Scope of self-billed e-invoice extended to Payment of Interest & Rebates

The specific guidance on e-invoicing dated 9 February 2024 extends the scope of self-billed e-invoicing by adding two new items, namely:- (i) Payment of interest; and (ii) Rebates 2024年2月9日的电子发票具体指南,扩大了自开电子发票的范围,总共增加了两个新的事项,即: (i) 支付利息及; 及 (ii) 回扣 ㊗️大家新年快乐 – https://fb.watch/qcj6eMVXdT/ 🧨🧨🧨🧨🧧🧧🧧🧧 🚨注意啦!东马的朋友们!🚨 十面埋伏老师来😻古晋😻与你们分享 E-Invoice 的实施策略部署啦‼️ 这是 HRDC Claimable 的! 座位有限,目前热卖中🔥🔥🔥 📅日期:26/02/2024 (星期一) ⏰时间:9.00a.m – 6.00p.m. 📍地点:Imperial Grand Ballroom […]

Tax Prep 2024: Tax Relief, Tax Deduction and Tax Rates for Resident Individual

Great news, everyone! The much-awaited Tax Prep 2024: Tax Relief, Tax Deduction, and Tax Rates for Resident Individuals, prepared by CCS, is now available! Whether navigating tax relief options, seeking deductions, or understanding tax rates for resident individuals, this comprehensive guide covers you. 好消息,各位!大家期待已久的《2024 年税务准备》: 由 CCS 编写的《居民个人减税、税务扣除和税率》现已面世! 无论您是在选择减税方案、寻求扣除额,还是了解居民个人的税率,这本全面的指南都能为您提供帮助。 Download your copy today by clicking […]

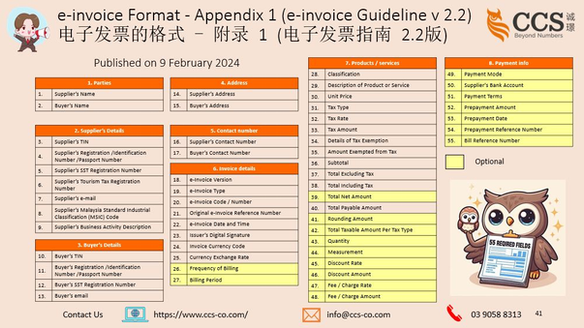

e-Invoice Guideline Version 2.2:Essential Data Fields for E-Invoice Issuance

As per e-Invoice Guideline Version 2.2 (published on 9 February 2024): There are 55 data fields that are required to issue an e-invoice. These fields are grouped into eight categories: 1. Address 2. Business Details 3. Contact Number 4. Invoice Details 5. Parties 6. Party Details 7. Payment Info 8. Products / Services 根据电子发票指南 2.2 […]