Initial Application of MFRS 17 and MFRS 9 – Comparative Information (Insurance Contracts)

Initial Application of MFRS 17 and MFRS 9 – Comparative Information (Amendment to MFRS 17 Insurance Contracts) – PDF 1. The MASB has issued Initial Application of MFRS 17 and MFRS 9—Comparative Information (Amendment to MFRS 17 Insurance Contracts). 2. The Amendment is limited to the transition requirements of MFRS 17 and has no effect on […]

Tax Concessions Due to COVID-19 Travel Restrictions expired on 31 December 2021

1. On December 24, 2021, the Inland Revenue Board (IRB) updated the FAQ on International Tax Issues Due to COVID-19 Travel Restrictions (FAQ) and announced: 👉 the Tax concessions Due to COVID-19 Travel Restrictions expired on 31 December 2021 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. 2021年12月24日,税税局 (IRB) 更新了关于新冠肺炎的旅行限制导致的国际税收事项常见问题 [FAQ],并宣布: 👉 关于新冠肺炎期间的行动限制所给予的税务宽免,于2021年12月31日结束 🌼🌼🌼🌼🌼🌼🌼🌼🌼🌼 10

Power to call for Bank Information for purpose of making a Garnishee Order Application

Power to call for bank information for purpose of making a garnishee order application – PDF 1. The Inland Revenue is only permitted to request your information from the bank under a garnishee order 2. When it comes to the new Section 106A of the Income Tax Act 1967, we have noticed a lot of […]

Form CP 21, CP 22, CP 22A & CP 22B

Dated: 15 January 2022 1. The prescribed forms CP21, CP22, CP22A, and CP22B will be in use from 1 January 2022; therefore, the Inland Revenue will not accept any further use of the old version of forms by employers other than those prescribed for in section 152 of the Income Tax Act 1967. 2. Also, […]

HRD Levy Payment for the newly registered employers for January 2022 has been Resumed

1. Please be advised that the levy payment for newly registered employers under the First Schedule of the PSMB Act 2001 (P.U.(A) 251/2021) for January 2022 has been reinstated for that month. 2. All newly registered employers are obliged to make the levy payment for January 2022 wage before or on the 15th of February […]

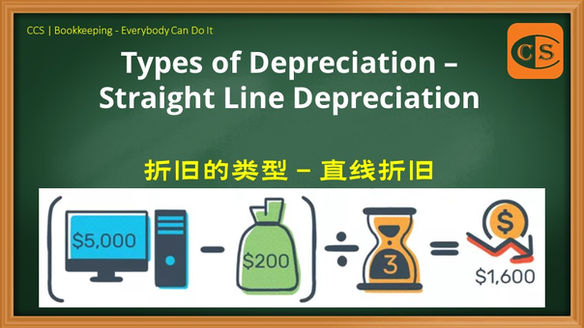

25 – Types of Depreciation – Straight Line Depreciation

Bookkeeping – Everyone Can Do It – 25 – Types of Depreciation – Straight Line Depreciation – PDF 1. 直线法是最常见(也是最简单)的固定资产折旧方法。这种方法将价值平均分配给资产的使用期限。 2. 公式: (资产成本 – 剩余价值) / 使用寿命 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. The straight-line method is the most common (and easiest) method of depreciating a fixed asset. This divides the value evenly over the asset’s useful […]

24 – What is a Depreciation Schedule

Bookkeeping – Everyone Can Do It – 24 – What is a Depreciation Schedule – PDF 1. 折旧表是一个表格,显示您的每项资产在一定时期内的折旧额 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A Depreciation Schedule is a table that shows you how much each of your assets will be depreciated over the course of a given period 2. Please read […]

23 – Useful Life

Bookkeeping – Everyone Can Do It – 23 – Useful Life – PDF 1. 针对使用期限,马来西亚财务报告准则 [MFRS] 第116条第6段作出了诠释 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Paragraph 6 of MFRS 116 provides an interpretation of the useful life 2. Please read more in the illustration 3. Join our Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 Bookkeeping – Everybody […]

22 – What kind of Assets can you Depreciate

Bookkeeping – Everyone Can Do It – 22 – What kind of Assets can you Depreciate – PDF 1. 根据会计标准,资产必须满足一些条件,我们才会计提折旧 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. According to accounting standards, some requirements must be met before we can depreciate them 2. Please read more in the illustration 3. Join our Telegram – […]

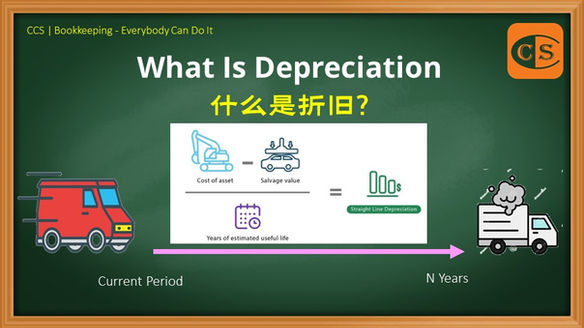

21 – What Is Depreciation

Bookkeeping – Everyone Can Do It – 21 – What Is Depreciation – PDF 1. 折旧的定义是系统化地减少固定资产的记录成本,直到该资产的价值为零或在会计界眼中看来可以忽略不计。 2. 在插图中阅读更多内容 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Depreciation is defined as the systematic reduction of the recorded cost of a fixed asset until the asset’s value is zero or negligible in the eyes of the accounting profession. […]