Paragraph 46(1)(c) of the ITA provides that a deduction up to a maximum of RM5,000 is allowed to an individual on the expenses incurred by him for the medical treatment, special needs and carer for his parents.

Effective from the YA 2021, the deduction on the expenses incurred by an individual for the medical treatment, special needs and carer for his parents is increased to RM8,000.

Expenses on medical treatment for parents who qualify for deduction include:-

- medical treatment and care services provided by a nursing home and

- dental treatment limited to tooth extraction, filling, scaling and cleaning but not including cosmetic dental treatment expenses such as teeth restoration and replacement involving crowning, root canal and dentures.

The scope on medical treatment for parents also includes expenses on medical treatment and care for parents who suffer from diseases or with physical or mental disabilities and who need regular treatment certified by qualified medical practitioners registered with the MMC.

Paragraph 46(1)(f) of the ITA provides that a deduction of up to RM7,000 can be claimed by an individual on the fees expended by that individual for any course of study undertaken by him up to tertiary level (up to graduate level), other than a degree at Masters or Doctorate level.

The deduction allowed is the fees for courses undertaken to obtain law, accounting, Islamic financing, technical, vocational, industrial, scientific or technological qualifications or skills.

For a degree at Masters or Doctorate level, fees on any course of study undertaken to acquire any skill or qualification are allowed as a deduction.

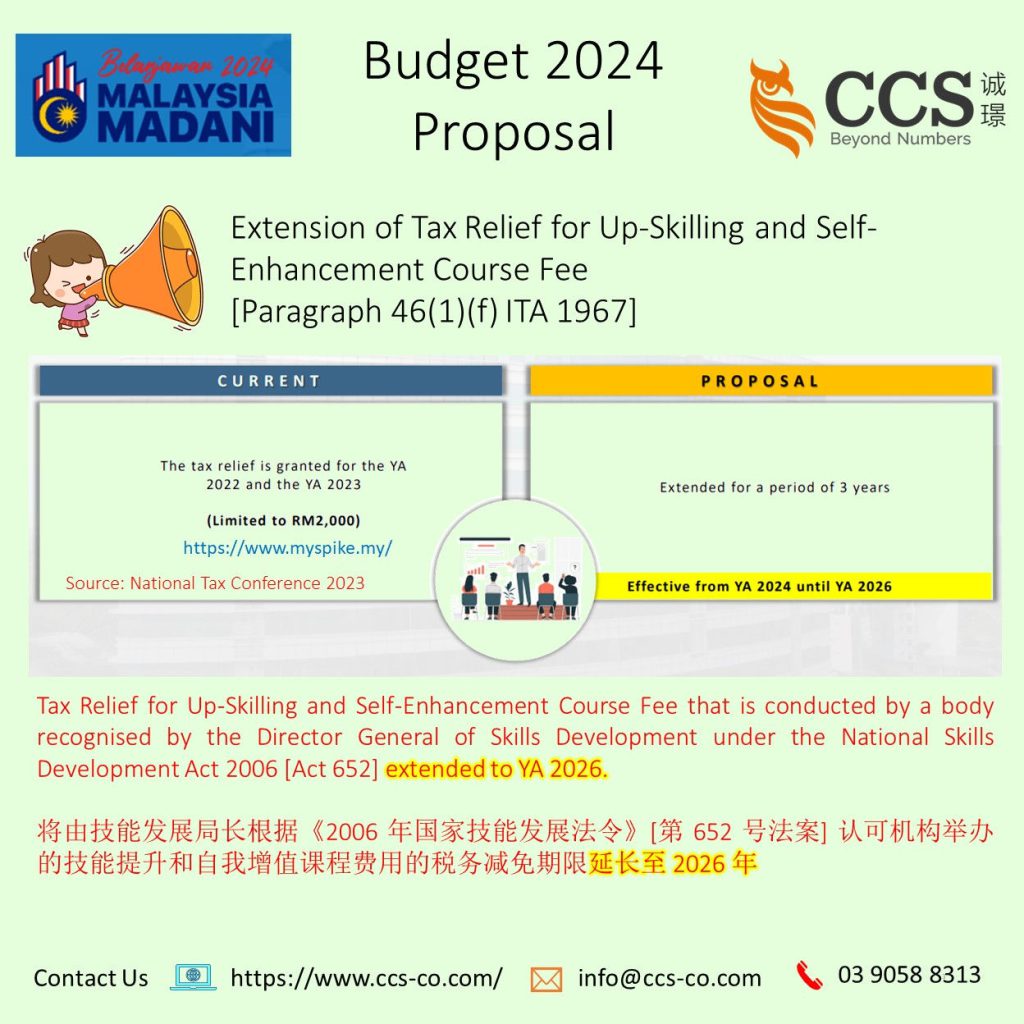

For the YAs 2022 and 2023, the course of study is extended to any course undertaken to upskill or self-enhancement, and that course is conducted by a body recognised by the Director General of Skills Development under the National Skills Development Act 2006 [Act 652].

The amount allowable for deduction is limited to a maximum amount of RM2,000 for each year of assessment, and that amount forms part of RM7,000, which is a deduction allowed for education fees under paragraph 46(1)(f) of the ITA.

