Recent changes were made to Form C by the Inland Revenue Board in preparation for the YA 2022. One of the most important changes is for those businesses participating in transfer pricing arrangements. As a result, the disclosure items have been significantly expanded to cover new areas.

These new areas include, among other things, stating the characterisation of your company by reference to its functional profile, the business restructuring undertaken by the group during the year, whether or not your company engages in cash pooling activities, performs any research and development activities or owns any intellectual properties.

Form C Requires Additional Disclosures

The taxpayer is NOW obligated to provide an entity characterisation concerning its business activities, specifically its manufacturing, distribution, and service activities; for instance:

- Whether manufacturing activities are carried out as a toll manufacturer, contract manufacturer, full-fledged manufacturer, or any other form of manufacturing;

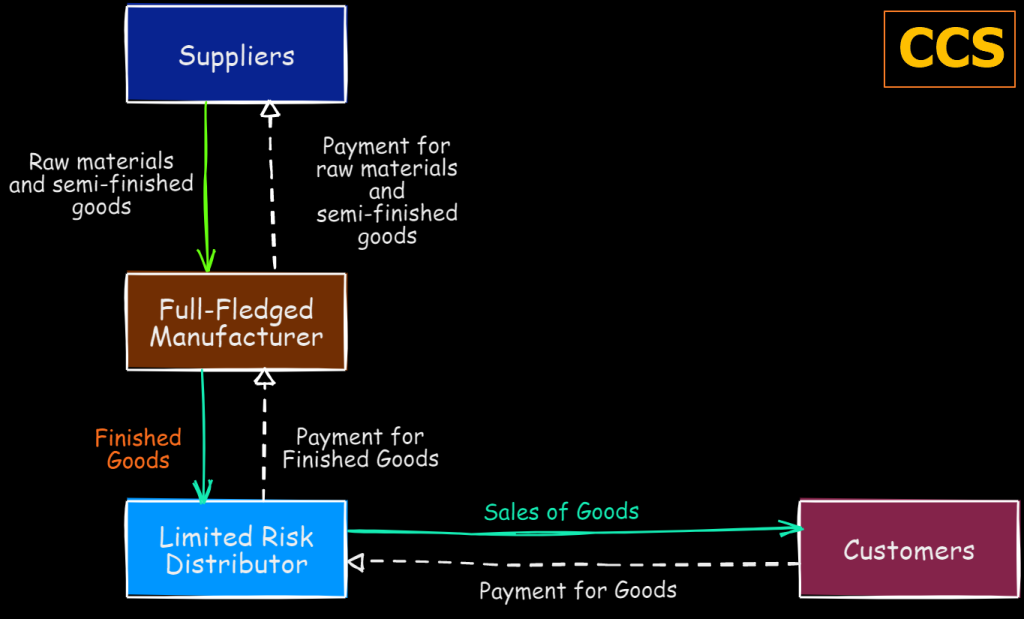

- Whether distribution activities are carried out as a full-fledged distributor, commissionaire distributor, agent distributor, limited risk distributor, licenced distributor or any other form of distribution;

- Whether service activities are carried out as a management-service provider, IT service provider, treasury or any other form of service.

The accurate definition of the entity is critical, and it must be decided based on an analysis of the transfer pricing functions, assets, and risks (FAR).

After the preliminary transfer pricing interviews (also known as functional analysis interviews) have been carried out and the required data has been collected, it is time to move on to the next step, explaining the manufacturer’s business model.

For transfer pricing, the following commonly used phrases are often used to characterise the operational manufacturing structures of a manufacturer. These terms are organised according to the risk profiles and economic characterisation of the structures:

- Entrepreneur (or a Full-Fledged Manufacturer);

- Toll Manufacturer;

- Contract Manufacturer; and

- Licensed Manufacturer.

在进行了初步的转让定价访谈(也称为功能分析访谈),并收集了所需的数据后,就该进入下一步,解释制造商的商业模式。

对于转让定价来说,以下常用的术语经常被用来描述制造商的运营制造结构。

这些术语是根据结构的风险状况和经济特征来组织的:-

- 企业家(或全功能制造商);

- 加工装配制造商;

- 合约制造商;以及

- 特许制造商。

The IRBM does not define any of the terms listed above. It is strongly advised that a comprehensive explanation be provided for each of the respective terms of the characteristics mentioned in Form C concerning the activities of manufacturing, distribution, and service.

