Guidelines on the application procedure for a special deduction in respect of a Qualifying R&D

On August 13, 2020, the guidelines on the application procedure for a special deduction in respect of a qualifying research and development (R&D) were issued by the Inland Revenue Board of Malaysia (“IRBM”).

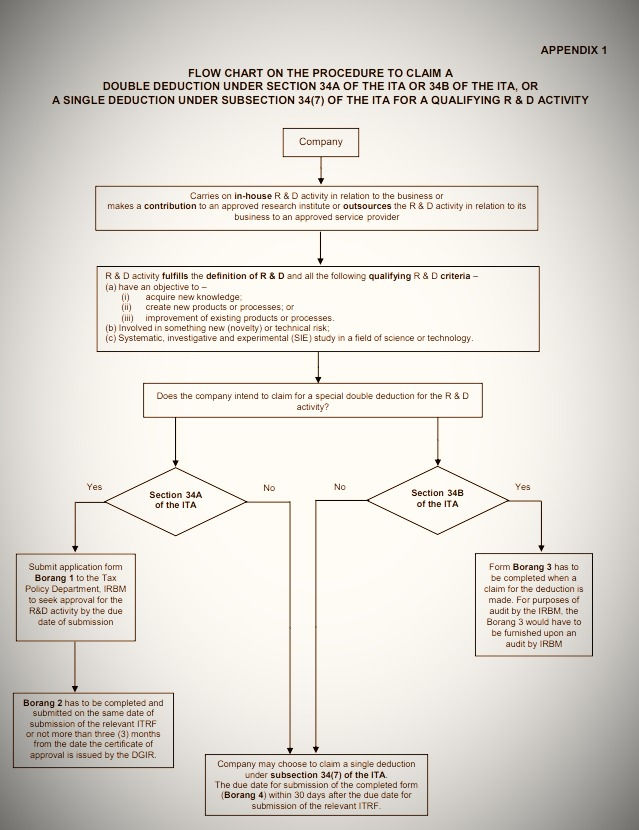

These guidelines explain the application process for an approved research and development activity eligible for a special deduction under section 34A of the Income Tax Act of 1967. (ITA).

Public Ruling No. 10/2021

The IRBM has issued Public Ruling No. 10/2021 entitled “Tax Treatment of Research and Development Expenditure Part II – Special Deductions.”

This ruling replaces Public Ruling No. 6/2020, titled “Tax Treatment of Research and Development Expenditure Part II.”

It is recommended that Public Ruling No. 10/2021 be read in conjunction with Public Ruling No. 5/2020 because it explains the expenditures that are eligible for special deductions (incentive) concerning a qualifying R&D activity.

Public Ruling No. 5/2020

The Public Ruling No. 5/2020 on “Tax Treatment of Research and Development Expenditure Part I — Qualifying Research and Development Activity” clarifies the definition of R&D and its qualifying criteria, which, in turn, determine whether the R&D activity in question is a qualifying R&D activity.

These two public rulings need to be read in conjunction with the “Guidelines on the Application Procedure for a Special Deduction in Respect of a Qualifying Research and Development Activity“, dated December 29, 2021.

In the Guidelines, examples 1-4 explain the application procedure for an approved qualifying R&D activity that is eligible for double deduction under Section 34A of the Income Tax Act (ITA) 1967, as well as the requirement to submit the relevant forms when a claim is made for deductions under Sections 34(7), 34A, or 34B of the ITA 1967.

The previous guidelines, published on 13 August 2020 and since replaced by these new ones, are comparable to the latest ones dated December 29, 2021. The following is an outline of the most significant changes:

- The legislative amendments passed by the Finance Act 2020 have been included in the Guidelines. These changes were previously emphasised in the Public Ruling No. 10/2021 on Tax Treatment of R&D Expenditure Part II – Special Deductions.

- An additional condition has been added to apply for an extension project under Section 34A of the ITA 1967. This criterion states that the project’s duration should be anticipated to be more than 12 months.

- The application Forms have been modified to reflect the latest changes.

Also, effective 1.1.2021, if the payment for R&D expenditure undertaken outside Malaysia (outsourced) is more than 30% of the total allowable R&D expenditure, the total expenses incurred will not qualify for a double deduction. However, the whole of expenses on R&D incurred shall be allowed as a single deduction under subsection 34A(4) of ITA.