Hence, the total deduction under this paragraph shall be subject to a maximum amount of RM7,000 for education fees.

Department Skills Development (DSD) is the government agency responsible for coordinating and formulating the implementation of the skill training system. For further information regarding the skill training can be obtained from the official portal of DSD at www.dsd.gov.my

Paragraph 46(1)(g) of the ITA provides that a deduction of up to RM8,000 is allowed on the amount expended by the individual for treatment of serious diseases on himself, his or her spouse or his or her child.

With effect from the YA 2020, the medical expenses are extended to include the expenses expended or deemed expended by the individual for undergoing fertility treatment to have a baby, on himself or his wife, or in the case of a wife on herself or on her husband.

Effective from the YA 2021, the medical expenses are extended to include the expenses expended or deemed expended by the individual for vaccination on himself, his wife or child, or in the case of a wife on herself or her husband or child. The amount of deduction is an amount limited to a maximum of RM1,000.

The vaccinations which qualify for deduction are for;

- pneumococcal;

- human papillomavirus (HPV);

- influenza;

- rotavirus;

- varicella;

- meningococcal;

- TDAP combination (tetanus-diphtheria-acellularpertussis); and

- Coronavirus Disease 2019 (COVID-19)

Additional tax relief of up to RM4,000 will be provided for expenses incurred by individuals for children aged 18 years and below on diagnosis, early intervention programs or rehabilitation treatment for specified learning disabilities effective from YA 2023.

Currently, Paragraph 46(1)(p) of the ITA is introduced to allow a tax deduction for expenses expended by an individual in that basis year:

- for the purchase of books, journals, magazines, printed newspapers and other similar publications to enhance knowledge for his use, the use of his or her spouse or child. Books would include school textbooks, periodicals, and comics, whether purchased locally or overseas, but exclude any banned reading materials such as morally offensive magazines. Buying books online is also allowed as a deduction. From the YA 2021, the expenses for the purchase of newspaper is extended to expenses of newspaper subscription electronically;

- for the purchase of a personal computer, smartphone or tablet (not being used for his own business) for his use, the use of his or her spouse or his or her child. Additional charge for the warranty is not allowed for deduction under this paragraph;

- for the purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997, which includes the purchase of a bicycle (excluding motorised bicycles) and gym membership for his own use or for the use of his or her spouse or his or her child (excluding club membership which provides gym facilities); and

- for the payment of monthly bills for internet subscription registered under the individual’s name for his own use or the use of his or her spouse or his or her child.

