Income Tax (Exchange of Information) Rules 2021: Exchange of Information

Exchange of Information – PDF 7

Tax Treatment – Entities that are Dormant or have not yet started Operations

Entities that are Dormant or have not yet started Operations – PDF 1. Companies, co-operative societies, limited liability partnerships, and trust bodies are all required to file tax returns, even if they are dormant, in the same way, they were in previous years. 2. They do not have to report the estimated tax payable (Form […]

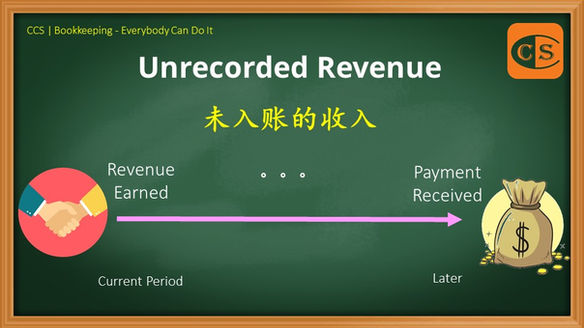

20 – Unrecorded Revenue

Bookkeeping – Everyone Can Do It – 20 – Unrecorded Revenue – PDF 1. 根据权责发生制会计 [Accrual Basis of accounting],收入应记录在赚取收入的期间,无论何时才收到客户的付款。 2. 通过这种方式,收入与收入发生期间的支出相匹配。 3. 当我们说“未入账的收入”时,我们指的是在本期赚取,但要等到之后才收到钱的收入。 4. 贷款的利息收入是其中一种例子。 5. 在插图中阅读更多内容 6. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. According to the Accrual Basis of accounting, revenues should be recorded for the period in which they are earned, regardless of […]

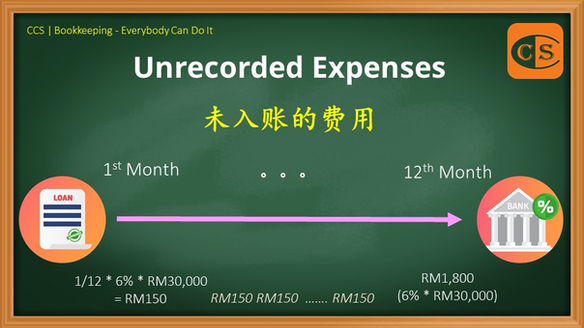

19 – Unrecorded Expenses (Part 2)

Bookkeeping – Everyone Can Do It – 19 – Unrecorded Expenses (Part 2) – PDF 1. 会计原则要求在费用发生时予以记录,而不考虑付款的时间,因为这影响到所有者权益。 2. 未入账的费用是指在当期发生但后来才支付的费用。 3. 当月赚取的工资但在下个月支付,就是一个很典型的“未入账的费用”的例子 4. 另一个常见的例子是,为银行贷款所支付的利息以及水电费的支出。 5. 在插图中阅读更多内容 6. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Accounting principles require that expenses be recorded when they are incurred, regardless of when the payment is made as this affects owners’ equity. […]

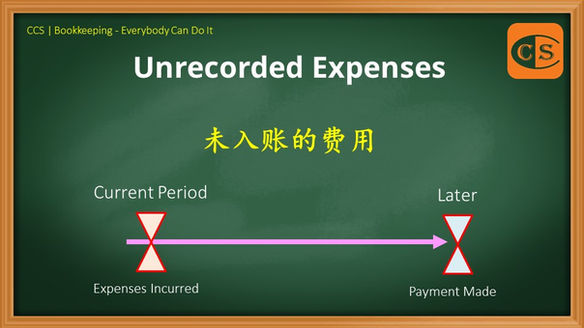

18 – Unrecorded Expenses (Part 1)

