Absenteeism Dismissals Upheld by Malaysian Courts If Fair Process Followed

Employee misconduct, such as absenteeism and disobedience, can significantly disrupt company operations and affect productivity. However, Malaysian employment law requires employers to follow fair procedures before dismissing staff for misconduct. Several industrial court cases demonstrate how companies must provide ample warnings and prove misconduct before courts will uphold absenteeism dismissals as justified. Below are 3 […]

“Congratulations on Your Auditor’s License Achievement!”

Dear Student, Congratulations on your remarkable achievement of successfully passing the audit license interview and obtaining your auditor’s license! This significant milestone marks the beginning of your journey as an auditor, and I, Mr Chin, the founder of CCS Group (www.ccs-co.com), am immensely proud of your accomplishment. I express my most profound appreciation for your […]

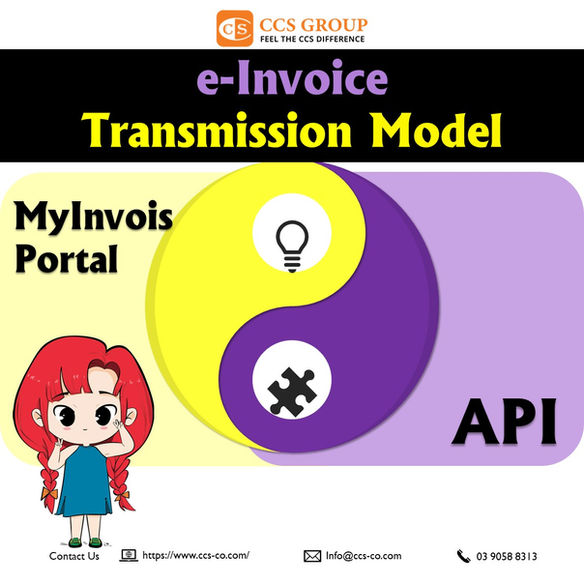

A comparison of the key aspects between the e-Invoice Transmission via MyInvois Portal and via API

In summary, the MyInvois Portal is suitable for smaller businesses with lower invoice volumes, as it provides a simple and user-friendly interface to manage e-Invoices without technical integration. The API method suits businesses with high invoice volumes, allowing automated generation and transmission of e-Invoices by integrating with the company’s existing systems. However, the API method […]

Declaration of Sales Tax on Disposal of Exempt Raw Materials under Schedule C Item 1

Sales Tax Exemption under Schedule C Item 1 Here are the key points extracted from page 71, Schedule C Item 1 of the Sales Tax (Persons Exempted From Payment Of Tax) Order 2018: Persons: Any registered manufacturer Goods Exempted: Raw materials, components and packaging materials, excluding petroleum Conditions: Certificate to be signed by: Registered Manufacturer […]

Benefits of e-invoice

Potential benefits For Accountants/Freelancers: Accountants/Freelancers may cope with the Transition: The transition to e-invoicing requires adaptation but offers significant benefits and opportunities for both businesses and accounting professionals to elevate their capabilities and service offerings. Reference: 1. e-Invoicing Guidelines for the year 2023 are now accessible starting 21 July 2023: https://www.ccs-co.com/post/e-invoicing-general-guidelines-for-the-year-2023-are-now-accessible-starting-21-july-2023 2. LHDN’s website: https://www.hasil.gov.my/e-invois/ […]

Congratulations to our Ex-Team Member on ACCA Exam Success!

We at CCS Group are delighted to extend our warmest congratulations to one of our exceptional ex-Team Members, Mr Woo, on passing the prestigious UK ACCA exams with flying colours. This remarkable achievement reflects his unwavering dedication, perseverance, and hard work in pursuing excellence in accounting and finance. The Association of Chartered Certified Accountants (ACCA) […]

Overview of the Customs Voluntary Disclosure Programme

For more info: Disclaimer: The articles, templates, and other materials on our website are provided only for your reference. While we strive to ensure the information presented is current and accurate, we cannot promise the website or its content, including any related graphics. Consequently, any reliance on this information is entirely at your own risk. […]

e-Invoicing Guidelines for the year 2023 are now accessible starting 21 July 2023

The Inland Revenue Board of Malaysia (IRBM) aims to facilitate the country’s transition from traditional to electronic invoicing methods. The initial phase of the Electronic Invoicing (e-invoicing) system is set for pilot implementation in the first half of 2023. Subsequently, the mandatory implementation is scheduled to commence in June 2024 for businesses with an annual […]

Solicitors’ Remuneration Order 2023

The Solicitors’ Remuneration Order 2023 was gazetted on 12 July 2023 and will take effect on 15 July 2023. The Solicitors’ Remuneration Order 2005 will be repealed as of 15 July 2023. The Solicitors’ Costs Committee, chaired by the Chief Judge of Malaya under Section 113 of the Legal Profession Act 1976 approved the Solicitors’ […]

HASiL: Forms CP 22A/ CP 22B/ CP 21 submission requirements & online submission of Notification Forms

The Inland Revenue Board of Malaysia (HASiL) has issued a letter dated 28 June 2023 to CTIM and other professional bodies regarding the submission requirements for Form CP22A/ CP22B/ CP21 and the online submission process for employee-related notification forms. The letter includes the following information:- 1. Notice of cessation of employment Section 83(3) of the […]