Entrepreneur (or a Full-Fledged Manufacturer)

Full-fledged manufacturers may be responsible for various tasks, including production planning, input procurement, supply chain management, quality control, long-term capacity utilisation planning, and possibly even selling to third-party clients.

Product responsibility, warranty, capacity utilisation, market demand, and pricing risks are some of the risks associated with the operations of a full-fledged manufacturer who holds (non) routine intangibles assets.

Full-fledged manufacturers may also be involved in significant research and development activities. In this case, the manufacturer assumes the risks associated with creating, maintaining, and protecting valuable intangible property that may result from research and development activities.

In a simplified model with one entrepreneurial entity and many non-entrepreneurial businesses that make up the value chain of an MNE group.

Non-entrepreneurial entities, such as limited-risk entities, generate returns on regular functions. The full-fledged manufacturer/entrepreneur receives all residual profits or losses from the value chain.

If there are group losses, the manufacturer entrepreneur will incur all group losses,

制造商模式:全功能制造商 全功能风险制造商可能负责各种任务,包括生产计划、投入采购、供应链管理、质量控制、长期产能利用计划,甚至可能向第三方客户销售。

产品责任、担保、产能利用、市场需求和定价风险是与持有(非)常规无形资产的全功能制造商的运营相关的一些风险。

全功能制造商也可能参与重要的研究和开发活动,在这种情况下,全功能制造商承担了与造、维护和保护研究和开发活动可能产生的有价值的无形财产有关的风险。

在一个简化模型中,有一个全功能型实体和许多非全功能型企业,构成了一个跨国企业集团的价值链。

非全功能型实体,如有限风险实体,以常规功能产生回报。全功能制造商则从价值链中获得所有剩余的利润或损失。

如果集团出现损失,全功能制造商将承担所有的集团损失。

Toll Manufacturer

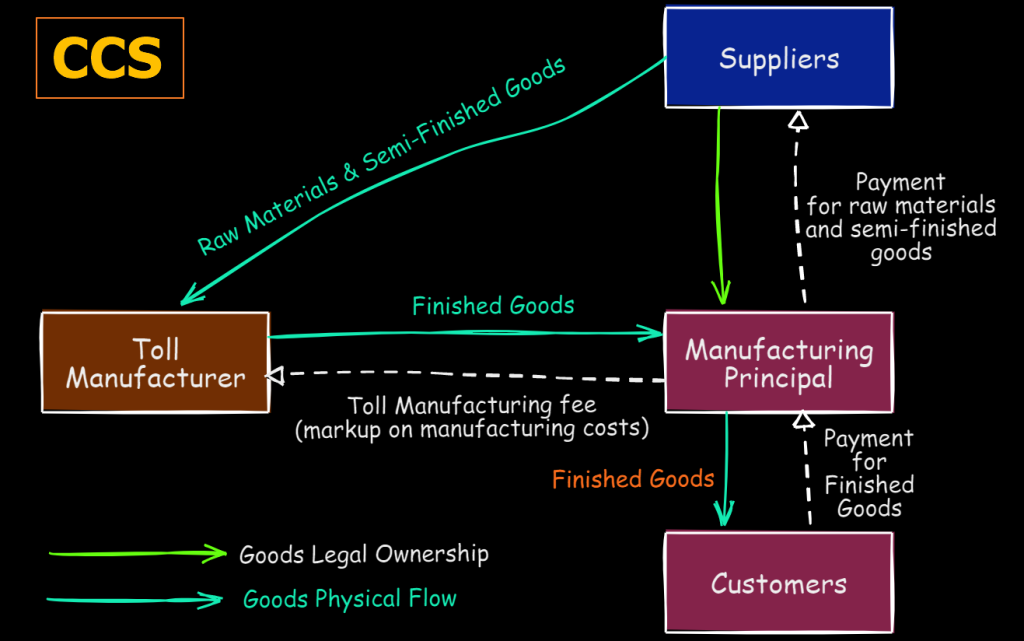

The principal keeps ownership of the raw materials, work-in-process, and finished products at all times during the manufacturing process when working with a toll manufacturer.

