The new Tax Corporate Governance Framework (“TCGF“), dated April 11, 2022, as well as the Guidelines for the TCG Framework (Guidelines), has been published on the website of the Inland Revenue Board of Malaysia (“IRBM”). The TCG Framework and these Guidelines are intended to be read in conjunction with one another.

For further information, see the article titled “Tax Corporate Governance Framework Introduced.”

The Chartered Tax Institute of Malaysia (CTIM) has received responses from the IRBM dated 20 September 2022 to members’ comments and requests for clarification on the Tax Corporate Governance Framework and TCGF Guidelines regard to specific issues.

Issue No 1 – The Criteria

Refer to paragraph 4.1 of the TCG Framework Guidelines:-

IRBM has confirmed that other companies, in addition to those mentioned above, are free to come forward voluntarily to apply for and participate in the Tax Corporate Governance Framework (TCGF) Programme.

Other interested organisations may contact IRBM via [email protected] to communicate their interest or to obtain further information on the Programme.

Issue No 2 – Application of Tax Corporate Governance

Refer to paragraph 4.2 of the TCG Framework Guidelines:-

CTIM members’ comments and requests for clarification:-

Will the application form to participate in the TCGF Programme be available on the IRBM’s website?

It is suggested that the IRBM issues a prescribed form for submission by taxpayers to maintain consistency in the applications submitted.

Please advise the earliest date a taxpayer can apply to participate in the TCGF Programme.

Is there any deadline to apply?

It is stated that an authentication letter is given to taxpayers once the IRBM is satisfied with the internal control after performing the preliminary review and assessment process. What is the timeline for the IRBM to issue this letter, and who will conduct the preliminary review and assessment?

IRBM’s Response:

A test run of the TCG is being carried out as a pilot project in Malaysia at the moment.

As a result, an invitation to participate in the programme will be sent from Inland Revenue to the chosen company, and the application form will be made available to them.

Other interested companies can get in touch with IRBM via [email protected] to express their interest or to gain further information, and notification will only be given to the qualified organisation.

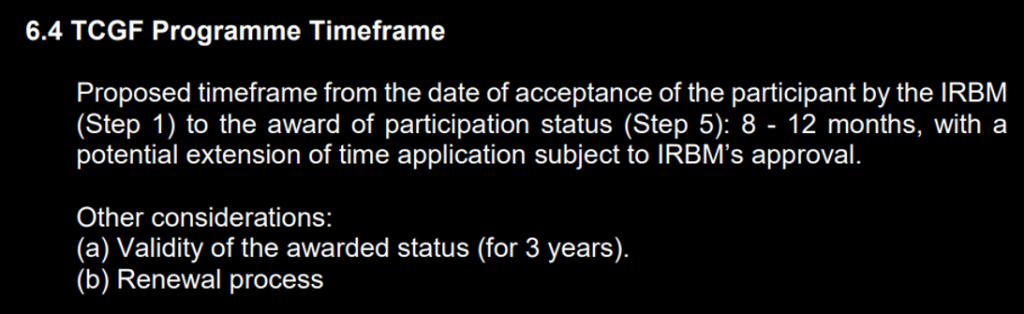

The framework says that the proposed time frame, which starts when the IRBM accepts the participant as a participant and ends when the participant status is granted, is eight to twelve months.

A TCG committee will examine this with TCG officers from the branch office.

Issue No 3 – TCG Review

Refer to paragraph 9 of the TCG Framework Guidelines:-

CTIM members’ comments and requests for clarification:-

- Please elaborate on the procedures in place to review the TCG. Please also clarify if the TCG will be reviewed by the same IRBM branch which handles the taxpayer’s income tax files.

- Is there any separate team in the IRBM in charge of the framework? If so, any contact details?

- Will the review process result in an audit on the taxpayer?

- Understand that taxpayers who fulfil the requirement and criteria listed by the IRBM will be deemed qualified for the program’s benefits and shall not be subjected to audit and investigation, but for how long (e.g. 3 years, 5 years, etc.) will not be subjected to audit and investigation after the Authentication Letter is issued?

- Also, please confirm if exclusion from audit and investigation will cover all tax aspects, so long as the framework covers the same taxes, transfer pricing etc.

- Please confirm that information provided to the IRBM for the purpose of the Programme are strictly confidential and will not be shared with other Government agencies or used against taxpayers to conduct tax audits and investigations.

IRBM’s Response:

The TCG review will be conducted by the TCG committee and TCG officers from the branch office, which handles the organisation’s income tax files.

The IRBM will perform an adequacy review of the organisation’s TCGF and an effectiveness review of the organisation’s tax control framework (TCF).

Organisations may contact IRBM via [email protected] for any questions regarding TCG Framework and Guidelines.

The review procedure is primarily for the IRBM to accept the organisation into the programme.

IRBM will discuss the issues upfront with the organisation if any key tax risk areas are identified during the review.