Bookkeeping – Everyone Can Do It – 18 – Unrecorded Expenses (Part 1) – PDF 1. 会计原则要求在费用发生时予以记录,而不考虑付款的时间,因为这影响到所有者权益。 2. 未入账的费用是指在当期发生但后来才支付的费用。 3. 当月赚取的工资但在下个月支付,就是一个很典型的“未入账的费用”的例子 4. 另一个常见的例子是,为银行贷款所支付的利息以及水电费的支出。 5. 在插图中阅读更多内容 6. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Accounting principles require that expenses be recorded when they are incurred, regardless of when the payment is made as this affects owners’ equity. […]

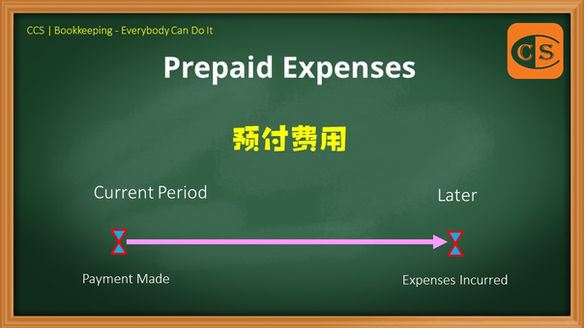

17 – Prepaid Expenses

Bookkeeping – Everyone Can Do It – 17 – Prepaid Expenses – PDF 1. 租金、保险和期刊是一些公司被要求提前付款的服务或商品的例子。 2. 这些公司在获得相关服务或商品之前,就以及作出了相关的支出。 3. 这些费用被称为”预付费用”。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Rent, insurance, and periodicals are examples of services or goods for which some companies require payment in advance. 2. These companies reported expenses before some benefits have […]

16 – Unearned Revenue

Bookkeeping – Everyone Can Do It – 16 – Unearned Revenue – PDF 1. 一些提供服务或商品的公司,如出租空间、提供保险服务或出版刊物,可能会提前收钱。 2. 这些公司的收入在赚取之前就已经收到并记录了。“未赚取的收入”是用来描述这些类型收入的术语。 3. 我们必须承认的是,在服务或商品的使用寿命期间, “未赚取的收入”已经产生,并导致所有者权益 [owners’ equity] 的增加。因此,我们将“未赚取的收入”归类为负债,因为日后公司有义务向客户提供服务或商品。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. Some companies offering services or goods, such as renting out space, providing insurance services, or publishing publications, may collect money in advance. 2. […]

15 – Sale on Cash

Bookkeeping – Everyone Can Do It – 15 – Sale on Cash – PDF 1. 一家公司向客户出售货物,并在交易后立即收到6千令吉的全部现金。 2. 这项交易影响到一个资产账户 [Asset Accounts] 和一个收入账户 [Revenue Accounts]。 3. 现金账户 [Cash Account] 增加了6千令吉,会计师在会计软件中输入了一个借方条目。 4. 在插图中阅读更多内容 5. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A company sells goods to clients and receives the whole amount of RM6,000 in cash right away from […]

14 – Sale on Credit

Bookkeeping – Everyone Can Do It – 14 – Sale on Credit – PDF 1. 一家公司向客户赊账销售了价值15千令吉的原材料。 2. 这项交易影响到一个资产账户 [Asset Accounts] 和一个收入账户 [Revenue Accounts]。 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A company sells raw materials worth RM15,000 on credit to a customer. 2. This transaction impacts one of the Asset Accounts and one of the […]

13 – Purchase on Cash

Bookkeeping – Everyone Can Do It – 13 – Purchase on Cash – PDF 1. 一家榴莲批发公司用 2千令吉的现金购买库存。库存账户 [Inventory Account] 和现金账户 [Cash Account] 这两个资产账户 [Asset Accounts] 都受到这项交易的影响。 2. 库存账户增加了 2千令吉,该账户应该因此而被借记 [should be debited]。现金账户减少了,应该贷记 [should be credited] 2千令吉以反映这一点。 3. 在插图中阅读更多内容 4. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. A durian wholesale company used RM2,000 in cash to purchase […]