The raw materials are owned by the related-party manufacturer, who then makes them available to the toll manufacturer so that they can be processed (that is, the toll manufacturer does not take title to raw materials).

The toll manufacturer performs the processing services, and the manufacturing principal rewards the toll manufacturer through a Toll Manufacturing Fee.

This fee is commonly determined as a markup on the processing costs.

The manufacturer is responsible for all risks, including those related to the final demand and price and those involved with storing raw materials and completed goods inventories.

制造商模式:加工装配

来料加工商不拥有原材料所有权,无需承担原材料价格波动造成的风险以及原材料存货风险。

来料加工企业主要承担与生产相关的功能风险,不承担由于产品销售市场萎缩或扩张而带来的 市场风险,来料加工商向委托方收取加工费,不应发生亏损。

转让定价特点和问题 :

- 在数据库中寻找与来料加工商相同或相似功能风险可比公司比较困难。

- 来料加工商有可能构成常设机构的风险,通常根据代理项目是否是委托人主营业务、采购代理人是否经常代表委托人签约、仓储、保存并交付货物等作出是否在业务所在国构成常设机 构的判断。

Contract Manufacturer

A manufacturing principal that directly bears the risk of demand and final consumer pricing is the “manufacturing principal” for whom the contract manufacturer manufactures items.

The principal may guarantee the acquisition of the goods if the product manufactured by the contract manufacturer meets the product and quality requirements set out by the principal.

Therefore, compared to a licenced manufacturer, a contract manufacturer may be subject to relatively limited risks connected with retaining finished goods and selling them.

Because the contract manufacturer often owns the plant and equipment and procures and owns the raw materials, they are still responsible for bearing the risks involved with retaining inventories of fixed assets and raw materials.

However, in many cases, a manufacturer may do some “contract manufacturing” activities in addition to its licenced or full-fledged manufacturing activities.

制造商模式:合约制造

合约制造商不拥有与产品有关的专有技术,而是由委托方授权使用该专有技术,并按委托方要 求控制产品生产进度和产品质量。

合约制造商可能要投入大量成本购置专门的生产设备,用来 制造委托方所需的产品。

如果委托方的订单量不足,就会导致合约制造商产能利用率低而产生 闲置成本。

而订单数量取决于委托方的营销能力、市场环境及产品本身的特性等因素的影响, 这不是合约制造商所能控制的。

因此,在独立交易中,合约制造商会希望在合同条款中把产能不饱和的风险转移到委托方。例如,委托方要保证在若干年内按照议定的价格每年达到一定的最低购买量等,从而降低合约制造商的产能风险。

总体上,合约制造商通常承担常规生产功能和有限风险,因此只能赚取稳定而有限的利润,而 不可能获取超额利润,但一般也不应发生亏损。

转让定价特点和问题 :

