Review of Tax Incentives for Bionexus Status Company

Updated on 15 July 2023- Dialogue between MOF, LHDNM, and CTIM [21/6/2023] To Download Revised Budget 2023 Speech and some other related publications – https://www.ccs-co.com/post/budget-2023-malaysia-madani Current Position “Bio Nexus Status Company” means a company incorporated under the Companies Act 2016 [Act 777] engaged in the life sciences business. Tax incentives for BioNexus status companies are […]

Employment of Inmate and Ex-Inmate of Henry Gurney School and Institutions under the SWD

Update: The Ismail Sabri Government Budget is no longer applicable. Malaysia’s national budget for 2023 was re-tabled again in February 2023. To Download Revised Budget 2023 Speech and some other related publications – https://www.ccs-co.com/post/budget-2023-malaysia-madani Current Position An employer is allowed a further deduction on remuneration paid to the following categories of employees: To qualify for […]

Salary to Senior Citizens, IRB disallowed Double deduction claim, CCS Successfully defends

In claiming a Double Tax Deduction for remuneration paid to an employee who reaches the age of 60 in the middle of the year, is the remuneration to be prorated to exclude the portion of his remuneration that relates to the period prior to reaching the age of 60? Few senior citizen employees of our […]

Petroleum (Income Tax)(Deductions for Employment of Disabled Persons) Rules 1989

Double Tax Deductions for Employment of Disabled Persons IN exercise of the powers conferred by subsection (1) of section 83 of the Petroleum (Income Tax) Act 1967, the Minister makes Petroleum (Income Tax) (Deductions for Employment of Disabled Persons) Rules 1989 [P.U. (A) 391/1989], These Rules shall have effect for the year of assessment 1989 […]

Double Tax Deduction for the Cost of Detection Test of Covid-2019

In the exercise of the powers conferred by paragraph 154(1)(b) read together with paragraph 33(1)(d) of the Income Tax Act 1967 [Act 53], the Minister, on September 9, 2022, gazetted the Income Tax (Deduction for Expenses in relation to the Cost of Detection Test of Coronavirus Disease 2019 (COVID-19) for Employees) (Amendment) Rules 2022 (P.U. […]

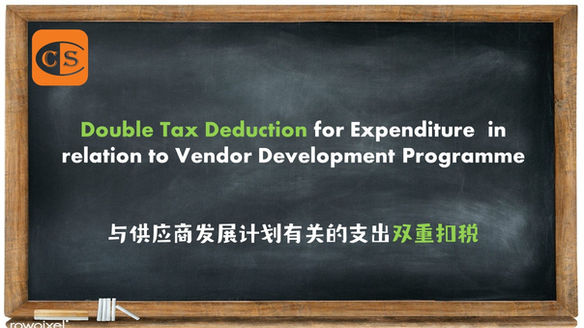

Double Tax Deduction for Expenditure in relation to Industry4WRD Vendor Development Program

What Is the 4th Industrial Revolution (4IR)? What exactly is meant by the phrase “the Fourth Industrial Revolution,” and why should you be concerned about it? The convergence of the physical, digital, and biological worlds are referred to as the “Fourth Industrial Revolution,” and it is a term that has been used to describe this […]

Income Tax (Deduction for Expenditure in relation to Vendor Development Programme (VDP) Rules 2022

1. With effect from Year of Assessment 2021, Anchor Enterprises can claim double deductions for eligible expenses made to encourage increased participation in the development of local vendors. 2. The eligible expenditure of up to RM300,000 every assessment year 3. Join our Telegram 👉 https://t.me/YourAuditor/2535 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. 从2021年的评估年开始,为了鼓励更多的人参与本地供应商的发展,锚点企业 [Anchor Enterprises] 所产生的合格支出,将享有双重扣除的资格。 2. 每个评估年度,高达 3百千令吉的合格支出享有双重扣除的资格 3. […]

Double Tax Deduction for the Sponsorship of Scholarships to Malaysian Students

1. On 31 December 2021, the Minister, in the exercise of the powers conferred by paragraph 154(1)(b) read together with paragraph 33(1)(d) of the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Deduction for the Sponsorship of Scholarship to Malaysian Student Pursuing Studies at the Technical and Vocational Certificate Levels) Rules 2021 [P.U. […]

Income Tax Deduction for the Sponsorship of Scholarship to Malaysian Student

9

Income Tax (Deduction for Expenditure on Provision of Employees’ Accommodation) Rules 2021

1. Under these Rules, to ascertain the adjusted income of a company from its business in a basis period for a year of assessment, a Double Deduction of up to fifty thousand ringgit (RM50,000) shall be allowed for the expenses incurred by the company on rental of a premise for employees’ accommodation within the period […]