English version of the FAQ on Implementation of e-TT System for TT, EFT and IBG Payment Methods

With effect from 1 April 2022, an e-Telegraphic Transfer (eTT) system has been implemented for the payment of: through Telegraphic Transfer (TT), Electronic Funds Transfer (EFT), and Interbank GIRO Transfer (IBG) methods from within and outside Malaysia. There are a total of 18 questions that are presented in the form of frequently asked questions (in […]

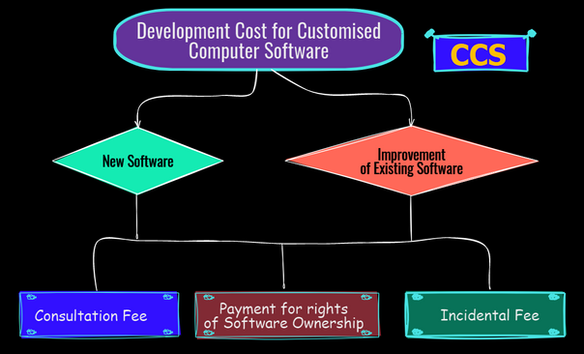

IRBM’s Response to CTIM’s Development Cost for Customised Computer Software

Income Tax (Capital Allowance) (Development Cost for Customised Computer Software) Rules 2019 On 3 October 2019, the Minister, in the exercise of the powers conferred by paragraphs 154(1)(b), 33(1)(d) and paragraphs 10 and 15 of Schedule 3 to the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Capital Allowance) (Development Cost for Customised […]

Payment for Google and Facebook ads or Agoda is it Subject to Withholding Tax?

1. The question of whether payments made to foreign digital service providers for software and payments for the use of or right to use the information and digitized products are subject to withholding tax has been debated for some time. 2. The Inland Revenue Board (IRB) may take a position that differs from the position […]

Press Release – 2% Withholding Tax on Payment (Commission) Made To Agent

1. The 2% Withholding Tax that must be withheld from commission payments to agents, dealers, and distributors has been a source of confusion for many businesses. 👉 What exactly is going on? 👉 Is there any news? 👉 Have the Remittance Forms been made available yet? 2. In reality, it appears that many people, maybe […]