会计准则解析之固定资产

会计准则解析之固定资产 – PDF 10

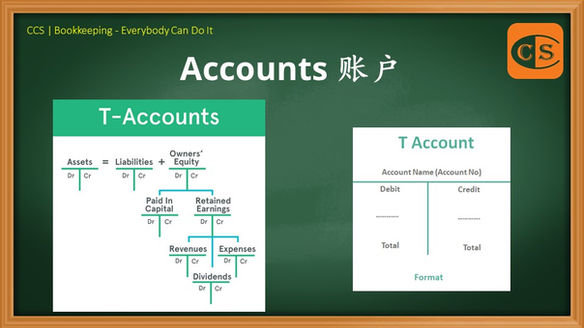

7 – Accounts

Bookkeeping – Everyone Can Do It 7 – Accounts – PDF 1. 账户是一种存储和记录交易和财务交易的机制。 2. 它记载了资产、负债、所有者权益、费用、收入因交易而发生的所有变化。 3. 借方和贷方分别呈现在每个账户的左边和右边。 4. 遵循和应用具体的规则可以帮助我们保持准确的财务记录,请参考图解 3. 加入我们的 Telegram – http://bit.ly/YourAuditor 🌻🌻🌻🌻🌻🌻🌻🌻🌻🌻 1. An account is a mechanism for storing and recording transactions and financial transactions. 2. It records all changes in assets, liabilities, owners’ equity, expenses, and income as a result […]

Finance Act 2021

1. On 31 December 2021, the Finance Act 2021 was Gazetted. 2. The Finance Act 2021 and the Finance Bill 2021 are identical. 3. Schedule 6 to the principal Act is amended in Part I— 👉 by substituting for paragraph 28 the following paragraph: 👉 “28. The income arising from sources outside Malaysia and received […]

RM 20,000 Tax Rebate for the Newly Set Up Company – Conditions Apply

1. On 31 December 2021, the Minister, in the exercise of the powers conferred by subsection 6D(4) of the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Conditions for the Grant of Rebate under subsection 6D(4)) Order 2021 [P.U. (A) 504]. 2. From YA 2021, a tax rebate [section 6D(4)] will be provided […]

Double Tax Deduction for the Sponsorship of Scholarships to Malaysian Students

1. On 31 December 2021, the Minister, in the exercise of the powers conferred by paragraph 154(1)(b) read together with paragraph 33(1)(d) of the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Deduction for the Sponsorship of Scholarship to Malaysian Student Pursuing Studies at the Technical and Vocational Certificate Levels) Rules 2021 [P.U. […]

Stamp Duty (Exemption)(No. 18) Order 2021: Merger or Acquisition

1. On 31 December 2021, the Minister, in the exercise of the powers conferred by subsection 80(1) of the Stamp Act 1949 [Act 378], gazetted the Stamp Duty (Exemption)(No. 18) Order 2021 [P.U. (A) 502]. 2. This Order is deemed to have come into operation on 1 July 2021. 3. Under this Order, subject to […]

Income Tax (Exemption)(No. 13) Order 2021: Export of Private Health Care Services

1. On 31 December 2021, the Minister, in the exercise of the powers conferred by paragraph 127(3)(b) of the Income Tax Act 1967 [Act 53], gazetted the Income Tax (Exemption)(No. 13) Order 2021 [P.U. (A) 501]. 2. This Order has effect from the year of assessment 2021 until the year of assessment 2022. 3. Join […]