- 转让定价政策需要考虑交易双方在相关交易中各自承担的功能、风险,从而选择合适的转让 定价方法。

- 有的高新技术企业在转让定价分析中定位为合约生产商,需要作出具体说明。

- 成本节约和市场溢价问题。

Licensed Manufacturer

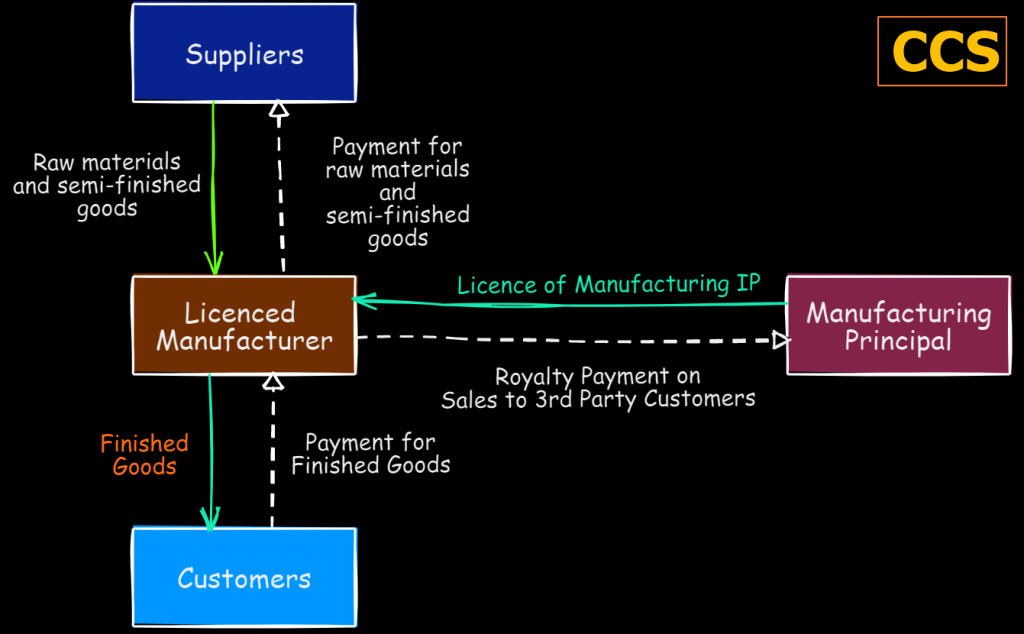

A licenced manufacturer manufactures items under the terms of a licence agreement.

This manufacturer uses the intangible manufacturing assets the licensor owns, such as patents, product designs, manufacturing processes, and know-how.

The licenced manufacturer is responsible for paying royalties for the use of licenced intangibles, often purchasing raw materials and semi-finished goods, and maintaining inventories of completed goods and raw materials.

As a result, it is responsible for the risks of storing inventory and selling items, including the risk connected with demand and pricing.

The licenced manufacturer will typically own the facility and equipment required for manufacturing activities and invest in the workforce’s training and development.

制造商模式:特许制造

特许制造商不拥有与产品有关的专有技术,而是由许可方授权使用该专有技术,并向许可方支 付技术使用费。

特许制造商可以自主安排产品的生产进度,控制产品质量,以及进行市场开拓 和营销活动。

特许制造商承担生产风险和市场风险。

相对于合约制造商,特许制造商利润水平波动较大,且可能出现亏损,但历年平均利润水平将明显高于前者。

转让定价特点和问题 :

- 亏损企业支付特许权使用费的问题。

- 特许权使用费抵扣需要作出受益性说明。

- 需要证明特许权使用费支付符合独立交易原则。

- 成本节约和市场溢价问题。

These terms, which summarise manufacturer risk and functional profiles, are often helpful in describing typical transfer pricing issues associated with the manufacturing sector.

Even though the boundaries between these terms are not always clear, and they may oversimplify complex manufacturing profiles, they help summarise manufacturer risk and functional profiles.

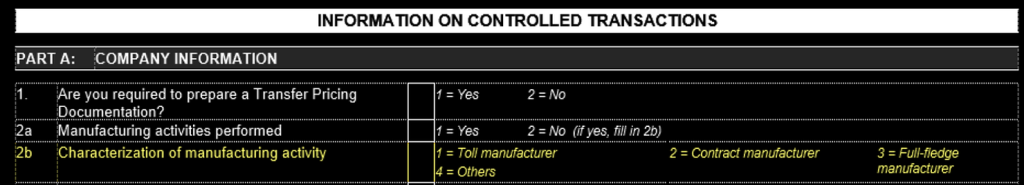

If controlled transactions are involved, you need to be able to classify them properly because they will need to be filled for the income tax return of 2022.

Select the character of the manufacturing activity performed by the company and enter ‘the number’ in the box.

1 = Toll manufacturer

2 = Contract manufacturer

3 = Full-fledge manufacturer

4 = Others

这些术语概括了制造商的风险和功能概况,通常有助于描述与制造业相关的典型转让定价问题。

即使这些术语之间的界限并不总是很清楚,而且它们可能过度简化了复杂的制造业概况,但它们有助于总结制造商风险和功能概况。

如果涉及到受控交易,你需要能够对其进行正确的分类,因为2022年的所得税报表需要填写制造商的模式。

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Any reliance on such information is therefore strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/