. However, the specific tax impact would depend on the individual circumstances of the taxpayer and how they choose to utilise this authorisation provision.

In summary, this amendment extends the authorisation capability to employees of individuals covered by subsection 75(1), potentially providing more options for efficient and secure electronic submission of required forms under the tax law.

The tax impact will vary based on individual taxpayer scenarios and how they leverage this authorisation provision for their employees.