Taxpayers that fulfil the requirement will not be subjected to audit and investigation for three (3) assessment years from the date of the award letter. TCGF should be applied comprehensively to collectively enjoy the programme benefit (terms applied).

The information provided to the IRBM for the purpose of the programme is treated as confidential.

Issue No 4 – TCG Process

Refer to paragraph 12 of the TCG Framework Guidelines:-

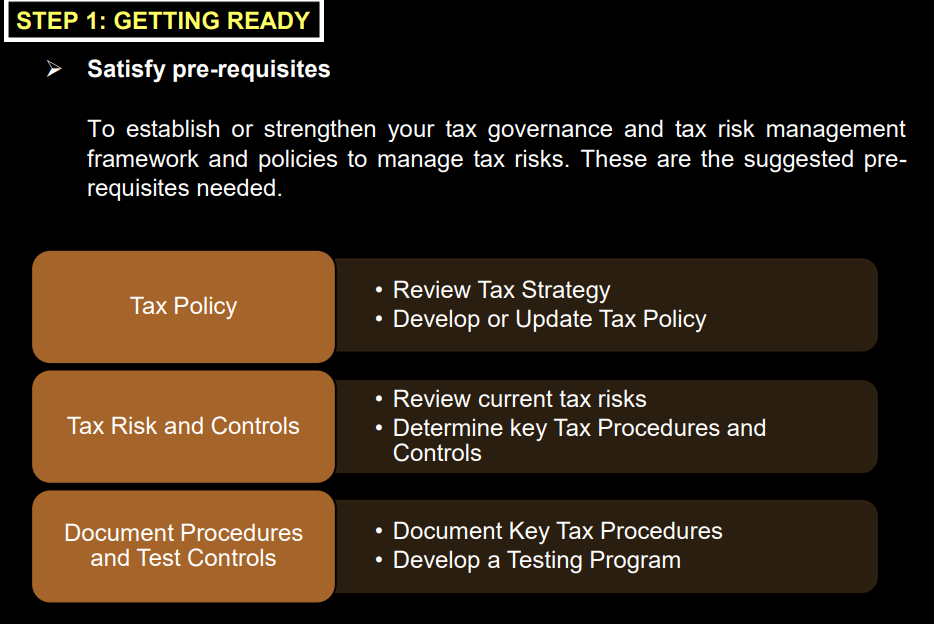

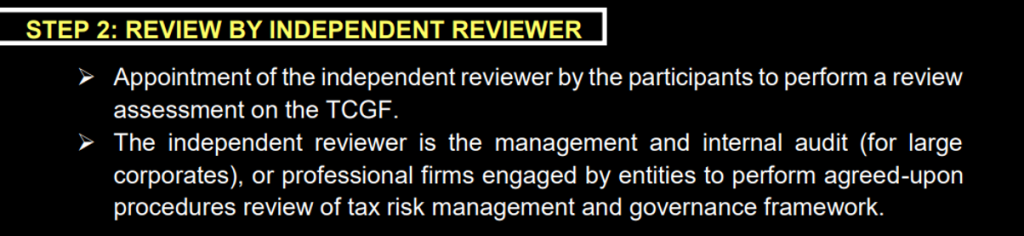

An approach to implementing tax governance procedures is described in the following process.

CTIM members’ comments and requests for clarification:-

Will thresholds be implemented to determine what constitutes key/material transactions undertaken by the taxpayer (including related party transactions) and thus needs to be specifically addressed in the TCGF in terms of tax risks involved?

If so, will the threshold be based on absolute value alone as per Paragraph 13.1 of the TCGF Guidelines (or proportion of a certain denominator, e.g. revenue)?

IRBM’s Response:

IRBM will not set the thresholds since the organisation may have different needs, sizes and backgrounds. The organisation’s tax control framework shall be able to identify, overcome, control and report tax risks suitable to the organisation’s tax policy/tax strategy and the organisation’s risk appetite.

CTIM members’ comments and requests for clarification:-

Can an approved tax agent under S.153 of the ITA 1967 undertake this review assessment?

If the preparation of the TCGF is outsourced to the tax agent, can another entity within the same group act as a tax agent to perform the review (e.g. internal audit service provider)

IRBM’s Response:

Yes. An approved tax agent under S.153 of the ITA 1967 can undertake this review assessment. However, for greater independence, the organisation should appoint different parties to perform the review.

CTIM members’ comments and requests for clarification:-

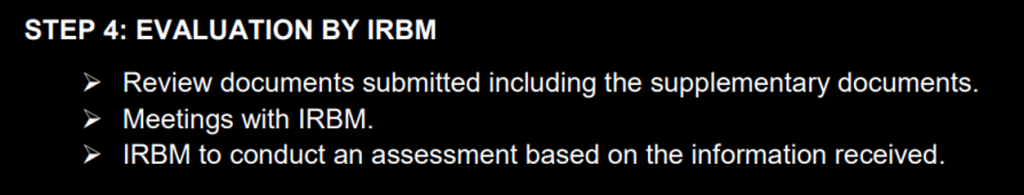

Please clarify the methods that will be used by the IRBM to review and evaluate the TCGF. Given that documentation must be made available upon request by the IRBM, please clarify the notice period provided to taxpayers upon the IRBM’s request.

