Amended Guidelines on Application for Stamp Duty Relief

The IRB published the following guidelines on March 24, 2022: The Guidelines take the place of the previous Guidelines, which were issued on February 26, 2019. These guidelines were issued to explain the procedures involved in applying for stamp duty relief in the reconstruction or amalgamation of companies provided under Section 15 of the Stamp […]

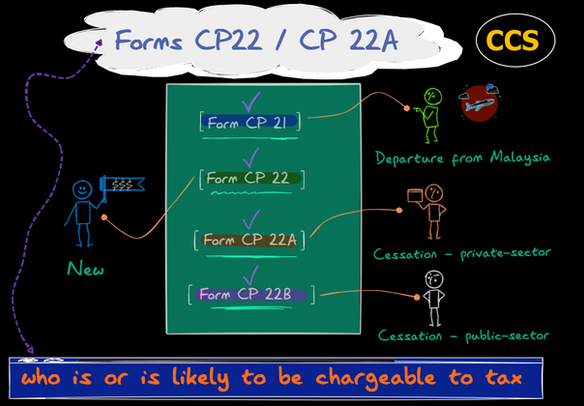

IRBM’s Response to CTIM on Forms CP 22 / CP 22A

Mandatory adoption of Prescribed Forms CP 21, CP 22, CP 22A and CP 22B effective from 1 January 2022 Effective January 1, 2021, under the amendments to subsections 83 (2), (3), and (4) of the Income Tax Act 1967, Forms CP 21, CP 22, CP 22A, and CP 22B must be submitted by the employers […]