37 – Exercise (1)

Bookkeeping – Everyone Can Do It – 37 – Exercise (1) 1. 不知不觉,此系列已经来到了尾声。结束前,不妨做点练习,看看自己的理解能力去到什么程度 2. 加入 Telegram – https://t.me/YourAudito 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. You’ve reached the end of this series of articles before you know it. Before you complete, try some exercises to see how far you can understand. 2. Join our Telegram – https://t.me/YourAudito 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 Bookkeeping – […]

31 – Types of Discount – Trade Discount

Bookkeeping – Everyone Can Do It – 31 – Types of Discount – Trade Discount – PDF 1. 我猜想你会知道,折扣是你在购买商品或服务时,从其标准价格所获取的回扣。然而,你是否知道,折扣其实有着两种类型,即贸易折扣 [Trade Discount] 和现金折扣 [Cash Discount] 吗? 2. 接下来,我们将探讨这两种折扣,以了解它们之间的区别。在这篇文章中,就让我们先看看,什么是”贸易折扣”。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. I’m assuming you’re aware that a discount is a reduction in the standard price of a good or service you purchase. However, did you […]

32 – Types of Discount – Cash Discount

Bookkeeping – Everyone Can Do It – 32 – Types of Discount – Cash Discount – PDF 1. 我猜想你会知道,折扣是你在购买商品或服务时,从其标准价格所获取的回扣。然而,你是否知道,折扣其实有着两种类型,即贸易折扣 [Trade Discount] 和现金折扣 [Cash Discount] 吗? 2. 接下来,我们将探讨这两种折扣,以了解它们之间的区别。在这篇文章中,就让我们先看看,什么是”贸易折扣”。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. I’m assuming you’re aware that a discount is a reduction in the standard price of a good or service you purchase. However, did you […]

33 – Difference Between Trade Discount and Cash Discount

Bookkeeping – Everyone Can Do It – 33 – Difference Between Trade Discount and Cash Discount – PDF 1. 贸易折扣 [Trade Discounts] 和现金折扣 [Cash Discounts] 之间存在显着的差异。 2. 贸易折扣是指供应商在将产品批量销售给相关买方时,允许买方以低于标准价格购买的一项优惠。 3. 相比之下,现金折扣是指供应商给予买方提前支付账单的折扣,以便能更快的收回债务。因此,只要买方能在规定的时间范围内提前支付现金,他们就可以获得现金折扣。 4. 在插图中阅读更多内容 5. 下载 – https://www.ccs-co.com/post/ccsinsights180-2022 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. There is a significant difference between Trade Discounts and Cash Discounts. 2. Trade discounts refer to a […]

34 – How To Calculate & Record Trade and Cash Discounts

Bookkeeping – Everyone Can Do It – 34 – How To Calculate & Record Trade and Cash Discounts – PDF 1. 我们要如何计算和记录贸易和现金折扣呢? 2. 在插图中阅读更多内容 3. 下载 – https://www.ccs-co.com/post/ccsinsights181-2022 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. How do we calculate and record trade and cash discounts? 2. Please read more in the illustration 3. To Download – https://www.ccs-co.com/post/ccsinsights181-2022 1. 我猜想你会知道,折扣是你在购买商品或服务时,从其标准价格所获取的回扣。然而,你是否知道,折扣其实有着两种类型,即贸易折扣 [Trade […]

35 – Discount Allowed

Bookkeeping – Everyone Can Do It – 35 – Discount Allowed – PDF 1. 当卖方为其买方提供折扣以换取提早付款时,这类型现金折扣,我们称之为“销货折扣”。 2. 如果授予买方销货折扣,卖方的收入就会减少,这在会计记录中显示为“销货折扣账户” [Discount Allowed Account]。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. When a seller offers a cash discount to its buyers in exchange for prompt payment, this type of cash discount is what we call a “Sales Discount.“ 2. If a cash discount […]

36 – Discount Received

Bookkeeping – Everyone Can Do It – 36 – Discount Received – PDF 1. 当买方接受卖方的现金折扣时,我们使用 “购货折扣 ”这一术语来形容。 2. 所收到的折扣会导致公司的开支减少,并在记账系统中记录为购货折扣账户 [Discount Received Account]。 3. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. The term “Discount Received” describes when a buyer accepts a cash discount from a seller. 2. The discount received results in a reduction in the company’s expenses and is recorded […]

26 – Types of Depreciation – Diminishing Balance Method

Bookkeeping – Everyone Can Do It – 26 – Types of Depreciation – Diminishing Balance Method – PDF 1. 这种方法是一种稍微复杂的资产折旧方式,它可以让你在购买资产后立即注销更多的价值,而在以后的日子里则逐渐减少注销。 2. 但是,如果折旧率不精准的话,在资产的使用寿命结束时可能会出现无法提供完整的折旧的情况。 3. 此外,在使用这种方法时,应考虑资产的使用年限。如果一项资产在一年中只使用了两个月,则只对这两个月进行折旧。 4. 公式: 年初的账面价值 * 折旧率 5. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. This method is a slightly more complicated way to depreciate an asset. It lets you write off more of an asset’s value […]

27 – Types of Depreciation – Units of Production Depreciation

Bookkeeping – Everyone Can Do It – 27 – Types of Depreciation – Units of Production Depreciation – PDF 1. 生产单位法是一种直接的方法,根据设备的工作量来折旧。 2. 术语”生产单位”既可以指设备的产出,如:小工具,也可以指设备运行的小时数。 3. 公式: (资产成本 – 剩余价值) / 使用期限内所生产出的单位 4. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. The units of production method is a straightforward way to depreciate equipment depending on the amount of work it performs. 2. […]

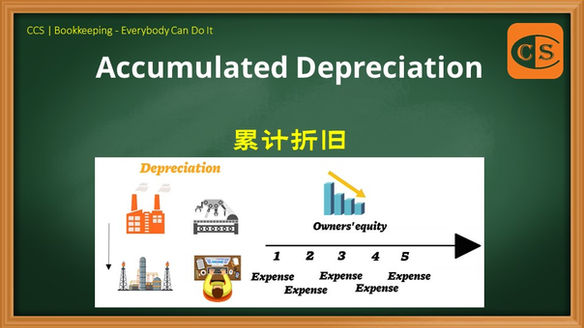

28 – Accumulated Depreciation

Bookkeeping – Everyone Can Do It – 28 – Accumulated Depreciation – PDF 1. 当我们购买固定资产被时,它不被认列为损益表上的一项费用支出。 2. 该资产的总价值,将会体现在公司的资产负债表上。 3. 在资产的使用年限内,其成本随着其价值的逐年下降而成为费用。此时资产负债表上资产价值的减少,将会在损益表上反映为折旧费用。 4. 累计折旧是资产负债表上的一个贷方余额,它是资产在其使用寿命内计入损益表的全部成本。 5. 在插图中阅读更多内容 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. When a fixed asset is purchased, it is not recognized as an expense on the Income Statement. 2. The asset’s total value is represented on the company’s balance sheet. 3. […]