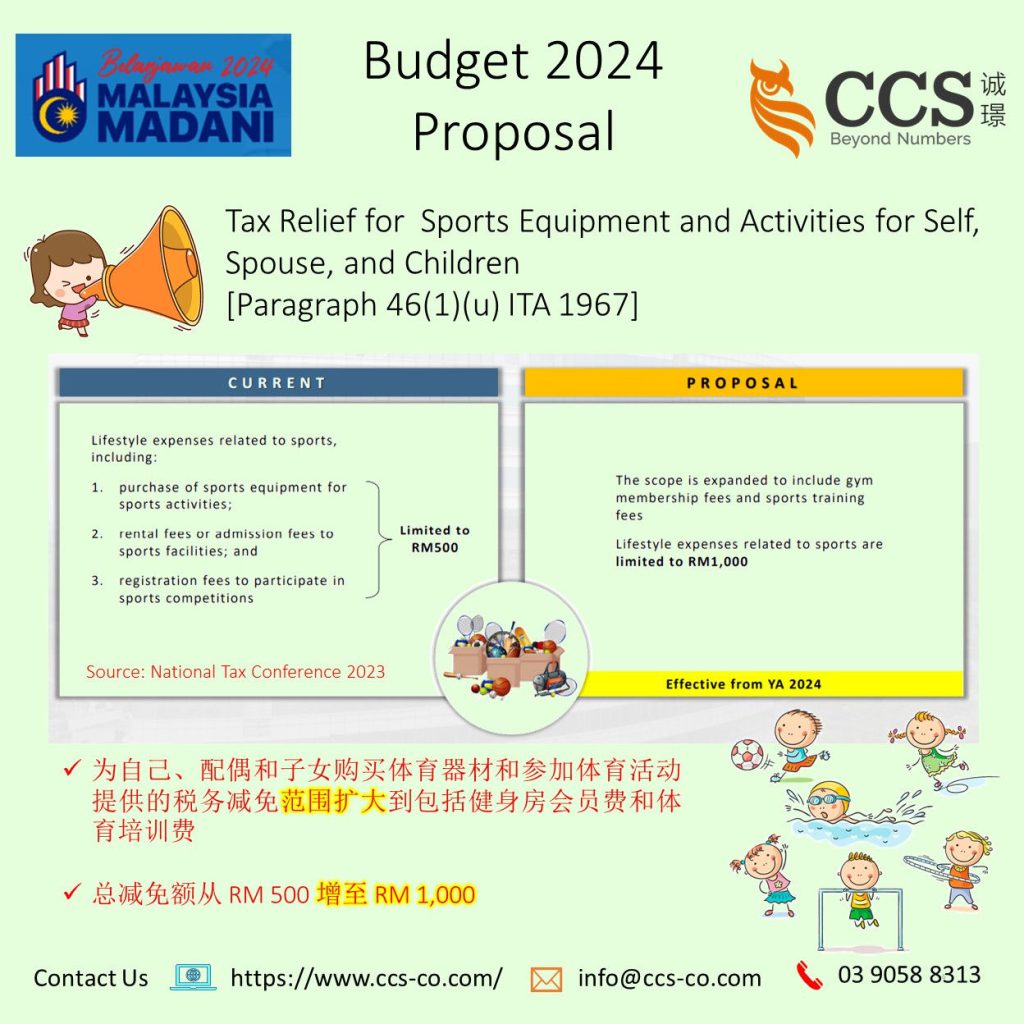

Effective from YA 2021, paragraph 46(1)(u) of the ITA is introduced to promote a healthy lifestyle through sports activity.

The deduction allowed is an amount limited to a maximum of RM500 expended or deemed expended in that basis year by an individual:

- for the purchase of sports equipment for any sports activity as defined under the Sports Development Act 1997 [Act 576] (excluding motorised two-wheel bicycles);

- for the payment of rental or entrance fee to any sports facility; and

- for the registration fee payment for any sports competition where the orgaorganisernizer is approved and licensed by the Commissioner of Sports under the Sports Development Act 1997.

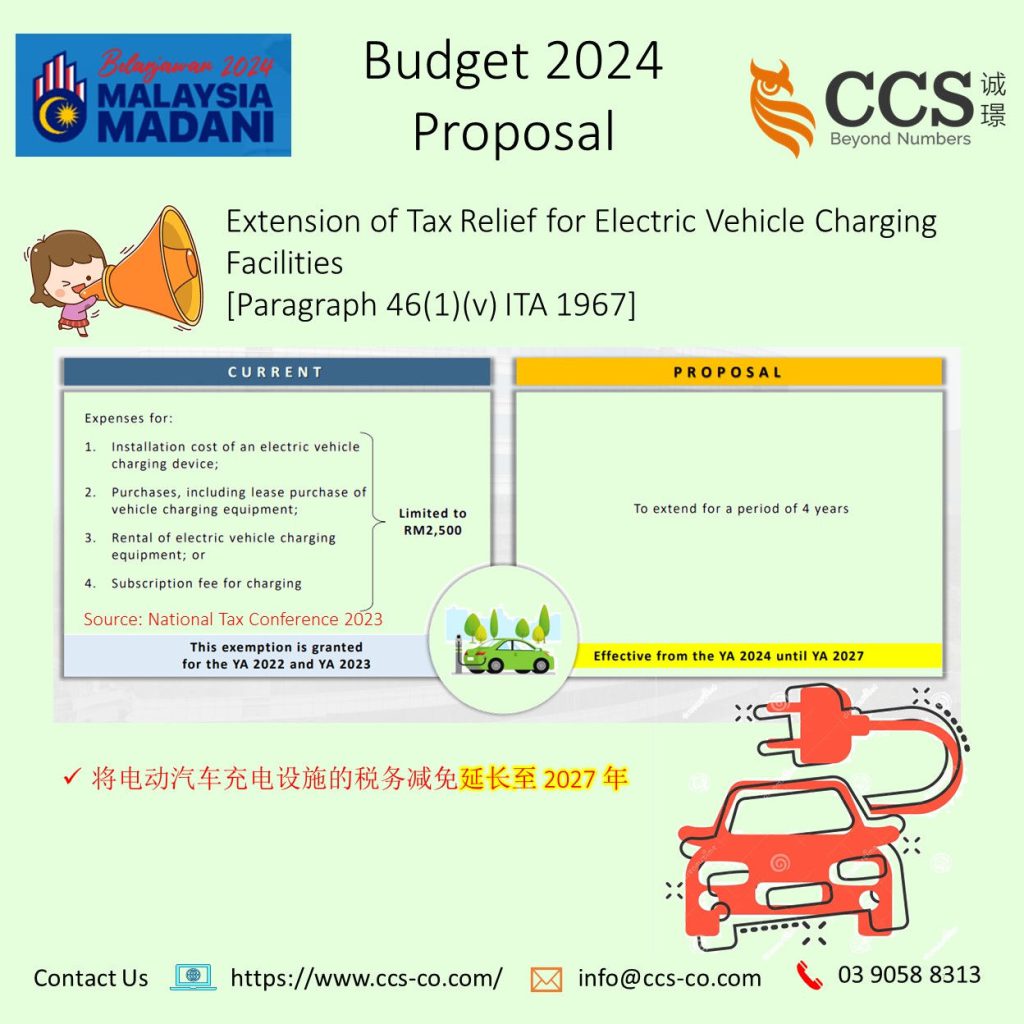

With effect from YA 2022 and 2023, relief of up to RM2,500 is given for:

- Installation cost of an electric vehicle charging device;

- Purchases, including lease-purchase of vehicle charging equipment;

- Rental of electric vehicle charging equipment or

- Subscription fee for charging