IRBM’s Response:

IRBM will perform an adequacy review on the organisation’s TCGF and an effectiveness review on the organisation’s TCF.

The following methods can be used to check and evaluate TCGF and TCF:

- Reperformance

- Tests and inspections

- Observation d) Questions

In general, the organisation is responsible for maintaining sufficient documentation to meet the programme’s requirements. We understand that due to certain reasons, the organisation may require more time to prepare the documents.

Therefore, ample time will be given to the organisation to submit the documentation.

Issue No 5 – TCGF Programme Timeframe

Refer to paragraph 6.4 of the TCG Framework:-

CTIM members’ comments and requests for clarification:-

We note that upon the award of the participation status in the TCGF Programme, the status is valid for a period of 3 years and renewal is required.

Please elaborate if taxpayers must undergo Steps 1 to 5 as mentioned in Paragraph 12 of the TCGF Guidelines.

IRBM’s Response:

Yes, taxpayers will be required to undergo Steps 1 to 5, as mentioned in Paragraph 12 of the TCGF Guidelines.

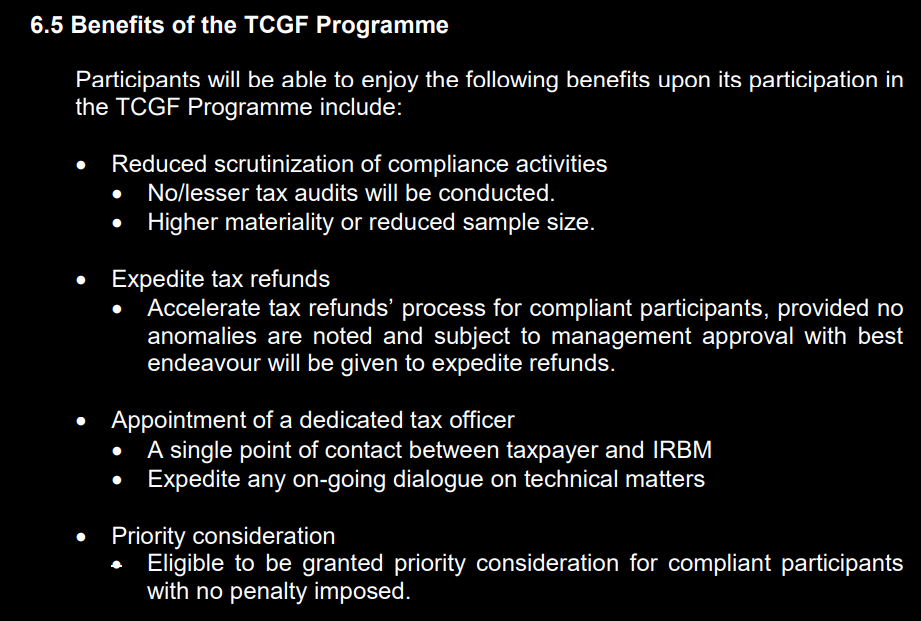

Issue No 6 – Benefits of the TCGF Programme

Refer to paragraph 6.5 of the TCG Framework:-

CTIM members’ comments and requests for clarification:-

Priority consideration

- Eligible to be granted priority consideration for compliance participants with no penalty imposed.

Please elaborate on the benefits available to taxpayers under this category.

Will taxpayers benefit from reduced penalty rates where there are issues of non-compliance detected?

If so, please advise the rate of penalty reduction.

IRBM’s Response:

The IRBM will assess the reason for non-compliance and see whether sufficient control has been applied at the organisational level for reduced or no penalty consideration.

The penalty rate will follow the current ruling.

Issue No 7 – Others

CTIM members’ comments and requests for clarification:-

Are there any participation fees charged by the IRBM?

IRBM’s Response:

No participation fee is required.

Our website's articles, templates, and material are solely for reference. Although we make every effort to keep the information up to date and accurate, we make no representations or warranties of any kind, either express or implied, regarding the website or the information, articles, templates, or related graphics that are contained on the website in terms of its completeness, accuracy, reliability, suitability, or availability. Therefore, any reliance on such information is strictly at your own risk.

Keep in touch with us so that you can receive timely updates |

要获得即时更新,请与我们保持联系

1. Website ✍️ https://www.ccs-co.com/ 2. Telegram ✍️ http://bit.ly/YourAuditor 3. Facebook ✍

- https://www.facebook.com/YourHRAdvisory/?ref=pages_you_manage

- https://www.facebook.com/YourAuditor/?ref=pages_you_manage

4. Blog ✍ https://lnkd.in/e-Pu8_G 5. Google ✍ https://lnkd.in/ehZE6mxy

6. LinkedIn ✍ https://www.linkedin.com/company/74734209/admin/